Novatek in Talks on LNG Transhipment

Russia's liquefied natural gas (LNG) producer Novatek is in talks to tranship its Yamal cargoes in Norway or Russia's Murmansk because it is unsure of the impact of U.S. sanctions on the Chinese COSCO tankers it uses, a Novatek official said.The United States imposed sanctions on Sept. 25 on state-owned COSCO's subsidiaries, COSCO Shipping Tanker (Dalian) Co and COSCO Shipping Tanker (Dalian) Seaman & Ship Management, for allegedly ferrying Iranian crude.U.S.-listed ship owner Teekay LNG said last week its shipping joint venture in Russia, Yamal LNG, had been "blocked" by the U.S.

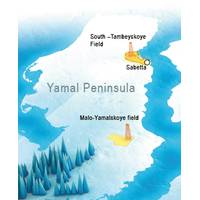

Russia: Second LNG Plant in Arctic

Russia on Tuesday started production at its second liquefied natural gas plant, Yamal LNG, with the aim of shipping the first cargo on Dec. 8 from the remote Arctic port of Sabetta. Russia's No.2 gas producer Novatek owns a 50.1 percent stake in Yamal LNG. France's Total and China National Petroleum Corp each control 20 percent, while China's Silk Road Fund owns 9.9 percent. Russia, seeking to produce more than 70 million tonnes of LNG per year in its remote Arctic regions, for now has just one operational LNG facility, run by Gazprom and co-owned with Shell on the Pacific island of Sakhalin.

Novatek Expects 50 pct Capex Growth in 2018, 2019

Russia's largest non-state gas producer Novatek expects capital expenditure to rise by around 50 percent in 2018 and 2019, as it pushes ahead with plans to increase liquefied natural gas production, a company official said on Thursday. Novatek Chief Financial Officer Mark Gyetvay said on a conference call that capital expenditure is seen rising to 60 billion roubles ($1 billion) per year in 2018 and 2019 from 40 billion roubles this year. Novatek is aiming to produce as much LNG as the world's biggest exporter Qatar and is drawing up plans to build a second plant, known as Arctic LNG 2, on the Gydan Peninsula that juts into the Kara Sea. Production there is due to start in 2022-2023.

Novatek Aims to Topple Qatar from LNG Top Spot

Russian gas producer Novatek aims to topple Qatar as the world's biggest exporter of liquefied natural gas as it gets closer to completing its first LNG project, a top executive said, batting away concerns about U.S. sanctions on the sector. The country's largest non-state gas producer is expected to start exporting LNG from the first phase of the Yamal project, situated far above the Arctic circle, towards the end of this year and may bring forward its final stage by six months, CFO Mark Gyetvay said. But it is the inception of Novatek's second, and Russia's third…

Novatek to Ensure LNG Projects Competitive with Qatar's LNG

Russia's largest non-state natural gas producer Novatek will work hard to ensure its future liquefied natural gas (LNG) projects are competitive with similar plants in Qatar, a company official said on Thursday. Novatek Chief Financial Officer Mark Gyetvay also told a conference call the global LNG demand has been robust. (Reporting by Vladimir Soldatkin)

Novatek Says No Need to Borrow More for Yamal LNG Project

Russia's largest private gas producer Novatek has no need to increase borrowing as it has sufficient funds for investments into its Yamal LNG project, the company's management said on Wednesday. At a conference call with analysts, Novatek's chief executive Leonid Mikhelson said his company has already invested $22 billion in Yamal LNG after securing borrowing on both global and domestic markets. He said Yamal LNG, a project to build Russia's second gas liquefaction plant, will receive another $6 billion in investment this year. Novatek's chief financial officer Mark Gyetvay…

Russia's Novatek to Update Long-term Strategy

Russia's No.2 natural gas producer Novatek is expected to present its new long-term strategy before year-end, Chief Financial Officer Mark Gyetvay told a conference call on Thursday. Novatek has been one of the fastest-growing oil and gas producers in Russia. The company plans to keep natural gas production flat this year, while eying a 30-percent rise in output of crude oil and gas condensate. Gyetvay said that Novatek, owned by its Chief Executive Officer Leonid Mikhelson and businessman Gennady Timchenko, is on course to cut capital expenditures this year by 30 percent from 58 billion roubles ($870.4 million) in 2015.

Yamal LNG Over 50% Complete

Novatek deputy chairman and CFO Mark Gyetvay said the Yamal LNG project in Russia have now passed the 50 percent overall completion mark. Gyetvay noted that 100 percent of the Yamal LNG’s production capacity has been sold. Additionally, he confirmed the first cargo from Yamal LNG’s first train, which has passed the 65 percent completion mark, will be shipped during the second quarter of 2017. Gyetvay said Yamal LNG was "very competitive" with other LNG projects globally, not least given the very low feedstock and other costs. Novatek was also looking at the possibility of building a brand new LNG facility on the nearby Gydan Peninsula to the east of Yamal, he added.

