Aramco CEO: Oil demand is strong and the market is watching Russia sanctions

The CEO of Saudi Arabia's state-owned oil giant Aramco stated on Tuesday that crude oil demand had been strong before sanctions were imposed against major Russian oil companies Rosneft, and Lukoil. He also said the Chinese demand was healthy. Donald Trump, the U.S. president, imposed sanctions against two Russian oil companies on October 22 in relation to Ukraine. The UK had targeted Lukoil, Rosneft and 44 shadow fleet tanks a week before in what they described as a renewed effort to tighten sanctions on energy and stifle Kremlin revenues.

Exxon expects a surge in natural gas demand by 2050

Exxon Mobil's annual outlook said that global demand for natural gases will increase by more than 20 percent from its level last year in 2050, as the gas replaces coal in powering industries and meeting higher electricity needs in developing countries. These projections form the basis of the long-term investment and strategy for the largest U.S. oil company. Exxon's growth plans are ambitious compared to those of other oil companies around the world. The company aims to increase production by 18% in the next five year.

Choose your favorite. Russell: China's imports of commodities can be either solid or soft.

The markets often use data, such as China's imports for major commodities, to determine trends regarding the second largest economy in the world. The July trade data is not very clear. It gives ammunition for both an economy that's resilient and recovering and another that's struggling to gain momentum. Crude oil provides a good example. Calculations based on data released Thursday show that China, the world's largest importer, received 11.11 million barrels of oil per day in July. This was an increase of 11.5% or 1,14 million bpd from the 9,97 million bpd in July of last year.

Choose your favorite. Russell: China's imports of commodities can be either solid or soft.

The markets often use data, such as China's imports for major commodities, to determine trends regarding the second largest economy in the world. The July trade data is not very clear. It gives ammunition for both an economy that's resilient and recovering and another that's struggling to gain momentum. Crude oil provides a good example. Calculations based on data released Thursday show that China, the world's largest importer, received 11.11 million barrels a day (bpd). This was an increase of 11.5% or 1,14 million bpd from the 9,97 million bpd in July of last year.

US crude oil demand surges as traders prepare for OPEC+ pricing war

The Tank Tiger storage broker reported that the demand for crude oil in the United States has risen in recent weeks, to a level similar to the COVID-19 epidemic. This is as traders prepare to receive a surge in supply from the Organization of the Petroleum Exporting Countries (OPEC) and its allies in the coming months. OPEC+ has agreed to increase oil production for a second month in a row, June. The group is looking to punish members who are overproducing. OPEC leaders also plan to increase oil production in July.

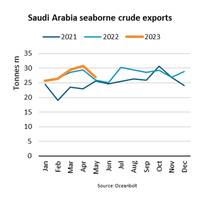

Saudi Arabian Crude Oil Exports Fall 12%

“By agreeing to an additional voluntary production cut within OPEC (Organization of the Petroleum Exporting Countries) of 500,000 barrels per day in May and announcing a further independent production cut of 1,000,000 barrels per day in July, Saudi Arabia is aiming to reduce excess supply and support prices,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.According to the EIA (U.S. Energy Information Administration), Saudi Arabian oil production fell to 9.9 mbpd (million barrels per day) in May…

Frontline Sees Opportunity in Tanker Market

So far in 2019, 41 VLCCs have been added to the global fleet compared to three vessel demolitions, said the world's largest oil tanker shipping company Frontline Ltd.An additional 33 VLCCs are scheduled to be delivered in 2019 with 43 more to follow in 2020 before the order-book declines sharply.It is important to note that both the VLCC and Suezmax tanker order book as a percentage of the total fleet are at the lowest levels seen in over 20 years.The order book has been the biggest challenge for the tanker markets over the last 24 months.

OPEC Output to Remain Flat: Rystad

OPEC and its allies, including Russia, can maintain their current cuts and not reduce outputs any more because there will be a crude oil demand surge later this year from changing shipping fuel standards worldwide.The OPEC+ countries will not be able to increase their collective oil production levels in the second half of 2019 without having a detrimental effect on oil prices. However, the production cuts required by OPEC+ in order to support prices need not be as much as 1.5 million barrels per day (bpd)…

Minnesota Regulators Question Enbridge Pipeline Expansion

Commissioners on a Minnesota regulatory board questioned crude oil demand for Enbridge Inc's Line 3 pipeline on whether work can proceed on a proposed expansion of the line. Enbridge wants to replace the aging 1,031 mile pipeline that runs from Alberta to Wisconsin, but approval is needed from the Minnesota Public Utilities Commission. Bottlenecks in Alberta have steepened a price discount for its heavy crude this year. Line 3, placed into service in 1968, operates at half its capacity due to integrity concerns.

