Statoil Transaction with Wintershall Completed

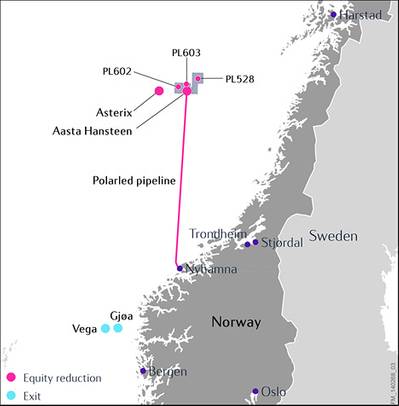

Statoil has now completed the transaction with the German oil and gas company Wintershall to farm down in Aasta Hansteen, Asterix and Polarled and exit two assets—the non-core Vega and Gjøa fields—on the Norwegian continental shelf (NCS).

The transaction will enable Statoil (STO) to redeploy around USD 1.8 billion of capital expenditure for the period from the effective date until the end of 2020.

Statoil monetises on the Aasta Hansteen field development project, while retaining the operatorship and a 51% equity share. The transaction also includes a farm down in four exploration licenses in the Vøring area.

The transaction consists of a cash consideration of USD 1.25 billion and a USD 50 million consideration contingent on Aasta Hansteen milestones.

Through this transaction Statoil focuses its NCS portfolio and further improves its capacity to invest in core areas.

Active portfolio management is part of Statoil’s strategy and this transaction demonstrates the company’s ability to capitalise on successful development projects. Statoil will recognise the accounting gain at completion of the transaction. The gain will be accounted for in the fourth quarter of 2014.

Subject to government approval, the operatorship for Vega and the Vega unit will be transferred from Statoil to Wintershall. The two companies expect that such operatorship transfer will take place within the end of the first quarter of 2015.