Staatsolie will raise 250 mln dollars, 50 mln euro through bonds due in 2033

Suriname’s state-owned power company Staatsolie launched on Friday a new debt bond offer maturing in 2033. The company hopes to raise $250m and 50m euros ($52m) to finance its participation in an important project off the coast of the country, it said. To secure a 20% share in Block 58 being developed by France’s TotalEnergies, and U.S. company APA Corp, the company must raise $2.4 billion via different financing mechanisms. This includes up to $1.5billion in bank loans.

Pemex Requests $8bn Loan Amid Heavy Uncertainty

Petróleos Mexicanos’ (Pemex) US$8 billion bank loan comes amid heavy investor uncertainty over the oil company’s debt load, but lenders wanting to maintain links with Pemex and the left-wing administration overseeing the firm may have little choice but to commit to the financing.The state-backed oil producer is tapping its relationship banks to refinance a chunk of liabilities, a big ask when there is minimal visibility over Pemex’s…

Seadrill Exits Chapter 11

Offshore drilling rig contractor Seadrill said on Monday it had successfully completed its reorganisation, emerging from a U.S. Chapter 11 bankruptcy process launched last September. The company, once the world's largest offshore driller by the market capitalisation, was forced to seek protection from creditors when it was unable to repay its debts amassed during boom years to buy new rigs. When oil prices fell in 2014, oil companies cancelled or postponed exploration plans to save cash which reduced demand for offshore drilling rigs.

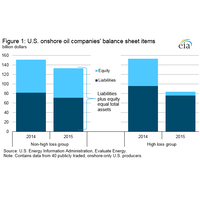

Effects of Price Slump Vary among Oil Firms -EIA

EIA: 2015 financials reveal significant differences across U.S. Analysis of the annual reports of 40 publicly traded onshore-only U.S. oil producers reveals combined losses of $67 billion in 2015, driven by significant reductions in sales revenue and write-downs of assets following the decline in crude oil prices over the last 18 months. However, there are significant differences across these companies. Eighteen of these companies, referred to here as the high loss group (HLG), reported 2015 losses in excess of 100 percent of their equity.

Solar Panels Power Business Surge in Tanzania

S amwel Nyakalege's life has recently become more of a grind - and that's a good thing. The 33-year-old miller from Bwisya village, on Lake Victoria's Ukara Island, is one of the first to benefit from a project to bring solar power to residents and business-owners. The entrepreneur, married with four children, has worked grinding millet, maize, rice and beans since 2007, but the high cost of fuel for his diesel generator made it hard to turn a profit.

Energy Transfer to Shed Sunoco Stake

Pipeline operator Energy Transfer Partners LP said it would sell its 68.42 percent stake in Sunoco LLC, which distributes motor fuel, to convenience store operator Sunoco LP for about $2.23 billion. The transaction, the latest among such asset sales between the two, will complete Sunoco LP's transformation into a wholesale fuel and retail marketing company, the companies said in a statement on Monday. Sunoco LP will pay Energy Transfer Partners about $2.2 billion in cash and the rest by issuing about 5.7 million common units.

Wintermar Offshore Profits Dip

Wintermar Offshore Marine eports 9M/2015 revenue was down 42% YOY to US$76.4 million, as oil and gas activity continued to decline during the quarter. Lower activity levels in the upstream oil industry impacted utilization and charter rates, and as the previous quarter with few tenders for projects. This led to lower utilization across the board. As a result of this, there was more competition from other vessels in available tenders and charter rates were lower for the new jobs secured in the quarter.

Drillsearch Secures $100 mln Loan Facility

Drillsearch Energy Limited is pleased to announce that it has entered into a binding terms sheet for a new three-year $100 million1 secured bank loan facility. The new facility will be a multi-currency, Reserve-Based Lending facility and will replace Drillsearch’s existing undrawn working capital facility which was due to mature in March 2016. Drillsearch has appointed its existing financiers, Commonwealth Bank of Australia Limited and Australia and New Zealand Banking Group Limited, to act as Joint Mandated Lead Arrangers.

DNB Bank: Loan Book Risk is Manageable

Norway's DNB bank, one of the lenders most exposed to the energy sector, has tested its loan book against big oil price falls and expects losses to remain below their usual levels next year, it said on Friday. Around 8 percent of DNB's loan book is to the oil and gas sector but the vast majority of this is low and medium risk so impairments will stay below normalised levels next year, in line with DNB's previous guidance, the company said in a statement.

Bosnia to Expand Coal-Fired Plant with China Exim Bank Loan

Bosnia will expand a coal-fired power plant with a loan of 668 million euros ($833 million) arranged with the Export-Import (Exim) Bank of China on Wednesday, local media reported. Top power utility EPBiH plans to build a 450-megawatt unit at its Tuzla power plant, marking the biggest investment in a drive to address the country's creaking energy infrastructure. Ante Krajina, prime minister of Bosnia's autonomous Bosniak-Croat Federation…

Petrobras Funding Options Narrow as Scandal Deepens

Brazil's state-controlled oil firm Petrobras may have to hike fuel prices, cut spending or seek a capital injection from the government next year as a widening corruption probe threatens to temporarily leave it out of capital markets. Yet any of those steps would be difficult to implement and may not be enough to fully substitute international bond markets as the company's main funding source, said one banker who helped oversee some of the company's bond offerings in recent years.

BW Offshore Completes $800m Bank Loan

BW Offshore has signed the facility documentation for the new $800 million 10-year senior secured credit facility for the Catcher FPSO project.e facility is a combined construction and long term financing facility. The credit facility was substantially oversubscribed by a group of 13 leading international banks. The Equity Ratio covenant (equity to total assets) in the Catcher facility is 25%, in line with BW Offshore's three bond loans.

Marathon Quits Norway in $2.1 bln Deal

Marathon fails to sell smaller UK business; deal worth $2.7 bln including debt. Det norske shares rise as much as 9 pct. Marathon Oil Corp is to sell its Norwegian business for $2.1 billion to oil exploration group Det norske, part of plans to shed assets in Norway and Britain to free up cash for the U.S. firm's shale activities in the United States. The deal goes some way towards Marathon's aim of quitting the North Sea and will transform Det norske into a full-blown exploration and production company.