China’s 2021 Crude Oil Imports Down 5.7% - BIMCO

Chinese crude oil imports fell year-on-year in June and July, ending a streak of five months of accumulated year-on-year growth. After the first seven months of 2021, China’s crude oil imports are down 5.7% compared with the same period last year. January to July imports stood at 301.9m tons, an 18.1m tons decline from January to July 2020.The June and July decline in crude oil imports is not attributable to unusually low imports as much as to unusually high…

China Crude Processing Spikes to All-time High

Chinese refinery crude oil throughput has reached its highest level ever, with total processed volumes up 12% in the first five months of this year compared to 2020, and up 10.9% from the same period in 2019. In total 292.7m tonnes have been processed so far this year according to the National Bureau of Statistics China.Despite the 12.0% growth in crude oil processing, Chinese crude oil supply, which includes imports and domestic production, has only grown by 2.3% in the first five months of this year.

BIMCO: All Eyes on US Gasoline; Will Demand Exceed 9.2M Bpd?

“Fill her up, son; unleaded. I need a full tank of gas where I'm headed,” former Police-front man, Sting, sang back in 1999 on his solo album Brand New Day. This country-inspired song could be the anthem for what is coming around next week, as Monday. May 31 is Memorial Day in the U.S., the day that kicks off “the U.S. driving season”. The season runs for about three months from Memorial Day to Labor Day on September 6, during which the Americans take to the road, and demand for motor gasoline reaches a seasonal peak.On 26 May, the U.S.

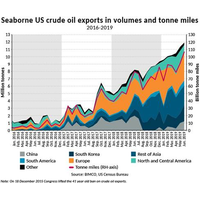

U.S. Crude Oil Exports: When 'Less is More'

Longer sailing distances cushion fall in US crude oil exportsTon mile demand generated by US crude oil exports has fallen by 9.7% in the first two months of 2021 compared with the start of 2020. The fall could however have been much worse; In volume terms, seaborne crude oil exports have fallen by 18.8%, to 20.9m tonnes, a 4.8m tonnes decline compared with last year, according to data from the US Census Bureau.While seaborne crude oil exports to all regions have fallen…

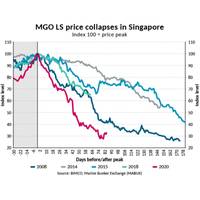

BIMCO: 2020 and the Collapse of Bunker Fuel Markets

The sulfur regulation from the International Maritime Organization (IMO) that came into force on 1 January 2020 took the center stage in the shipping industry at outset of the new decade. Four months on, the spotlights have turned to the coronavirus and the OPEC+ oil price war.The outlook for global economic growth remains bleak as the world is faced with the largest recession since the Great Depression in the 1930s.Commodity prices have declined across the board and most recently…

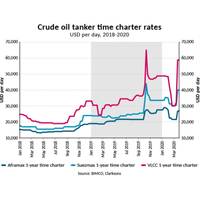

While Oil Prices Plummets, Tanker Rates Fly High

If one ever needed proof that, no matter how dire the situation, there is always a silver lining, look no further than the crude tanker market, which has seen it day rates skyrocket in the face of a global pandemic that has effectively ground world commerce to a crawl.As is the case with other gravity defying business phenomena, geopolitics is a central factor, in this case a battle between Russia and Saudi Arabia to flood the world with oil in the face of…

BIMCO: US Crude Exports Soar in June 2019

The highest US crude oil exports to China in 11 months lifted total seaborne US crude oil exports to a record high at 11.9 million (m) tonnes in June 2019. Also contributing to the June record was South Korea, as exports to the other main Far Eastern buyer reached an all-time high volume of 2.3m tonnes.1.2m tonnes were shipped to China between June 1, and June 30, , up from 1m tonnes in May and worlds apart from no exports at all in the months of August through…

US Crude Oil Exports to China Stalled

The development that saw no U.S. seaborne exports of crude oil to China in August has continued into September, according to BIMCO. This is despite crude oil not being a part of the ‘official trade war’.“The trade war between the U.S. and China is now impacting trade in both tariffed and some un-tariffed goods with both countries looking elsewhere for alternative buyers and sellers,” said Peter Sand, BIMCO’s Chief Shipping Analyst.“Ton mile demand generated by total U.S.

