Tanker Outlook Dented by Middle East Refineries

A steep rise in refinery capacity in the Middle East, the world’s crude oil production hub, will diminish oil trade growth and with it prospects for tanker shipping, according to the latest edition of the Tanker Forecaster, published by global shipping consultancy Drewry.

The global crude oil trade, which surged last year on the back of strong growth in oil demand and stocking activity, is expected to continue to expand strongly over the next 18 months supported by an anticipated rise in U.S. imports.

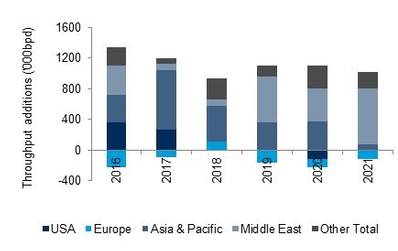

But once U.S. crude oil production stabilizes and import growth recedes, the global oil trade will be heavily dependent on demand growth in Asia, where refinery capacity is scheduled to expand in the coming years. However, the bulk of refinery growth is expected to take place in the Middle East, accounting for as much as 70 percent of worldwide capacity uplift over the next few years. With oil importing countries raising refining capacity at much slower rates, it leaves little growth prospects for seaborne trade. A recovery in U.S. domestic shale oil extraction, which is a likely scenario from 2017, could dampen tanker shipping tonnage demand further. As a result, Drewry forecasts that global seaborne crude oil demand growth will slow to an annual rate of 1.2 percent in 2019-21 from 3 percent currently.

“Slower trade growth by 2019-21 will negatively impact tonnage demand, which in turn will keep freight rates under pressure despite the expected slowdown in fleet growth,” said Rajesh Verma, Drewry’s lead analyst for tanker shipping.