Indonesian regulator confirms Tangguh LNG disruption

Indonesia's upstream gas and oil regulator SKK Migas confirmed that there was an outage on the third train at BP's Tangguh liquefied gas (LNG), facility in West Papua. It said operations would begin to resume from Saturday. Hudi Suryodipuro, spokesperson for SKK Migas, said on Thursday that an accident occurred on Train 3 Tangguh LNG in November 16 due to instrumentation problems at an onshore reception facility. This caused an emergency shut-off valve to be closed.

TotalEnergies purchases more gas assets in Texas for value chain boost

TotalEnergies, a French company, has expanded its natural gas footprint into the United States by announcing a deal with Lewis Energy Group. The two companies have agreed to buy a 45% share in certain dry gas producing assets located in the Eagle Ford Basin in Texas. TotalEnergies is one of the largest exporters of U.S. made Liquified Natural Gas. This gas is in high demand, as countries such as Europe and other parts of the world are moving away from cheap Russian gas and coal.

Timor Gap and Timor-Leste JV Gas Project Majority owned by Santos

Santos, the majority joint venture owner in Timor-Leste, announced on Monday that Timor Gap, a state-owned Timor-Leste oil company has acquired a 16 percent interest in Bayu-Undan's gas project. Timor Gap is now a member of the Bayu-Undan JV which includes SK E&S, INPEX, Eni, and Tokyo Timor Sea Resources. The joint venture partners manage jointly the Bayu-Undan Upstream Gas Project, which includes an offshore oil field and offshore production facilities and processing in Timor-Leste.

Rolling the Dice in Chaos: The Prospects of Investment in the Gas Industry

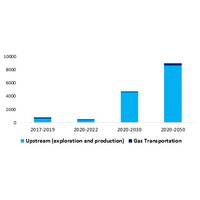

As stated in the Declaration of Malabo at the 5th Summit of Heads of State and Government of the GECF Member Countries, in order to sustain the security of demand and supply of natural gas, it is necessary to ensure sufficient investments through the entire gas value chain among all gas market stakeholders [1].Since the start of 2020, every aspect of the global economy, including investment projects in natural gas industry, have been strongly hit by the outbreak of the Covid-19 pandemic.

China: BP, ENN Sign 300,000t a Year Gas Supply Deal

British oil major BP has signed a gas supply agreement with China's ENN Group (ENN) for the supply of 300,000 tonnes per year of pipeline gas re-gasified from LNG for two years from January 1, 2021, in Guangdong, China. The LNG will be received and re-gasified through the LNG receiving terminal of Guangdong Dapeng LNG Company Limited (GDLNG) where BP holds regasification capacity. Dev Sanyal, executive vice president of BP gas & low carbon energy…

Canadian E.Coast LNG Export Plans Progress Shell Deal

Pieridae Energy moved closer to building a liquefied natural gas (LNG) export terminal on Canada's East Coast after taking ownership of fields from Royal Dutch Shell which will feed gas into the plant, the company said.The Goldboro LNG terminal would be the first on Canada's East Coast and compete with the growing number of plants on the U.S. Gulf Coast, hoping its shorter distance to Europe and further west will help…

Natural Gas to be 29% of World’s Energy Supply by 2050

The global oil demand will peak in the mid-2020s and gas demand will keep rising to 2033, says DNV GL.Gas demand will then plateau, and the fuel will remain dominant until the end of the forecast period in 2050, when it will account for over 29% of the world’s energy supply, it said.Significant investment will be required to ensure production meets demand, including realising the potential from stranded gas reserves and for reserve replacement.

Sound Energy Starts Drilling Well in Eastern Morocco

Moroccan focused upstream gas company Sound Energy confirmed that the drilling at TE-10, the second well of a planned three exploration well campaign in Eastern Morocco, has commenced.The TE-10 well will test the North East Lakbir prospect in the Company's Greater Tendrara permit and is located approximately 25 kilometres to the northeast of the recently awarded Tendrara production concession.The well is designed to test both a material TAGI stratigraphic trap and a smaller TAGI structural closure.