US Seaborne Oil Exports at All-time High

Following a seasonal surge in December 2017, the US seaborne export of oil products (materials derived from crude oil) reached the highest annual level ever, in terms of volume and tonne miles demand. An increase in volume, combined with a marginal increase in the average sailing distance, caused the total annual tonne miles demand to surpass the previous high set in 2013. BIMCO’s Chief Shipping Analyst Peter Sand comments: “The development in US seaborne exports…

South Korean Yards Eyed for $3.8 Bln LNG Shipbuilding Deal

A little-known investment company said it intends to order up to 20 liquefied natural gas (LNG) carriers, probably from South Korean shipbuilders. The contracts would be worth as much as $3.8 billion, two people with direct knowledge of the matter told Reuters. CBI Energy and Chemical, which is controlled by Australian and Canadian investors and has offices in Hong Kong, also said in a statement to Reuters that it would be seeking to buy floating LNG production and import facilities as part of an ambitious plan for Africa and Asia.

BIMCO - Oil Product Tankers Earnings Decline as stockbuilding Slows Down

BIMCO’s expectations remain as the oil product tanker fleet continues to grow with earnings at the lowest since Q3 in 2014. But there is still money to be made in the second half of 2016. The oil product tanker market has reached a net fleet growth of 4.3m DWT so far in 2016. That is well in line with BIMCO’s full estimate of 8.5m DWT for the full year 2016. The main drivers of the total growth continue to be the MRs and LR2s. With a net fleet growth of 5.8 % in 2015…

Iran's Tankers Target India, EU

Iran wants to up exports to India by 200,000 bpd within 6 months. With Iran ready to resume business as usual with the world under a historic nuclear deal, Tehran will target India, Asia's fastest-growing major oil market, and old partners in Europe with hundreds of thousands of barrels of its crude. Iran expects the United Nations nuclear watchdog to confirm on Friday it has curtailed its nuclear programme, paving the way for the unfreezing of billions of dollars of assets and an end to bans that have crippled its oil exports.

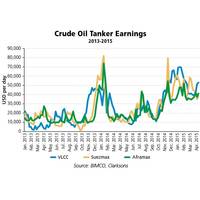

Strong Tanker Market Extends Peak Season High Earnings

Tanker earnings for crude oil tankers have climbed to new strong levels in the first quarter of 2015, with averages not seen since 2008, the Baltic and International Maritime Council (BIMCO) reported. The demand for crude oil tankers remains high even though the winter months are far behind us. Following the winter peak season of 2013/14, crude oil tanker earnings collapsed and remained low during spring, before rebounding over the summer. In the winter peak of 2014/15, this has not been the case.

Copenship Files for Bankruptcy

Privately-owned shipping company Copenship has filed for bankruptcy in Copenhagen after losses in the dry bulk market, its Chief Executive Michael Fenger told Reuters. Copenship had been operating over 50 chartered small-sized dry-bulk vessels carrying goods such as grain, iron ore and timber. "We have done what we could to raise the funds to save the company, but we have reached a point where there is not more to do," Michael Fenger wrote in a text message to Reuters on Wednesday.

Cost to Fuel Ships Falls

For a ship that burns 24 tonnes of fuel per day while steaming, fuel costs are reduced by as much as $1 million a year if current price level stay put. Assuming a difference from the average of first half of 2014 at $578 for 380 cSt, High Sulphur Fuel Oil (HSFO) in Rotterdam, to a new level of $412, and a sailing time of 70%. On an industry-wide scale, the drop have reduced the entire international shipping industry’s daily bunker cost by $117 million per day.

Floating Storage at Sea Stalls Despite Falling Oil Prices

Despite falling oil prices, traders in recent weeks have booked just a few tankers to store cargoes at sea as higher freight costs outweigh any profit play for now. This is partly due to expectation among tanker owners for higher rates in the final quarter of the year. That means oil traders will have to pay a premium to lease vessels for longer periods as shipping firms remain reluctant to tie up vessels given the potential for quicker earnings. "Owners will not do storage and miss out on the spot rallies to come," a tanker market source said.

Suez Canal: Better Service to the Shipping Industry

According to the U.S. Energy Information Agency, one of the world’s oil transit choke-points is the Suez Canal, the Panama Canal being another. However, the recently announced Suez Canal expansion plans are more likely to cater for containership transits, in strong competition with the expanding Panama Canal, rather than respond to the demand from oil tanker transits. On Tuesday, August 5, 2014, the Egyptian President Abdel Fattah el-Sisi unveiled the project, which is bound to be a multiyear, multibillion dollar one.

Ship Glut Burdens LNG Tanker Market, Slashes Profits

Deliveries of new gas tankers have created a glut that is threatening to tip some operators into losses, just as other shipping markets emerge from their worst downturn in decades. The liquefied natural gas (LNG) tanker market was until recently the only bright spot in an otherwise depressed freight industry. A global surge in the demand for gas, led by Japan in 2011, boosted trade, tied vessels to longer routes and drove rental rates to record highs. But the 119 new carriers ordered from 2011 will have expanded the fleet by over 30 percent by end-2017.