The net profit of Swedish bank SEB in Q2 is lower than expected

Swedish bank SEB reported a smaller-than-expected fall in second-quarter net profit on Wednesday as the effects of lower interest rates were partially offset by continued growth in lending and deposit volumes. Analysts polled by LSEG predicted a net profit of 8.25 billion crowns (US$849.5 million), down from 9.42 billion crowns a year ago. The net interest income (which includes mortgage revenues) fell from 11.7 billion crowns to 10.3 billion crowns in the previous year, slightly above the 10,2 billion predicted by analysts. It is the first bank to announce its second-quarter results among Sweden's largest banks.

The New Offshore Reality

Swedbank’s chief economist, Harald Andreassen, isn’t “too hopeful” about the long-term prospects for the oil price, but then again, “I’m less certain of this than I’ve ever been as an economist,” he told a floating production conference in Oslo. After two-and-half years of oil-price collapse followed by layoffs in the thousands; stacked oil rigs and order freezes for offshore shipping, price insecurity itself is a partial expression of confidence. Beneath some palpable yet halting movements toward recovery in 2017, there’s 2016’s rigorous cost-cutting by, among others, Statoil and its subsea supply chain.

Statoil Profit Jumps on International Ops Growth

First-quarter operating profit $3.3 bln is firm's first international profit since third-quarter of 2014. Statoil reported a far bigger jump in first-quarter operating profit than expected on Thursday, helped by the first profit from the Norwegian company's international operations since 2014 and higher oil prices. Like rivals such as Royal Dutch Shell, the majority state-owned oil and gas company benefited from a 55 percent increase in crude prices from the same period a year ago and its cost-cutting efforts. Statoil's overall adjusted operating profit came in at $3.3 billion, well above the $2.67 billion expected by analysts and $857 million a year earlier.

Rieber Shipping Hopes for Recovery, but is Prepared to Wait

CEO Irene Waage Basili of Norway's Rieber Shipping says hopes marine seismic market could begin to recover in 2017, but is prepared for current market weakness to last another 2-3 years. ** The seismic equipment on the vessels was owned by Dolphin.

Oil Firms Deepen Cost Cuts as Price Recovery Remains Elusive

Oil companies are deepening cost cuts through efficiency and standardisation to stay profitable while maintaining dividends as a supply glut pushes back a potential recovery in the price of crude, top executives and analysts said. The sector has slashed jobs, projects and investments to cope with a 60 percent downturn in crude prices over the past two years, with consultancy Wood Mackenzie putting the drop in exploration and production spending by the top 56 oil and gas firms at 49 percent, or $230 billion, over the period. But hopes for a steep recovery in prices have been dashed by persistent oversupply…

Statoil buys Petrobras stake in Brazil oil find

Statoil aims to offset declining output from mature fields. Norway's Statoil agreed on Friday to buy Petrobras' stake in an exploration licence off Brazil for $2.5 billion, a rare deal in an oil industry struggling with low prices. The purchase of the 66 percent stake from Brazil's state-led Petroleo Brasileiro SA (Petrobras) will help Statoil secure future production as output from its mature fields declines. The deal, Statoil's biggest in several years, will give it the bulk of oil and gas resources in the key Carcará field, one of the largest finds in the world in recent years, and bolster its future production abroad, the Norwegian firm said.

Oil Industry Suppliers See Light at the End of the Tunnel

European suppliers to the oil industry, hit by their customers' spending cutbacks over the past two years, have produced stronger than expected second-quarter earnings and are cautiously pointing to signs of recovery in demand. These companies, which encompass oil drillers, engineering groups, oil services providers and seismic surveyors, have had to slash jobs, costs and investments to cope with the fallout from a 60 percent drop in the oil price since 2014. The tide may be turning now the oil price has stabilised but any recovery for…

Norwegian Oil Spend to Shrink Further in 2017

Investment in Norway's oil and gas sector, a cornerstone of the country's economy, will continue to fall next year as weak crude prices curb oil firms' spending, a survey conducted by Statistics Norway (SSB) showed on Thursday. Norway's offshore sector generates a fifth of gross domestic product and a fall in crude prices has forced energy companies to delay or cancel projects and lay off staff. Due to lower investments in all categories, preliminary data suggest a drop of about 8 percent to 153.2 billion Norwegian crowns ($18.49 billion) when compared to the latest estimates for 2016, according to the survey.

