Aramco's chief executive expects an additional oil demand of 1,3 million bpd in this year

Amin Nasser, the chief executive of Saudi oil giant Aramco, said that he believes the oil market is healthy and anticipates a demand increase of 1.3 million barrels a day this year. Nasser, speaking on the sidelines at the World Economic Forum, Davos, was answering a question about the impact of U.S. president Donald Trump's decisions on energy, which could lead to an increase in U.S. oil production. He said that oil demand will reach 106 million barrels a day this year, after having averaged 104.6 million barrels a day in 2024. He said: "We still believe the market is healthy.

Future Fuels: 275 Altenative Fuel Ships Ordered in 2022

The total number of ships with alternative fuels ordered in 2022 was 275 (excluding battery operated vessels), according to numbers released today from DNV viat its Alternative Fuels Insight report.In addition, more than 50 LPG carriers have been ordered with LPG dual fuel systems. Predictably, LNG led the way with 222 ships or 81 % of total orders. Seventy-four percent of these orders were for container vessels and Pure Car and Truck Carriers (PCTCs), while product tankers came in third representing 9 % of orders.

Iran's Oil Storage Almost Full as Sanctions and Pandemic Weigh

Iran has slashed crude oil production to its lowest level in four decades as storage tanks and vessels are almost completely full due to a fall in exports and refinery run cuts caused by the coronavirus pandemic, industry data showed.Total onshore crude stocks surged to 54 million barrels in April from 15 million barrels in January, and swelled further to 63 million barrels in June, according to FGE Energy.Market intelligence firm Kpler estimated Iranian average onshore crude…

Bloom Energy, Samsung to Design Electric Ships

California-based Bloom Energy, the provider of stationary fuel cells, has announced a collaboration with South Korean shipbuilder Samsung Heavy Industries (SHI), to design and develop ships powered by Bloom Energy’s solid oxide fuel cell technology.SHI aims to be the first shipbuilder to deliver a large cargo ship for ocean operation powered by fuel cells running on natural gas. Such an innovation will play a key role in helping the company exceed the 50 percent emissions reduction target…

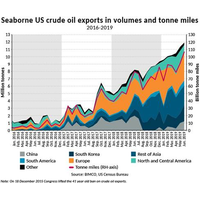

BIMCO: US Crude Exports Soar in June 2019

The highest US crude oil exports to China in 11 months lifted total seaborne US crude oil exports to a record high at 11.9 million (m) tonnes in June 2019. Also contributing to the June record was South Korea, as exports to the other main Far Eastern buyer reached an all-time high volume of 2.3m tonnes.1.2m tonnes were shipped to China between June 1, and June 30, , up from 1m tonnes in May and worlds apart from no exports at all in the months of August through October in…

Gazprom, Sovcomflot Pact on LNG Bunkering

Russian shipping company Sovcomflot and compatriot oil producer Gazprom Neft Marine Bunker have signed an agreement to cooperate on projects for bunkering ships with LNG fuel.The agreement was signed by Igor Tonkovidov, Executive Vice President and CTO/COO of Sovcomflot, and Andrey Vasiliev, CEO of Gazprom Neft Marine Bunker.Sovcomflot said that the agreement reinforces the mutual interest of both parties regarding their cooperation in the bunkering of Sovcomflot’s tankers with LNG fuel.Compared to conventional marine fuels…

Subtropical Storm Alberto's Landfall Expected Early Next Week

U.S. Gulf of Mexico producers and refiners are monitoring Subtropical storm Alberto, which is expected to make landfall between east Louisiana and the Florida panhandle early next week, the companies said on Friday. The National Weather Service on Friday predicted the storm would bring heavy rain to the central Gulf Coast region and the southeastern United States later this weekend and continue into early next week. The Louisiana Offshore Oil Port (LOOP), located about 20 miles south of the Louisiana coast in the Gulf, was operating normally, according to the company's website.

Tanker Shipping: Is the Oil Market Rebalancing or Not?

The one key factor to watch is the one thing that’s impossible to measure accurately on a global scale, oil stocks. Global stocks for both crude oil and oil products rose significantly following the sharp fall in crude oil prices in the second half of 2014. But while this may seem to be in the past, it is still haunting the oil market and the oil tanker market. Demand in the tanker market is below normal levels and will only increase once the global oil stocks have been reduced.

Sinopec to Open Zhanjiang Oil Tanks; SPR Site Delayed

Commercial crude storage of 8.5 mln bbls due start by June; Sinopec also building a rock cavern strategic reserve base nearby. Sinopec Corp is expected to start operating by June a new commercial crude oil tank farm in the southern Chinese city of Zhanjiang, where a large strategic reserve site is also under construction, three industry sources said this week. The new commercial tanks will store 8.5 million barrels, equivalent to over four supertankers. The tank farm consists of twelve tanks of 100…

Hvid to Take Over as Teekay President and CEO

Teekay Corporation’s board of directors has elected Kenneth Hvid to succeed current president and CEO, Peter Evensen, who will retire January 31, 2017 after more than 13 years with the company. Hvid is presently serving as president and CEO of Teekay Offshore Group Ltd. “Kenneth Hvid is the natural successor to Peter Evensen as CEO of Teekay at this time,” said Teekay's Chairman, Sean Day. Hvid has served on the board of Teekay daughter companies, and has worked closely with all the business segments in Teekay in his previous role as Chief Strategy Officer.

