BIMCO: All Eyes on US Gasoline; Will Demand Exceed 9.2M Bpd?

“Fill her up, son; unleaded. I need a full tank of gas where I'm headed,” former Police-front man, Sting, sang back in 1999 on his solo album Brand New Day. This country-inspired song could be the anthem for what is coming around next week, as Monday. May 31 is Memorial Day in the U.S., the day that kicks off “the U.S. driving season”. The season runs for about three months from Memorial Day to Labor Day on September 6, during which the Americans take to the road, and demand for motor gasoline reaches a seasonal peak.

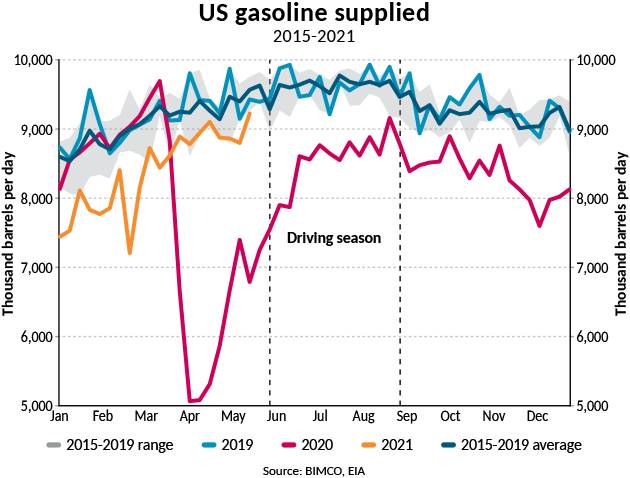

On 26 May, the U.S. department of Energy (EIA) releases its estimate for the week ending May 21. Will last weeks’ sharp uptick in ‘gasoline supplied’ – a proxy for demand – go even higher? ‘Gasoline supplied’ climbed from 8.8m barrels per day (bpd) on May 7 to 9.224m bpd on May 14 (source: EIA); the highest number of barrels per day since March 13, 2020.

Closing the gap?

Daily COVID-19 cases in the U.S. have declined from the early January peak when 300,000 people were infected, to slightly above 20,000 case on May 25. In combination with the fast-tracked vaccine rollout, the road is paved for what could very well become a seasonal peak for motor gasoline demand like the ones we used to know.

“We know that the U.S. consumers are loaded with cash, following several stimulus packages that have rapidly and considerably increased the disposable personal income. We also know that a lot of the money has been spent on goods – but far from all of them,” said Peter Sand, BIMCO’s chief shipping analyst.

“BIMCO expects a strong driving season, one that could exceed the 2019 level of gasoline supplied and prove that the recovery for motor gasoline is accomplished,” Sand said.

What about jet fuel demand?

On May 25, the accumulated year-to-date U.S. flight passengers so far in 2021, exceeded that of 2020, while remaining 47% below that of 2019. Primarily international flights are falling short. This means that levels of supplied jet fuel remain quite depressed, which tell us that the recovery of total oil demand is still waiting further down the road.

For the week ending May 14, 1.19m bdp of jet fuel was supplied, according to the EIA, much lower that the pre-pandemic level of 1.77m bpd estimated for May 10, 2019.

Total oil products supplied on May 15 came in at a four-week average of 19.2m bdp, 4.4% below the pre-pandemic level of 20.1m bdp on May 10 2019, but sharply up from 16.1m bdp estimated mid-pandemic on May 15, 2020.

“Reaching pre-pandemic levels of US oil product demand requires a resumption of international air travels. Until that happens, freight rate volatility will predominantly come from market disruptions of any kind,” Sand said.

(Source: BIMCO)