Songa Restructures as Statoil Shortens Contracts

Norwegian rig firm Songa Offshore will issue new debt and shares worth up to $150 million and convert existing bonds of the same amount to equity as part of a plan to fix a liquidity shortfall, the company said in a statement on Tuesday. Songa's top customer, oil major Statoil, has meanwhile cut the contract length of two drilling rigs, the first by about one year and the second by six months, but still leaving Songa with an order backlog of $5.1 billion, it added. The refinancing plan includes an immediate bridge loan of $91.5 million to safeguard operations and fix a liquidity shortfall triggered by lower than expected utilisation of rigs…

Det norske buys Premier Oil's Norway Stake

Norway's Det norske oljeselskap has agreed to buy Premier Oil's Norwegian business in a $120 million cash deal that prompted gains in both companies' shares. The deal is one of a flurry of transactions made in the Norwegian North Sea in the last month, showing buyers and sellers are finding more common ground on price expectations. Last month, E.ON sold its Norwegian oil and gas business for $1.6 billion to Russian billionaire Mikhail Fridman's fund LetterOne and Det norske also acquired Svenska Petroleum's Norwegian assets for $75 million.

Lundin Petroleum Finds More Alta Arctic Oil

Lundin Petroleum finds more oil at site; firm will drill more wells next year. Sweden's Lundin Petroleum has found oil at two appraisal wells at its Alta discovery in the Arctic, a find that could open up a new area of oil production off northern Norway. The Alta find raised hopes when it was discovered in 2014 that more oil could be found in a region where only a handful of oilfields have been discovered after several decades, and none have started production. The firm did not revise its resource estimate for the find, originally seen at 125 million to 400 million barrels of oil equivalent, but said it will drill more on the site next year.

Statoil Bets on Oil Price Recovery, Investments Continue

Statoil cutting less in capex than any other major; continues to invest in long term projects. Norway's Statoil is cutting investments less than any other oil major this year, positioning for a crude price recovery but taking a risk should the slump be protracted. By continuing to spend on projects that won't start making returns for a up to a decade, the state-controlled energy giant hopes to sidestep the kind of boom-to-bust cycle often seen in the oil sector. Crude oil prices halved last year. "We as an industry tend to have a permanent bipolar disorder. We are either euphoric or depressed," Statoil Chief Economist Eirik Waerness said.

Paragon Acquires Majority Stake in Prospector

Paragon Offshore plc reported that it has acquired 52,749,014 shares of Prospector Offshore Drilling S.A., a publicly traded offshore drilling company listed on Oslo Axess. Paragon acquired the shares at a price of 14.50 Norwegian kroner (NOK) per share, or $2.13 per share based on the exchange rate of one United States dollar to 6.80 NOK. Following this transaction, Paragon owns a total of 52,749,014 shares of Prospector, equal to 55.8 percent of the outstanding shares of Prospector. Paragon intends to launch a mandatory tender offer for the remaining outstanding shares of Prospector within four weeks as mandated by applicable Luxembourg and Norwegian law.