Kemp: Cheap Oil is Blunting Drive for Fuel Efficiency

Fuel consumption is not very sensitive to a small change in prices in the short run, but if the price change is large enough and lasts long enough the amount used can change significantly. The 60 percent decline in oil prices over the last two years has now been large enough and lasted long enough that it is starting to have a significant impact on the medium-term outlook for oil demand. Most crude oil is used as a transportation fuel in aircraft, ships, trains, trucks and cars…

BIMCO: Tanker Market Stays Strong, Demand is High

According to a recent BIMCO Shipping Market Analysis, the global tanker market remains a bright spot in the global shipping market, with demand staying high. Below is a synopsis of the report's latest findings. More than anything else, the healthy refinery margins that have followed in the wake of the lower input price has stimulated oil products trading and refinery throughput. This has been a strong boost to overall oil tanker demand. Freight rates would not have reached the highest levels seen since Q4-2014, especially for crude oil tankers without it.

Ample Storage Could Limit Energy Price Moves

New storage capacity to come on line in Asia this year. There is more storage space for crude around the world than anticipated, which will help prevent further sharp falls in the price but also weigh against significant price rises, analysts and industry watchers say. New storage tanks built in recent years, mostly in the United States and Asia, leave hundreds of millions of barrels of space to fill, confounding expectations that excess production could overflow tanks and drive prices further down.

Traders Prepare for Next Oil Price Dip

March 2016 would mark start of low-demand spring season. Oil traders are preparing for another downward turn in prices by March 2016, market data suggests, as what is expected to be an unusually warm winter dents demand just as Iran's resurgent crude exports hit global markets after sanctions are ended. Crude futures have already lost around 60 percent of their value since mid-2014 as supply exceeds demand by roughly 0.7 million to 2.5 million barrels per day to create a glut that analysts say will last well into 2016.

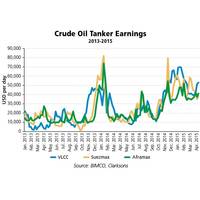

Strong Tanker Market Extends Peak Season High Earnings

Tanker earnings for crude oil tankers have climbed to new strong levels in the first quarter of 2015, with averages not seen since 2008, the Baltic and International Maritime Council (BIMCO) reported. The demand for crude oil tankers remains high even though the winter months are far behind us. Following the winter peak season of 2013/14, crude oil tanker earnings collapsed and remained low during spring, before rebounding over the summer. In the winter peak of 2014/15, this has not been the case.

Stronger Tanker Markets Prolonged on Strong Fundamentals - BIMCO

Demand for crude oil and oil product tankers is currently strong and both segments are enjoying an extended winter season with high earnings. Spot market earnings in January for VLCC and Suezmax reached USD 70,000 and USD 65,000 per day at the peak respectively. For the product tankers, Handysizes peaked at USD 35,000 per day in Q4 before heading south as the other product tanker segments did in January, only to rebound in the second half of February. In the product tanker market, freight rates on the spot market shot up in October and have managed to stay high since then.

General Maritime to buy Navig8 Crude Tanker

General Maritime Corp, which operates crude oil tankers, will acquire Navig8 Crude Tankers Inc in a stock-for-stock deal, the two companies said in a statement. A newly formed unit of General Maritime will acquire all of Navig8 Crude's common shares to form Gener8 Maritime Inc. Tanker companies, struggling to cope with poor charter rates, are teaming up to improve efficiency and reduce operating costs, besides adding to their fleets. General Maritime's deal for Navig8 comes…

Shipbuilding: NAT Finalizes Deal for Two New Tankers

On December 9, 2014, Nordic American Tankers Ltd. announced that preliminary contracts had been entered into with a South Korean shipyard, for the construction of two suezmax tankers to be delivered in the third quarter 2016 and first quarter 2017. The final documents were signed December 19, 2014. The contracts are now firm, bringing the NAT fleet to 24 suezmax crude oil tankers, being able to transport one million barrels of oil each. The purchase price of the two newbuilding vessels is in the region of $65 million each, which is expected to be financed by the internal resources of NAT.

TEN Charters up to Two Suezmax Shuttle Tankers

Tsakos Energy Navigation Ltd., a crude, product and LNG tanker operator, reached an agreement for a long-term time charter to a national oil company of a new DP2 suezmax shuttle tanker for delivery in the first quarter of 2017, with an option for a second vessel. This project will make a positive contribution to TEN’s bottom line. Shuttle tankers are a highly specialized sector, which calls for state of the art vessels specifically designed for oil transport from an offshore field.

ClassNK Registered Al Kout Delivered to KOTC

Leading classification society ClassNK announced that it has completed work on the 165,178GT VLCC Al Kout, built by Daewoo Shipbuilding & Marine Engineering Co., Ltd. (DSME) as part of a series of vessels constructed for the Kuwait Oil Tanker Company S.A.K. (KOTC). The Al Kout was officially delivered to KOTC at a ceremony held at KOTC Head Office in Kuwait on 30 October 2014. The Al Kout is the final vessel of the four VLCCs and one Aframax Tanker constructed by DSME as part…