Shell restructures its executive team; integrated gas and upstream director departs

Shell announced on Tuesday that Zoe Yujnovich will be leaving the company at the end this month, after spending more than a decade working for the oil giant. Shell's leadership structure has been simplified by the appointment of Cederic Crémers as president of Integrated Gas, and Peter Costello to lead Upstream. Shell has a strategy of streamlining its senior management structure.

Wintershall Dea Trims Norway Portfolio

Wintershall Dea has agreed to sell its stakes in Norway's Nyhamna gas processing terminal and the Polarled gas pipeline to CapeOmega and Solveig Gas to focus on its upstream oil and gas activities, the German oil and gas company said on Tuesday.Cape Omega will acquire a 5% interest in the Nyhamna terminal, while Solveig Gas will buy a 13.3% stake in Polarled…

Total Plans $5 Bln in Asset Sales

French energy giant Total will sell around $5 billion worth of assets, mostly from its upstream exploration and production business, as it seeks to focus on low breakeven projects that can weather weak oil prices, it said on Thursday.The company reported a 19% year-on-year drop in adjusted net profit to $2.9 billion in the second quarter,…

Equinor Completes NCS Asset Sales

Norwegian energy company Equinor announced Friday it has completed the sales of two non-core discoveries on the Norwegian Continental Shelf (NCS) for a combined $470 million.Equinor announced in October that it would divest from the King Lear and Tommeliten discoveries as part of an effort to prioritize and refocus its asset portfolio.The first sale…

Faroe Criticizes DNO's Takeover Bid as 'Opportunistic'

The oil and gas company with focus in Norway and the U.K. Faroe Petroleum has reaffirmed that Norwegian oil giant DNO ASA's GBP608mln ($761.65 million) unsolicited takeover offer for the AIM-listed firm is "opportunistic" and "substantially" undervalues it.Aberdeen-headquartered Faroe accused DNO of trying to exploit the recent drop in oil prices to acquire the company “on the cheap”.In a statement on Wednesday…

Total Sells Majority Interest In Géosel

Total has signed an agreement to sell an interest of 50% plus one share in Géosel Manosque (“Géosel”) to a 50-50 consortium composed of EDF Invest and Ardian. The transaction values Total's interest at €265 million as at January 1, 2015, excluding inventory and is subject to the confirmation of the other Géosel shareholders and the customary regulatory approvals.

Strong Interest in Keppel DC REIT IPO

Keppel DC REIT Management Pte. Ltd., a wholly-owned subsidiary of Keppel Telecommunications & Transportation Ltd has received overwhelming demand from institutional and retail investors for its initial public offering of 261,138,000 Units. The Offering comprised an international placement of 207,375,000 Units1 to investors, including institutional and other investors in Singapore (the "Placement Tranche")…

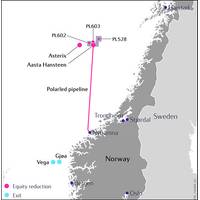

Statoil Transaction with Wintershall Completed

Statoil has now completed the transaction with the German oil and gas company Wintershall to farm down in Aasta Hansteen, Asterix and Polarled and exit two assets—the non-core Vega and Gjøa fields—on the Norwegian continental shelf (NCS). The transaction will enable Statoil to redeploy around USD 1.8 billion of capital expenditure for the period from the effective date until the end of 2020.

Realising Value to Further Strengthen NCS Portfolio

Statoil ASA farms down in Aasta Hansteen, Asterix and Polarled and exits two assets on the NCS for a consideration of USD 1.3 billion, including contingent payment. Through this transaction Statoil monetises on the Aasta Hansteen field development project, while retaining the operatorship and a 51 % equity share. In addition Statoil exits the non-core Vega and Gjøa fields.

Statoil Exits Two NCS Assets

Statoil ASA farms down in Aasta Hansteen, Asterix and Polarled and exits two assets on the NCS for a consideration of $1.3 billion, including contingent payment. Through this transaction Statoil monetises on the Aasta Hansteen field development project, while retaining the operatorship and a 51 % equity share. In addition Statoil exits the non-core Vega and Gjøa fields.

Statoil Farms Down in Angolan Pre-salt

Statoil has signed an agreement to farm down a 15% interest to WRG Angola Block 39 Limited in the Statoil-operated block 39 offshore Angola in the Kwanza pre-salt basin. WRG is a 50/50 joint venture comprising White Rose Energy Ventures and Genel Energy plc. “This is part of Statoil's active portfolio management. The farm-down reflects the…