China’s 2021 Crude Oil Imports Down 5.7% - BIMCO

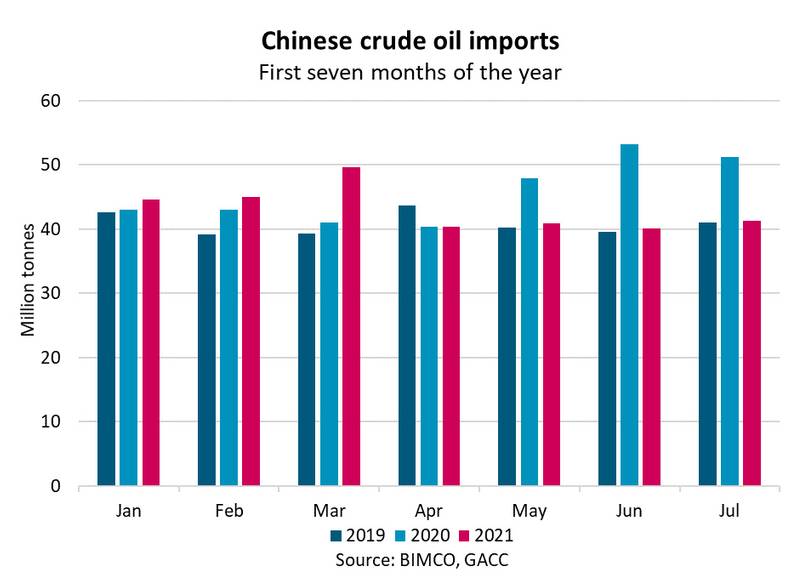

Chinese crude oil imports fell year-on-year in June and July, ending a streak of five months of accumulated year-on-year growth. After the first seven months of 2021, China’s crude oil imports are down 5.7% compared with the same period last year. January to July imports stood at 301.9m tons, an 18.1m tons decline from January to July 2020.

The June and July decline in crude oil imports is not attributable to unusually low imports as much as to unusually high imports in June and July 2020 when oil importing countries – including China - took advantage of attractive prices as the oil price war raged. In June and July 2020 Chinese crude oil imports totalled 104.5m tons, compared with 81.4m tons during the same two months this year, and much more in line with the 80.6m tonnes imported in June and July 2019.

Imports down from largest suppliers

Imports from all top five suppliers of crude oil to China have fallen, although only marginally when it comes to the biggest supplier, Saudi Arabia.

Imports from Saudi Arabia have declined by just 83,331 tonnes (-0.2%) during the first seven months of the year compared to the same period in 2020. Imports from Russia, the second largest supplier of crude oil to China, have declined by 4.9m tonnes (-9.6%) in the period. The biggest declines have come in imports from Brazil and Iraq which have seen exports to China fall by 5.8m tonnes (-23.3%) and 8.2m tonnes (-20.9%) respectively.

“As BIMCO had expected imports over the summer have failed to match last summer’s imports when the oil price war caused China to boost its stocks with cheap oil. The volumes seen at that time were never going to be matched this summer even if a wave of new COVID-19 cases had not spread across China and resulted in new restrictions and therefore lower demand for oil,” says Peter Sand, BIMCO’s Chief Shipping Analyst.

After record-breaking crude processing volumes in May and June, crude oil processing in China fell in July as tighter domestic travel restrictions and local lockdowns hit demand. In fact, crude oil processing was down 0.9% from July 2020, though on an accumulated basis crude oil processing remains 8.9% higher this year than last with 412.4m tonnes having been processed.

Source: BIMCO