Hydrogen at Risk of Being Missed Opportunity, According to DNV Report

Hydrogen has a crucial role in decarbonizing the world’s energy system, but uptake will be too slow. Governments need to make urgent, significant policy interventions, according to a new report by DNV.

In Hydrogen Forecast to 2050, DNV predicts the amount of hydrogen in the energy mix will be only 0.5% in 2030 and 5% in 2050. However, to meet the targets of the Paris Agreement, hydrogen uptake would need to triple to meet 15% of energy demand by mid-century.

“Hydrogen is essential to decarbonize sectors that cannot be electrified, like aviation, maritime, and high-heat manufacturing and should therefore be prioritized for these sectors,” said Remi Eriksen, Group President and CEO of DNV. “Policies do not match hydrogen’s importance. They will also need to support the scaling of renewable energy generation and carbon capture and storage as crucial elements in producing low-carbon hydrogen.”

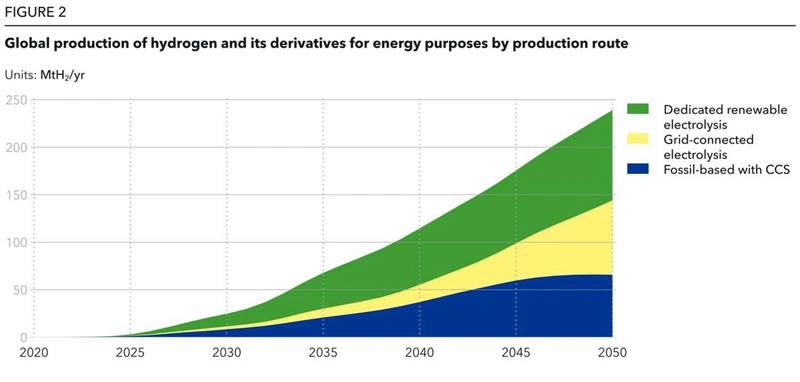

According to Hydrogen Forecast to 2050, electricity-based green hydrogen – produced by splitting hydrogen from water using electrolysers – will be the dominant form of production by the middle of the century, accounting for 72% of output. This will require a surplus of renewable energy, to power an electrolyser capacity of 3,100 gigawatts. This is more than twice the total installed generation capacity of solar and wind today.

Blue hydrogen – produced from natural gas with emissions captured – has a greater role to play in the shorter term (around 30% of total production in 2030), but its competitiveness will reduce as renewable energy capacity increases and prices drop.

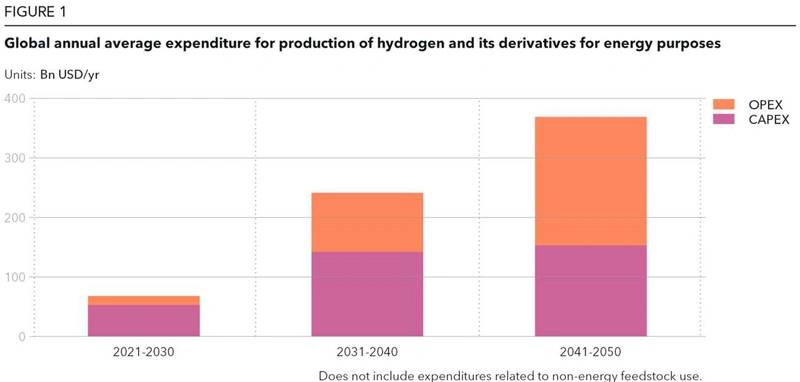

Global spend on producing hydrogen for energy purposes from now until 2050 will be $6.8 trillion, with an additional $180B spent on hydrogen pipelines and $530bn on building and operating ammonia terminals, according to DNV’s forecasts.

Cost considerations will lead to more than 50% of hydrogen pipelines globally being repurposed from natural gas pipelines, as the cost to repurpose pipelines is expected to be just 10-35% of new construction costs. Hydrogen will be transported by pipelines up to medium distances within and between countries, but not between continents. Global hydrogen trade will also be limited by the high cost of liquefying hydrogen for ship transport and the low energy density of hydrogen. The hydrogen derivative ammonia, which is more stable and can be more readily transported by ship, will be traded globally.

The uptake of hydrogen will differ significantly by region, heavily influenced by policy. According to the DNV report, Europe is the forerunner with hydrogen set to take 11% of the energy mix by 2050, as enabling policies both kickstart the scaling of hydrogen production and stimulate end-use. OECD Pacific (hydrogen 8% of energy mix in 2050) and North America (7%) regions also have strategies, targets, and funding pushing the supply-side, but have lower carbon-prices and less concrete targets and policies. Greater China (6%) follows on, recently providing more clarity on funding and hydrogen prospects towards 2035, coupled with an expanding national emissions trading scheme. These four regions will together consume two-thirds of global hydrogen demand for energy purposes by 2050.

Source: DNV

Source: DNV

Source: DNV

Source: DNV