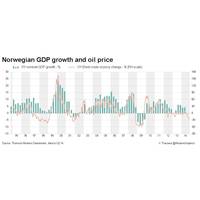

Oil Price Crash has Silver Lining for Norway

Norway, Western Europe's top crude producer, looks set actually to benefit from the oil price crash as its energy sector is forced to relax its stranglehold over much of the economy and non-oil firms profit from more favourable business conditions. Although it generates almost a quarter of its GDP from oil and gas, about the same as Russia or Venezuela, Norway's economy remains surprisingly resilient, and even its oil industry has begun a readjustment towards lower costs that could extend the sector's lifetime. While Russia faces recession and Saudi Arabia a budget deficit if crude prices hold at four-year lows of $78 per barrel…

Statoil: $32.5 bln for Sverdrup Startup

Development of field could cost up to $32.5 bln; cost estimate higher than analyst forecasts. Sverdrup scheduled to start up in late 2019. Statoil's giant Johan Sverdrup oil field could cost as much as $32.5 billion, the company said in its first full estimate of the price tag to develop Norway's most expensive ever industrial project. Discovered in 2010, Sverdup is the biggest North Sea find in decades, reinvigorating Norway's oil sector where production has been declining for more than a decade. At maximum, its production would equal nearly half of Norway's current oil output.

Statoil Records Loss; Energy Prices Impact Profits

Shares fall as much as 2.5 percent; takes impairment on Canada, Angola, U.S. Norway's Statoil reported an unexpected third-quarter net loss on Wednesday, weighed down by impairments, and said its underlying profit fell by a quarter on low oil and gas prices. State-controlled Statoil said it took $2 billion worth of charges on a halted Canadian oil sands project and exploration assets in the United States and Angola, while its underlying operations were hurt by a 21 percent drop in gas prices and a plunge in oil price. Still, the firm said…

Lundin Petroleum Hits More Oil, Shares Surge

Norwegian Arctic discovery could be game changer; Lundin Petroleum shares rise 7 percent. Noreco, Det Norske shares also rise on news. Swedish oil firm Lundin Petroleum has made a big oil and gas discovery in the Norwegian Arctic, sending its shares more than 7 percent higher and raising hopes that more oil could be found in the remote region. Lundin Petroleum's find in the Alta prospect contains between 125 and 400 million barrels of oil equivalent, including 85 to 310 million barrels of oil, near Statoil's Snoehvit field and Lundin's own Gohta find, the firm said in a statement on Tuesday.

Statoil Exits Shah Deniz Gas Project

Asset sales to protect dividends; firms face rising costs, falling oil prices. Statoil will retain stakes in ACG oil field, TAP Pipeline. Statoil exited Azerbaijan's Shah Deniz gas project on Monday, selling a 15.5-percent stake to Malaysia's Petronas for $2.25 billion as part of asset sales to shore up returns to shareholders. Like other oil majors, Norway's Statoil has been selling assets amid rising costs and falling oil prices. It earlier sold a 10 percent stake in Shah Deniz. French oil major Total sold out of Shah Deniz in May saying it would focus on operating projects rather than holding minority stakes.

Lundin Petroleum's Norway Discovery disappoints

Lundin Petroleum's Luno II oil and gas discovery offshore Norway is smaller than expected and analysts said it may be too small to support a stand-alone development. Luno II, discovered last year in the Norwegian sector of the North Sea, is now estimated to hold between 27 million and 71 million barrels of oil equivalents (boe) in gross contingent resource, below an initial estimate of 25-120 million boe, Lundin said in a statement on Friday. "In our view, the probability for a standalone development is now minimal and that a tie back development to the Edvard Grieg platform is the most likely solution…

Gas tanker firm Avance announces Oslo IPO

Gas tanker operator Avance Gas Holding is planning an initial public offering (IPO) and aims to list its shares on the Oslo Bourse in April, one of its owners said on Wednesday, joining a flurry of Nordic firms planning stock market debuts. "As part of the IPO, Avance Gas will raise new capital to pursue consolidation opportunities, and in addition, the three major shareholders are considering selling shares in order to facilitate sufficient share liquidity," Stolt-Nielsen Limited said. Avance Gas was formed by a merger of shipping assets from Stolt-Nielsen…