Decom North Sea Names Warrender as Chief Executive

Decom North Sea, the membership organization for the oil and gas decommissioning sector, has appointed John Warrender as Chief Executive, commencing on August 1.Warrender brings over 30 years of domestic and international experience to the position. His work with IOCs, NOCs and independent operators includes significant leadership experience in the strategic development of complex decommissioning programs in the North Sea.Most recently an independent advisor to the industry…

Sound Energy Commences Drilling at TE-8 Tendrara

Sound Energy, the African and European focused upstream gas company confirmed the commencement of drilling at the third Tendrara well, onshore Morocco. Following the recent success at the Company's first two Tendrara wells (TE-6 and TE-7), the Company's third well (TE-8) was spud on 19 February 2017. The TE-8 well is a step out appraisal well some 12 kilometres to the Northeast of TE-7 with the objective of proving up significant additional volumes in the TAGI (Trias Argilo-Gréseux Inférieur) reservoir whilst also…

Sound Energy Gets Sidi Moktar Regulatory Approvals

Sound Energy, the African and European focused upstream gas company is in receipt of the regulatory approval for the transfer to the Company of the 75% operated interest in the Sidi Moktar licences, onshore Morocco (the "Acquisitions"). The terms of the Acquisitions were announced by Sound Energy on 14 January 2016, 10 March 2016 and 23 September 2016 respectively. The Sidi Moktar licences consist of three onshore gas permits (the "Sidi Moktar Licences") covering 2…

Sound Energy Updates on TE7 Drilling, Log Results

Sound Energy, the European and African focused upstream gas company informed that TE-7, the second well at the Company's Tendrara licence (onshore Morocco), has now been successfully drilled to total measured depth of 3,459 metres corresponding to a vertical depth of 2,611 metres. The Company has successfully completed a 700 metre sub horizontal drill through the TAGI reservoir. Consistent with those seen in the drilling of TE-6, the Company has observed significant gas shows from the TAGI sandstones.

Sound Energy Confirms Significant Gas Discovery in Morocco

Sound Energy, the European / Mediterranean focused upstream gas company confirmed a significant gas discovery and a potential single gas column at the Company's Tendrara licence, onshore Morocco. The first Tendrara well, TE-6, was drilled to a depth of 2,665 metres and encountered the top of the structure and approximately 28 metres of net gas pay in the TAGI reservoir. Having completed operations on 7 August 2016 a stabilized gas flow rate…

Directorate Change at Sound Energy

Sound Energy, the European / Mediterranean focused upstream gas company, announced that its Non-Executive Chairman, Simon Davies, has decided to step down as a director of the Company following the Annual General Meeting being held today. Mr Davies is stepping down to pursue his other interests. The Company has asked James Parsons to act as interim Non-Executive Chairman whilst the Company concludes a search for a replacement Non-Executive Chairman.

Sound Energy Update on Tendrara and Meridja

Sound Energy, the European / Mediterranean focused upstream gas company provides the following update with regards Tendrar and Meridja. The processing of the logs while drilling and wire line logs at the first Tendrara well has now been completed. The preliminary petrophysical analysis confirms the presence of a number of gas bearing levels and a total net pay of 28 metres in the TAGI reservoir. This is ahead of initial expectations.

Sound Energy"s Tendrara Update

Sound Energy, the Mediterranean focused upstream gas company mobilised the National 110 UE (1500 HP) traditional rig for the upcoming first well at the Company's Tendrara licence area, onshore Morocco. The rig has been mobilised from Mauritania and is expected to arrive on site in early March 2016. The Company also reports having now received final approval from the Moroccan National Environmental Committee for the first and second Tendrara wells. There are no other approvals required before drilling can commence.

Sound Energy Update on Tendrara

Sound Energy, the European/Mediterranean focused upstream gas company has commenced with the ground works on site at the Company's Tendrara licence area and that all contracts have now been awarded for the first well. This includes the upgrading of local infrastructure which will be followed by the preparation of the camp and the two well pad areas. Further to the Field Management Agreement ("FMA") entered into with Schlumberger in relation to Tendrara…

Sound Energy to Acquire Meridja Area, Morocco

Sound Energy, the Mediterranean and European focused upstream gas company, announces that it has signed a binding agreement with Oil & Gas Investment Fund S.A.S ("OGIF") whereby OGIF has granted Sound Energy an option to acquire a 55% interest in the Meridja permit, onshore Morocco (the "Option"). Meridja is adjacent to Sound Energy's existing Tendrara licence and is a highly prospective 9,000 Km2 area with the same fundamental geology as Tendrara, where Sound Energy expects to drill its first well shortly.

First Gas for Sound Energy's Nervesa

Sound Energy, the Mediterranean focused upstream gas company has achieved first commercial production at the operated onshore Nervesa gas discovery on 3 February 2016. The Nervesa discovery was drilled successfully by the Company in 2013 and benefits from a gas sales agreement with the Shell Group. A further announcement confirming production rates will be made in due course, after the initial clean-up phase is completed and the stable flow rate has been assessed.

Shell pushes back investment decision on Canadian LNG project

British Columbia's ambitions to become North America's next major liquefied natural gas exporter took another hit on Thursday, as Royal Dutch Shell pushed back a final investment decision (FID) on its LNG Canada project to late 2016. The delay came as Europe's largest oil company reported its lowest annual income in over a decade and said it would take further steps to cut costs to cope with weak oil prices if needed.