Novatek Shareholders Invested Around $10 bln in Yamal LNG

The shareholders in Yamal LNG, a liquefied natural gas project led by Russia's No.2 gas producer Novatek, have invested around $10 billion into the venture, Novatek Chief Financial Officer Mark Gyetvay told a conference call. The other shareholders are France's Total and China's CNPC. Last month, Novatek also signed a framework agreement allowing China's Silk Road Fund to obtain a 9.9 percent stake in Yamal LNG. (Reporting by Katya Golubkova and Denis Pinchuk)

Russia's Novatek May Extend Shares Buyback Program

Russia's No.2 natural gas producer Novatek is likely to extend the program of buying back its shares, Chief Financial Officer Mark Gyetvay said on Wednesday. "We believe ... that we will extend it for another year," he said during a conference call. The current program expires in June. He added the company will consider returning to the market with the buy back program once financing of Yamal LNG project is settled. (Reporting by Vladimir Soldatkin)

Russia's Novatek: No Delays on Yamal LNG Project

Yamal LNG, a project to produce 16.5 million tonnes of liquefied natural gas per year, is proceeding without delays, Mark Gyetvay, chief financial officer of Russia's No. 2 gas company Novatek, told a conference call on Monday. Novatek's access to global financial markets has been limited due to Western sanctions over Moscow's role in the Ukraine conflict, however it has secured funding from the Russian state. The $27 billion Yamal LNG is scheduled to start output in 2017. Reporting by Vladimir Soldatkin

Novatek: Urengoyskoye to Return to Full Capacity Next Year

Russia's Novatek, Russia's second biggest gas producer, said on Thursday its Urengoyskoye field should reach full capacity next year after a fire in April. "Most of the damaged equipment has been replaced and testing at the facility has commenced," Novatek's Chief Financial Officer Mark Gyetvay told a conference call. "The second stage production line will be launched right after the facility's put back in operation by the year-end. No one was injured in the fire at the Urengoyskoye gas field at its Severenergia unit. Novatek had earlier cut its gas output growth forecast this year to between 2 to 3 percent, down from previous forecasts of a 7 to 8 percent rise, due to the fire.

Novatek Cuts Gas Output Growth Outlook After Fire

Novatek, Russia's No.2 natural gas producer, has more than halved its 2014 production growth forecast due to a fire at one of its gas fields last month, the company's chief financial officer said on Friday. CFO Mark Gyetvay estimated that Novatek's total gas output will increase by between 2 to 3 percent this year, down from previous forecasts of a 7 to 8 percent rise. But the company was confident it could restore normal production in the fourth quarter of this year, and the fire would not influence 2015 production, he told a conference call. No one was injured in the fire at the Urengoyskoye gas field at its Severenergia unit in April.

Russia's Novatek Revises Down Gas Output Plans Due to Fire

Novatek, Russia's No.2 natural gas producer, has revised down its production plans due to a fire at its Urengoyskoye gas field earlier this year, the company's Chief Financial Officer Mark Gyetvay said on Friday. He estimated Novatek's total gas output increase at between 2 to 3 percent this year, down from previous forecasts of a 7 to 8 percent rise. Production of liquids, such as gas condensate and crude oil, is now expected to rise between 20 to 30 percent, compared to 40 to 50 percent a year earlier, he said. (Reporting by Vladimir Soldatkin; Editing by Alissa de Carbonnel)

Novatek looks to sell Yamal LNG Stake

Novatek is in discussions with Asia-based companies on the sale of a stake in the Yamal LNG project, Mark Gyetvay, its chief financial officer, said on Wednesday. "We're still discussing a potential sell down of 9 percent but right now there's no decision," said Gyetvay, adding that although the discussions were with a couple of Asia-based companies, Indian companies were no longer part of those discussions. The second-largest Russian gas producer plans to revise down its liquid gas production in the next week or two after a fire at its SeverEnergia venture curbed output.

China Committed to Russian Gas Project

Chinese investors are committed to financing part of Novatek's $27 billion Russian gas project, ensuring it has sufficient backing despite losing U.S. support because of sanctions, the company said on Wednesday. Russian corporate bond and loan issuance this year has languished on lenders' concern over becoming caught up in U.S. and EU sanctions imposed on Russian individuals in retaliation for Moscow's annexation of Crimea and support for separatists in eastern Ukraine. But the scramble for funds is driving businesses to Asia, where cash-rich investors and governments are less critical of the Kremlin's actions.