Russell: OPEC and IEA are focused on China's oil demand but it is the crude imports that matter.

What is more important to the crude oil market? Which is more important: the growth forecasts by major agencies of Chinese oil demand or the actual weakness of imports? The International Energy Agency (IEA), as well as the Organization of Petroleum Exporting Countries, (OPEC), both talk about the demand for oil when they forecast the future of the oil industry in China, the largest crude importer of the world. It is a practice that has been around for a while and is not challenged by the market.

Russell: OPEC and IEA are focused on China's oil demand but it is the crude imports that matter.

What is more important to the crude oil market? Which is more important: the growth forecasts by major agencies of Chinese oil demand or the actual weakness of imports? The International Energy Agency (IEA), as well as the Organization of Petroleum Exporting Countries, (OPEC), both talk about the demand for oil when they forecast the future of the oil industry in China, the largest crude importer of the world. It is a practice that has been around for a while and is not challenged by the market.

The IEA reports that Russia's oil exports increased to $15.8 Billion in January.

The International Energy Agency reported on Thursday that Russia's commercial revenue from crude oil and oil product sales in January increased by $900 millions from December, to $15.8 Billion, due to the higher oil prices, and stable export volume, despite sanctions. Early January, the United States announced their most comprehensive sanctions to date against Russian oil companies as well as tankers transporting Russian oil in response to Moscow's conflict with Ukraine. Some sanctions will take effect in late February or March. Donald Trump, the U.S.

US fuelmakers report lower profits in Q3 due to weaker margins and fuel demand

Energy analysts predict that the third quarter profits of U.S. refiners will be lower than last year due to a decline in margins, as fuel demand has slowed and more refining capacity is coming online. After the pandemic, and Russia's invasion in Ukraine, which boosted margins at record levels, refiners are now reversing their favorable pricing and high demand. The difference between the product price and the crude oil price for U.S. gasoline, diesel, and jet fuel declined in the third quarter.

BP warns that weak margins in refining will hit Q3 profits

BP has said that a decline in the refining margins will reduce its third quarter profit by $400 to 600 million dollars compared to the previous three-month period. In a press release, the British group said that it also expects its oil trading results to be poor. Oil refineries around the world are experiencing a decline in profits that is at a multi-year low. This marks a downward turn for an industry which had seen a surge in returns following the pandemic. It also highlights the global slowdown.

Shell's refining margins in the third quarter drop dramatically

Shell said that its refining profits fell sharply from the previous quarter to the third due to a slump in global demand. Its oil product trading earnings were also down, the company added. Shell's trading update, released ahead of its quarter-end results on October 31, revealed that its refining margins had fallen by almost 30% in the three months leading up to the end September. They were $7.7 per barrel the previous period. Shell has said that it expects its trading results in its Chemicals and Oil Products division to be lower than the second quarter.

Shell LNG Trading Gives Quarterly Boost

Earnings from Shell's liquefied natural gas (LNG) trading operations are likely to have been significantly higher in the fourth quarter of last year despite a sharp output drop owing to plant outages, it said on Friday.Europe's largest oil and gas company's update ahead of its full-year results on Feb. 2 also said it expects to pay about $2 billion in additional 2022 taxes related to the European Union and British windfall taxes imposed on the energy sector.Fourth…

Oil Barrels Toward $79 to Start '22

Oil rose towards $79 a barrel on Monday supported by tight supply and hopes of further demand recovery in 2022 spurred in part by a view that the Omicron coronavirus variant is unlikely to significantly dampen the outlook.Libyan oil output will be cut by 200,000 barrels per day for a week due to pipeline maintenance. OPEC and its allies, known as OPEC+, are expected to stick to a plan to raise output gradually at a meeting on Tuesday.Brent crude rose 95 cents, or 1.2%, to $78.73 a barrel as of 0923 GMT. U.S.

BIMCO: All Eyes on US Gasoline; Will Demand Exceed 9.2M Bpd?

“Fill her up, son; unleaded. I need a full tank of gas where I'm headed,” former Police-front man, Sting, sang back in 1999 on his solo album Brand New Day. This country-inspired song could be the anthem for what is coming around next week, as Monday. May 31 is Memorial Day in the U.S., the day that kicks off “the U.S. driving season”. The season runs for about three months from Memorial Day to Labor Day on September 6, during which the Americans take to the road, and demand for motor gasoline reaches a seasonal peak.On 26 May, the U.S.

