China Committed to Russian Gas Project

Chinese investors are committed to financing part of Novatek (NVTK.ME)'s $27 billion Russian gas project, ensuring it has sufficient backing despite losing U.S. support because of sanctions, the company said on Wednesday.

Russian corporate bond and loan issuance this year has languished on lenders' concern over becoming caught up in U.S. and EU sanctions imposed on Russian individuals in retaliation for Moscow's annexation of Crimea and support for separatists in eastern Ukraine.

But the scramble for funds is driving businesses to Asia, where cash-rich investors and governments are less critical of the Kremlin's actions.

"You are seeing a swing from where these big debt sources might have been to where they may move," one Moscow-based adviser said. "I think there will be a lot of conversations and travel between Moscow and Beijing - a more open dialogue."

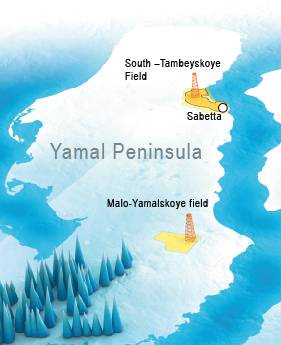

Novatek's Yamal liquefied natural gas (LNG) project is being developed in partnership with France's Total and China National Petroleum Corp (CNPC).

The project recently lost U.S. export credit agency Ex-Im Bank as a sponsor after sanctions were imposed, Novatek said. Ex-Im, which has about $1.7 billion of exposure to Russia, said it suspended consideration of the Yamal LNG application in March.

Among the individuals on the U.S. list of people subject to asset freezes and visa bans is Novatek shareholder and billionaire businessman Gennady Timchenko, an ally of Russian President Vladimir Putin. Timchenko owns 23 percent of Novatek via his investment vehicle Volga Resources, which is also subject to U.S. sanctions.

"Adequate Support"

"We believe that there is adequate financial support for the Yamal LNG project from the remaining export credit agencies, as well as positive comments from Chinese financial institutions regarding their commitment to provide a substantial portion of the total financing package," Novatek Chief Financial Officer Mark Gyetvay said in a conference call.

CNPC and a consortium of Chinese banks signed a memorandum on project financing for the Yamal project in September.

China Development Bank Corporation, Industrial and Commercial Bank of China (BACHF), Bank of China and China Construction Bank were considering actively participating in the external project financing transaction, Novatek said at the time.

"Our work activities relating to the Yamal LNG project are proceeding as planned," said Gyetvay. "We continue to hold constructive discussions with the international banking community, including export credit agencies."

Yamal LNG is slated to start production in 2017, targeting output of 16.5 million tonnes of LNG a year by 2020.

The $27 billion project is key for Russia's aim to double its global LNG market share to 10 percent by the end of the decade and will help Moscow in its efforts to diversify energy supplies away from Europe to Asia.

(By Megan Davies and Vladimir Soldatkin; Editing by David Goodman)