China’s 2021 Crude Oil Imports Down 5.7% - BIMCO

Chinese crude oil imports fell year-on-year in June and July, ending a streak of five months of accumulated year-on-year growth. After the first seven months of 2021, China’s crude oil imports are down 5.7% compared with the same period last year. January to July imports stood at 301.9m tons…

China Crude Processing Spikes to All-time High

Chinese refinery crude oil throughput has reached its highest level ever, with total processed volumes up 12% in the first five months of this year compared to 2020, and up 10.9% from the same period in 2019. In total 292.7m tonnes have been processed so far this year according to the…

LR’s Nick Brown: Climate Emergency is “same magnitude, different time domain" to COVID-19

As the maritime industry settles in on a COVID-19 induced ‘new norm,’ and long-range planning is dramatically shortened,, Nick Brown, Marine and Offshore Director, Lloyd’s Register, said that while much deserved focus must be paid to the current crisis, the industry cannot lose sight of another one looming just as large: climate change.

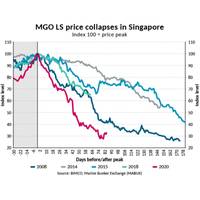

BIMCO: 2020 and the Collapse of Bunker Fuel Markets

The sulfur regulation from the International Maritime Organization (IMO) that came into force on 1 January 2020 took the center stage in the shipping industry at outset of the new decade. Four months on, the spotlights have turned to the coronavirus and the OPEC+ oil price war.The outlook…

OPINION: Drowning in Oil, Regulatory Measures to Keep Prices Afloat

These days history seems to be in the making on a daily basis. On April 20, 2020, the price of the NYMEX West Texas Intermediate Sweet Crude Oil (WTI) futures contract for May delivery plunged into the negative, forcing sellers to actually pay customers for taking the crude oil off the sellers’ hands.

Key Offshore Wildcat Wells At Risk of Being Suspended

At least nine of the world’s top planned exploration wells for 2020 are at risk of being suspended as a result of the blended impact of COVID-19 on oil and gas activities and the oil price war, Rystad Energy said Tuesday.These wells, the Norwegian energy intelligence firm said, located in Norway…

Exxon Cuts Spending by $10B

Exxon Mobil Corp on Tuesday throttled back a multi-year investment spree in shale, LNG and deep water oil production and will cut planned capital spending this year by $10 billion as the coronavirus pandemic saps energy demand and oil prices.Oil companies are reversing 2020 spending and…

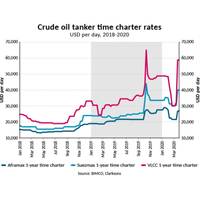

While Oil Prices Plummets, Tanker Rates Fly High

If one ever needed proof that, no matter how dire the situation, there is always a silver lining, look no further than the crude tanker market, which has seen it day rates skyrocket in the face of a global pandemic that has effectively ground world commerce to a crawl.As is the case with other gravity defying business phenomena…

Oil Facing Prolonged Period of Demand Destruction

Oil prices rose on Friday as the world's richest nations poured unprecedented aid into the global economy to stop a coronavirus-driven recession and U.S. President Donald Trump hinted he may intervene in the price war between Saudi Arabia and Russia.Brent crude futures were up $1.14, or 4%, at $29.61 a barrel by 1133 GMT. U.S.

U.S. Shale Greater Threat to OPEC After Oil Price War

In a corner of the prolific Bakken shale play in North Dakota, oil companies can now pump crude at a price almost as low as that enjoyed by OPEC giants Iran and Iraq. Until a few years ago it was unprofitable to produce oil from shale in the United States. But the steep slide in costs has U.S.

U.S. Shale Back in Business, Buoyed by OPEC, Trump

U.S. shale producers are redeploying cash, rigs and workers, cautiously confident the energy sector has turned a corner after Donald Trump's election victory and OPEC's recent signal that it plans to curb production. The downturn produced a leaner, more efficient U.S. shale industry that…

Oil Price War Threatens US Sense of Energy Security

The political economy of oil prices in the United States is complicated. The United States is the world's largest oil consumer and one of its biggest importers. But it is also a substantial producer with large oil and gas resources. And its oil is medium-cost, more expensive to produce…

Russia No Help in Oil Price War

Russia needs oil price of $100 to balance budget. Oil prices at four-year low of $78 and Russia can't cut output, has no storage to limit exports. Russia can do little to shore up slumping global prices even if OPEC wants it to. Russian wells will freeze if they stop pumping oil, and the country cannot store the output it would otherwise export.

Sinking Oil Prices May Curb US Output Too Slowly for Saudis

Saudi Arabia effectively started a global oil price war this month aimed at quickly denting U.S. oil output. Slowing a U.S. drilling boom, however, could take more than a year. Many observers expect a downward spiral of global oil prices to rapidly dampen shale oil drilling in the United States, slow production growth and help bolster prices.

U.S. Oil Output Cuts Could Take a While

Saudi Arabia effectively started a global oil price war this month aimed at quickly denting U.S. oil output. Slowing a U.S. drilling boom, however, could take more than a year. Many observers expect a downward spiral of global oil prices to rapidly dampen shale oil drilling in the United States, slow production growth and help bolster prices.

Oil Price War Waged with Deep Discounts

Kuwait crude discount to Arab Medium at widest in 10 years; Iraqi Basra Light OSP lowest in 1 year against Arab Medium. Little room for OPEC members to lower prices, gain market share. Kuwait, Saudi Arabia's traditional Gulf ally, is challenging its bigger neighbour in an increasingly…