China Grants Zheijang First Private Fuel Export License

China has granted Zhejiang Petroleum & Chemical Co (ZPC) a license to export refined oil products, making it the first private oil refiner to win such permission, two sources with knowledge of the matter said on Thursday.The license would allow ZPC to directly sell oil products to the international market, competing against state-owned refiners and helping to ease oversupply pressure in China's domestic market.However, the refiner will still need to be granted a government quota that will determine the size of its exports before it can begin shipments…

Gunvor Returns to Profit in 2019

Energy trader Gunvor Group returned to profit in 2019 after its first net loss a year earlier, helped by record earnings in its U.S. division, and said business so far in 2020 remained strong.The Geneva-based firm, which reported a 2019 net profit of $381 million after a loss of $330 million in 2018, said on Tuesday it was also helped last year by earnings from gas trading and its European refining business.But the group, one of the world's top five oil traders, said revenue dipped to $75 billion in 2019 from $87 billion in 2018.Gunvor, which launched its U.S.

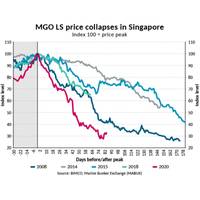

BIMCO: 2020 and the Collapse of Bunker Fuel Markets

The sulfur regulation from the International Maritime Organization (IMO) that came into force on 1 January 2020 took the center stage in the shipping industry at outset of the new decade. Four months on, the spotlights have turned to the coronavirus and the OPEC+ oil price war.The outlook for global economic growth remains bleak as the world is faced with the largest recession since the Great Depression in the 1930s.Commodity prices have declined across the board and most recently…

Country-by-Country Look at Dropping Fuel Demand

It's hardly news that the COVID-19 pandemic has sent most every market into tumult, most notably the oil and gas market as political power plays flood the world with oil precisely when demand has plummeted. Here we provide some recent insights on just how steep falls in fuel demand has been as lockdowns to contain the spread of the novel coronavirus limit the movement of more than 4 billion people.UNITED STATESU.S. fuel demand has dropped 28% in the last four weeks…

Japan's Oil Refiners Keep Running Even as Coronavirus Curbs Fuel Sales

Sales of petroleum products are slumping in Japan as the coronavirus outbreak worsens in the world's fourth-biggest importer of crude, but the country's biggest refiners say they are not planning to cut production.Oil product sales, including gasoline and jet fuel, slumped more than a quarter last week, the most recent period for which figures are available. Jet fuel sales sunk nearly 80% as Japanese and global airlines cancelled flights to China and other destinations.The…

Saudi Still China's Top Oil Supplier

Saudi Arabia held its position as China's largest crude oil supplier in September helped by demand from new refineries and as imports from Iran and Venezuela continued to fall due to U.S. sanctions, customs data showed on Friday.The drone and missile attack on oil-processing plants in Saudi Arabia on Sept. 14, knocking out half of the country's production, will likely have an impact on deliveries in October.At the height of the disruption, Saudi Aramco asked customers…

China Crude Runs Hit Record High

China's crude oil throughput rose 9.4% in September from a year earlier to its highest level on record, official data showed on Friday, led by increases from new refineries and as some independent plants returned from maintenance.Refinery runs hit 56.49 million tonnes, or about 13.75 million barrels per day (bpd), according to figures from the National Bureau of Statistics (NBS).The September rate was also up around 8% from 12.72 million bpd in August and beat the previous daily record of 13.07 million bpd set in June.Throughput in the first nine months gained 6.2% year-on-

IMO 2020: Shell, HES to Resurrect Refinery

Royal Dutch Shell has struck a deal with Dutch tank terminal firm HES International to partially restart a German oil refinery mothballed since 2011 in response to new restrictions on marine fuels, two trading sources told Reuters.A new cap set by the International Maritime Organization (IMO) that will cut the sulfur content in shipping fuel to 0.5 percent from 3.5 percent from next year is set to be one of the biggest fundamental events to hit oil markets in years.HES…

Storms, Snow Disrupt Exports from Russian Baltic

Storms, snow and freezing temperatures in Russia's northwest to the south have delayed some oil product exports but the fall in volumes so far has not been exceptional for the time of year, industry sources said on Thursday.Products are mainly shipped from ports on the Baltic coast, Black Sea, Sea of Azov and the Far East. They are mostly transported by rail and pipelines, with small volumes travelling by truck.Fuel oil loadings from the Russian Baltic were delayed by snow that caused disruptions to rail shipments to the ports…

Valero Reports Oil Product Leak in Britain's Milford Haven Waterway

Valero Energy Corp said on Thursday that an unknown amount of oil product had spilled into the Milford Haven waterway in Pembroke in Wales."Valero is working in coordination with response agencies to contain the effects from the release of oil," it said in an emailed statement.Valero operates the 220,000 barrel per day Pembroke oil refinery.(Reporting by Ahmad Ghaddar Editing by Edmund Blair)

Nghi Son Refinery Begins Commercial Production

Vietnam's Nghi Son oil refinery has officially begun commercial production following months of tests, the owner of the refinery said on Monday.Commercial production had begun from Nov.