Russian Oil Exporters Struggle to Stay Afloat as Discounts Deepen

Discounts on Russian oil at export terminals have once again approached historic highs, putting pressure on exporters' trade profits amid weak global oil prices, Reuters calculations show.Western sanctions over Russia's military action in Ukraine have forced its oil companies to sell crude at steep discounts, reaching $20 to $30 per barrel below Brent in December - the widest gap at Russian ports since early 2022…

Italy's Energy Minister sets out a path to reduce gas prices

Gilberto Pichetto Fratin, the Energy Minister said that Italy was targeting gas transport costs in order to reduce domestic energy bills. Giorgia Melons, the Italian Prime Minister is being pressed to lower the price of energy for both companies and consumers who pay much higher prices than the average in Europe. Pichetto stated during a Milan conference that he wanted to "correct an anomaly".

IEA reduces 2030 low-emission hydrogen production forecast by almost a quarter

The International Energy Agency reported on Friday that a wave of cancellations as well as cost pressures and policy uncertainties have reduced the projected 2030 development by almost a quarter. The IEA's Global Hydrogen Review states that the IEA expects to produce 37 million metric tonnes of low-carbon fuel per year by 2030. This is down from 49 millions a year ago as developers have shelved plans or delayed them.

Citi estimates that Brazil corn ethanol will almost double in production by 2032.

Citi Investment Bank said that Brazil's corn ethanol production will almost double by 2032 to 16 billion liters, citing the rapid growth of the industry. Citi estimates that Brazil will produce 6.3 billion liters (or ethanol) of corn in 2023-2024. The bank expects this to increase to 9.5 billion during the current crop season. The note stated that Brazil had 22 corn ethanol plants in operation as of last year.

DTE Energy's capital expenditure plan is increased, but the fourth-quarter profits are lower due to lower rates

DTE Energy increased its five-year plan for capital expenditures by $5 billion, on Thursday. The utility had posted a decline in the fourth quarter profit due to lower electricity prices. U.S. utilities are increasing their capital expenditure plans in order to upgrade the electric grid and lines to meet the needs of power-hungry industries. DTE announced…

US issue partial guidance on clean-fuel subsidies, which chastises ethanol producers

The U.S. Government released on Friday short-term guidelines on how companies could secure clean fuel tax credit under the Inflation Reduction Act. However, it did not finalize the key details of the program. The biofuels industry is eager to get clarity about the tax credits that are available for fuels which combat climate change. They hope this will allow corn-based fuel ethanol to be used as a feedstock in sustainable aviation fuel.

PDVSA Changes Oil Deals to Include Shipping as Sanctions Bite

Venezuelan state-run oil firm PDVSA has begun offering to ship its own oil, figuring in the costs in crude supply deals to help customers who have struggled to hire vessels to carry the country’s oil due to U.S. sanctions, according to company documents seen by Reuters.The United States has blacklisted vessel owners, shipping operators and threatened to sanction…

New Design for Liquid Hydrogen Bunkering Vessel Unveiled

Design and engineering services company Moss Maritime has, in cooperation with Equinor, the global maritime industry group Wilhelmsen and DNV GL, developed a design for a liquefied hydrogen (LH2) bunker vessel.The vessel design comes at a time when hydrogen is developing into a viable solution. Liquefied hydrogen at a temperature of -253°C is expected to…

Moody's Says Global Oil and Gas Heads into 2019 on Steady Footing

The global Oil and natural gas prices will be volatile, but also range-bound in 2019, Moody's Investors Service says in its annual report outlining key credit themes in oil and gas for the year ahead.While the recent announcement that OPEC and Russia will cut production helps alleviate concerns about oversupply, the pivotal questions in the coming year are…

Venezuela, Mexico Divert Crude to U.S. as Canadian Barrels Get Stuck

Cash-strapped state-run oil companies in Mexico and Venezuela have begun diverting crude historically processed for domestic use and sending it to U.S. refiners now facing transportation constraints to secure similar grades from Canada, data shows.The situation reflects an unusual set of events, including urgent needs by Venezuela and Mexico for cash for debt payments and investment…