Sinopec Plans Refinery Overhaul, Cuts Saudi Oil Imports

Sinopec's 460,000-bpd Zhenhai refinery plans full shutdown through May. Sinopec Corp will shut down its largest refinery for maintenance throughout May, and at least four independent oil plants have started overhauls this month, curbing China's crude oil demand. The news comes after Sinopec, China's largest state refiner, announced big cuts in its Saudi oil imports. Sinopec's 460,000 barrels-per-day (bpd) Zhenhai Refining and Chemical Company will be shut down from May 1 for 40-day maintenance…

Energy Battle is More Than OPEC vs U.S. Shale

The market narrative consuming crude oil markets currently is the interplay between supply cuts by OPEC and its allies and rising U.S. shale output, with a side helping of Chinese imports driving demand. While there are solid reasons for industry participants to focus on these dynamics, there is also the risk of missing out on other factors that help shape the market. Such a factor is India, which has long flown below the radar of the crude oil market, despite becoming the second-biggest importer in the fast-growing Asian market behind China…

China Still the Main Game for Commodity Demand: Russell

China strode like a colossus over major commodity markets in 2017, as the world's biggest buyer of natural resources made its presence felt on demand for coal, iron ore, crude oil and liquefied natural gas (LNG). China's influence on major commodities is likely to remain the single most important factor driving supply and demand in 2018, but that's not to say next year will simply be a repeat of what happened this year. Still, some trends established in 2017 will continue, or even accelerate, with LNG potentially the best example.

China's Crude Splurge is OPEC's Best Friend

China's crude oil imports surged to the second-highest on record in September, but this isn't a sign of supercharged demand in the world's second-biggest economy. It's rather a shuffling of where oil is being stored around the globe and a couple of factors that caused a temporary boost to Chinese import demand. China's crude imports jumped to 37 million tonnes in September, equivalent to 9 million barrels per day (bpd), according to preliminary customs data released on Oct. 13. This was up from August's 8 million bpd, but it's worth noting that August was an eight-month low.

Big Monthly Loss for WTI Looms in Harvey's Wake

U.S. gasoline at two-year high above $2 a gallon, as almost a quarter of U.S. U.S. crude oil prices are on track to post the steepest monthly losses in more than a year on Thursday as concerns spread over falling demand in the world's top oil-consuming country after storm Harvey knocked out almost a quarter of its refineries. But prices rallied in the oil products markets, with U.S. gasoline futures hitting a two-year high above $2 a gallon, buoyed by fears of a fuel shortage just days ahead of the Labor Day weekend that typically sees a surge in driving.

China's Appetite for Crude Could Wane

The sharp slowdown in China's refinery processing in July may be another warning sign that the robust growth in crude oil demand this year in the world's top importer is poised to moderate. Refinery throughput was 45.5 million tonnes of crude in July, or about 10.71 million barrels per day (bpd), the lowest operating rate since September last year, and a drop of 500,000 bpd from June. For the first seven months of the year, refinery runs were 11.04 million bpd, up 2.9 percent from the same period last year.

China's Thirst for Crude continues, Although More Slowly: Russell

There is little doubt China's crude oil imports enjoyed a robust 2016, hitting a record high. The question is how long the party can continue? Customs data released on Jan. 13 showed Chinese imports of crude reached 36.38 million tonnes in December, or 8.57 million barrels per day (bpd), the most in a month and well above the previous mark of 8.04 million bpd set in September. For the year crude imports were 13.6 percent higher at about 7.6 million bpd. In volume terms this represents a gain of about 912…

Brent Softens, but Third Week of Gains Likely

Brent crude oil fell on Friday after hitting an eight-week high, as weak fundamentals countered a lift in sentiment over talks next month on a possible output freeze, though futures remained on track to rise for a third consecutive week. International benchmark Brent futures were trading at $50.70 per barrel at 1128 GMT, down 19 cents from their last close. Brent earlier hit $51.22, its highest since June 22. U.S. West Texas Intermediate (WTI) crude futures were down 9 cents at $48.13 a barrel after reaching $48.75, their highest since July 5.

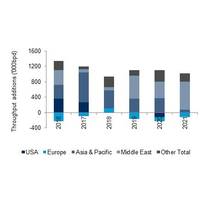

Tanker Outlook Dented by Middle East Refineries

A steep rise in refinery capacity in the Middle East, the world’s crude oil production hub, will diminish oil trade growth and with it prospects for tanker shipping, according to the latest edition of the Tanker Forecaster, published by global shipping consultancy Drewry. The global crude oil trade, which surged last year on the back of strong growth in oil demand and stocking activity, is expected to continue to expand strongly over the next 18 months supported by an anticipated rise in U.S. imports. But once U.S.

OPEC Bullish on Oil Demand in H2 2016

“Higher oil demand is expected in the 3rd and 4th Quarters”, HE Dr Mohammed Bin Saleh Al-Sada, Qatar’s Minister of Energy and Industry and current OPEC President said, expressing positive sentiments in a brief released from OPEC. He added that, since February of this year, the oil price had experienced a steady improvement following a decline in crude oil production, supply outages and a decrease in oil inventories, while the global demand for oil improved in that period. Dr Al-Sada said that the recent decline observed in oil prices and the current market volatility is only temporary.

Oil Slides on Oversupply, Economic Headwinds

Oil prices fell on Monday, holding near two-month lows amid worries that a global glut of crude and refined products would weigh on markets for some time. Brent crude futures were trading at $45.34 a barrel at 1149 GMT, down 35 cents from their previous close, while U.S. crude was down 37 cents at $43.82 a barrel. Both benchmarks were close to two-month lows reached last week. Traders said oversupply and growing economic headwinds were weighing on oil. "The potential for larger-than-normal stock builds is growing," Morgan Stanley said in a note.