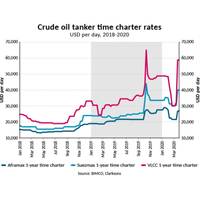

While Oil Prices Plummets, Tanker Rates Fly High

If one ever needed proof that, no matter how dire the situation, there is always a silver lining, look no further than the crude tanker market, which has seen it day rates skyrocket in the face of a global pandemic that has effectively ground world commerce to a crawl.As is the case with other gravity defying business phenomena, geopolitics is a central factor, in this case a battle between…

OGCI Invests in Wind Power for Ships

OGCI Climate Investments has led an EUR 8 million investment round in Norsepower, along with current investors, to accelerate Norsepower’s growth on global markets.The investment enables Norsepower to scale up production at its manufacturing facilities as part of a next phase of commercialization triggered by demand for its renewable wind energy propulsion systems, said a press release from Norsepower Oy Ltd.…

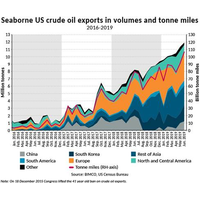

BIMCO: US Crude Exports Soar in June 2019

The highest US crude oil exports to China in 11 months lifted total seaborne US crude oil exports to a record high at 11.9 million (m) tonnes in June 2019. Also contributing to the June record was South Korea, as exports to the other main Far Eastern buyer reached an all-time high volume of 2.3m tonnes.1.2m tonnes were shipped to China between June 1, and June 30, , up from 1m tonnes in…

Tanker Shipping: Is the Oil Market Rebalancing or Not?

The one key factor to watch is the one thing that’s impossible to measure accurately on a global scale, oil stocks. Global stocks for both crude oil and oil products rose significantly following the sharp fall in crude oil prices in the second half of 2014. But while this may seem to be in the past, it is still haunting the oil market and the oil tanker market. Demand in the tanker market is below normal levels and will only increase once the global oil stocks have been reduced.

Trafigura Backs Out of Tanker Foray

Trafigura has sold five oil vessels to a unit of China's Bank of Communications , ending the trading house's move into owning tankers, the company said on Friday. Under the deal, the five medium-range tankers, ordered by Trafigura in 2013 from a shipyard in China, were sold to Bank of Communications Financial Leasing Company Ltd and subsequently leased back to the Swiss trading house. Financial terms were not disclosed.

Survival of Fittest for 2016 Commodity Shippers

Downturn in dry freight market started in 2008; more ships expected to hit the water next year. Shipping companies that transport commodities such as coal, iron ore and grain face a painful year ahead, with only the strongest expected to weather a deepening crisis caused by tepid demand and a surplus of vessels for hire. The predicament facing firms that ship commodities in large unpackaged…

Billionaire Fredriksen to Acquire Distressed Rig Assets

Norwegian-born billionaire John Fredriksen has set up a company to snap up oil rigs from firms struggling with low crude prices, adopting a similar approach to the one he used in 2012 when the tanker market collapsed. In an interview with business daily Dagens Naeringsliv, the man with an estimated fortune of 100 billion crowns ($11 billion), said he was putting some of his money into the venture called Sandbox, but might seek outside investors in due course.

NewLead Fixes Tanker

NewLead Holdings Ltd. announced today that the Company has entered into a new time charter contract for one of its bitumen tanker vessels, the MT Newlead Granadino for a minimum of six months with the charterer's option to extend the contract at the end of the first six months for additional six month periods up to a maximum of eighteen months. The net charter-out rate is $10,500 for the initial six months and $10,750 for the remaining optional periods.

Crude Oil Tanker Market Weakened, says OPEC

Crude oil tanker market sentiment weakened in April as average spot freight rates dropped on most reported routes, OPEC said in its latest monthly report. On average, dirty tanker freight rates were down 8% from the month before. Despite a stronger market seen in the VLCC sector, average dirty spot freight rates declined, influenced by the declines in Suezmax and Aframax freight rates.

Tanker Firms Eye US Listings as Market Rebounds

Inspired by an upturn in shipping markets after one of the worst sector downturns on record, a batch of oil tanker companies are looking to raise capital through U.S. listings. While crude prices have fallen more than 50 percent since June, tanker prospects have brightened, helped by a drop in bunker fuel prices and demand for oil among bargain hunters. Overcapacity, which has dogged owners for years, is also receding.

Euronav Posts 62% Core Profit Increase

Belgian crude oil shipping group Euronav on Wednesday unveiled a 62 percent rise in first-quarter core profit as daily rates for its fleet rebounded from last year. Euronav said that while rates were very volatile in the first three months of 2014, they had improved from the first quarter of 2013 when excess capacity on the oil tanker market had kept prices low. The group said it expected…