Transporting Costs Go Up: TMM

The thirty-sixth edition of the Transport Market Monitor (TMM) by Transporeon and Capgemini Consulting reveals high transport prices due to declining transport capacities and rising fuel costs.In Q2 2018, the capacity index decreased by 36.3% to 70.1 compared to the previous quarter (index 110.1). In Q2 2017 the capacity index was 65.8, which means the index…

Canada Crude Differential Seen Staying High as Refiners Take Downtime

The discount on Canada's heavy crude, which reached a nearly five-year high this week, looks to remain elevated with pipelines strained and the refiners who buy it going offline for maintenance, industry officials say.Western Canada Select (WCS) oil traded on Tuesday for $34.15 per barrel less than West Texas Intermediate light oil, the biggest differential since November 2013, according to Shorcan Energy Brokers.

Novatek, Sovcomflot Pact for LNG Shipping from Yamal LNG

Leonid Mikhelson, Chairman of the Management Board of PAO Novatek and Sergey Frank, General Director of PAO Sovcomflot have signed a Strategic Cooperation Agreement on developing a strategic partnership to transport hydrocarbons (LNG and gas condensate) produced at Yamal LNG, Arctic LNG 2 and other Arctic projects of the Company. “Our unique partnership with…

LNG Destination Flexibility Seen Spreading

Japan's biggest city gas seller Tokyo Gas Co expects that contracts for liquefied natural gas (LNG) cargoes with destination flexibility will spread from the West and Japan to be a common thing worldwide, the company's new president said. Japan's Fair Trade Commission last June ruled that destination restrictions that prevent the reselling of contracted LNG cargoes breach competition rules.

Price Rally Spells Fleeting Relief for Canadian Producers

Canadian heavy crude rallied to a two-month high relative to U.S. crude this week, offering some relief to oil producers in Alberta struggling with thin margins amid plentiful supply. The rally was likely to be short-lived, traders and analysts said, because output continues to grow without a corresponding increase in transportation capacity. Canada's crude typically trades at a discount to U.S.

U.S. Shale Breakeven Price Pegged at $50

U.S. shale producers need a WTI oil price around $50 per barrel to break even, according to an analysis of financial statements for the second quarter. Fifteen of the largest shale oil and gas producers reported total net losses of $470 million for the three months between April and June when benchmark WTI prices averaged $48. Total losses were down from…

US Shale Breakeven Price Revealed

U.S. shale producers need a WTI oil price around $50 per barrel to break even, according to an analysis of financial statements for the second quarter. Fifteen of the largest shale oil and gas producers reported total net losses of $470 million for the three months between April and June when benchmark WTI prices averaged $48. Total losses were down from…

U.S. Coal Exports Soar, Revived in Part by New Energy Policy

U.S. coal exports have jumped more than 60 percent this year due to soaring demand from Europe and Asia, according to a Reuters review of government data, allowing President Donald Trump's administration to claim that efforts to revive the battered industry are working. The increased shipments came as the European Union and other U.S. allies heaped criticism on the Trump administration for its rejection of the Paris Climate Accord…

US Refiners Process Record Volume of Crude as Demand Climbs

U.S. oil refineries are processing record volumes of crude but stocks of refined fuels remain well contained thanks to strong exports and demand at home. U.S. refineries processed 17.5 million barrels per day (bpd) of crude in the week ending on May 26, according to the U.S. Energy Information Administration ("Weekly Petroleum Status Report", EIA, June 1).

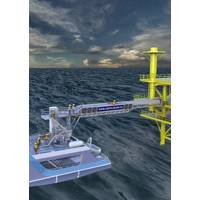

Ampelmann Debuts S-type Walk-to-Work System

Dutch company Ampelmann says it has designed its latest motion compensation access system, the S-type, as a cost effective and safe option in the transportation of workers and luggage to and from offshore platforms. The company, a provider of offshore access systems to the energy industry, is launching the new Walk-to-Work system as an alternative to using helicopters or baskets.