French and Benelux stocks: Factors to watch

Here are some company news and stories that could impact the markets and individual stocks in France and Benelux. Source familiar with the issue said that German, French, and Spanish Defence Ministers will meet on December 11, to discuss FCAS. Europe's next generation fighter project is at risk due to industrial turf wars. AIRBUS/TIGERAIR : Taiwan's low-cost airline Tigerair 6757.TW announced on Wednesday that the board of directors had approved the purchase of 4 new A321neo planes from Airbus AIR.PA, and the leasing of 11 additional aircraft for T$40billion ($1.28billion) to expand the network.

Auto stocks rise as European shares soar in focus of earnings season

European stocks rose on Monday, as investors digested the latest round of earnings reports. Auto shares also gained amid optimism that Dutch chipmaker Nexperia will resume China shipments. The pan-European STOXX 600 index rose 0.4%, to 574.11 by 0910 GMT. This is a rebound from the one-week-low hit last week. After a White House announcement that Nexperia news will be announced soon, auto stocks like Renault, Mercedes Benz, and Aumovio each gained more than 3.3%. Nexperia was recently taken over by the Dutch government, owned and operated by Chinese company Wingtech. This prompted Beijing, to stop Nexperia from leaving China.

Sources say that the US will object to the green jet fuel recommendation made by UN Aviation Council.

Two sources with knowledge of the issue said that the U.S. would object to the recommendation of the UN Aviation Agency Council, which Washington believes unfairly benefits Brazilian corn farmers to the detriment of U.S. producers when it comes to the development of green jet-fuel. One source said that the discussion could be resolved through a compromise. Brazil's corn-ethanol producers warned, however, that the disagreement may undermine global confidence in the certification of sustainable aviation gasolines. In order to achieve net zero emissions in 2050…

UK stock prices fall on uncertainty over tariffs; Heathrow power failure disrupts airlines

British stocks ended lower on Friday due to continued concerns about the impact of U.S. Tariff policy. Meanwhile, a Heathrow Airport shutdown impacted travel stocks. The blue-chip FTSE 100 index fell 0.6%. The FTSE 250 mid-cap index fell 0.9%. The blue-chip index gained 0.3% despite the losses of the day. The mid-cap index ended four weeks of losses by rising 0.5%. Heathrow Airport in Britain said that it has begun the process to reopen after an electrical fire shut down the airport's power supply for the day. Stocks in the airline and travel industry suffered globally due to the shutdown…

Sovcomflot, a Russian airline, says that new U.S. Sanctions create operational difficulties

Sovcomflot - the largest Russian tanker company - said that the new U.S. Sanctions would cause additional operational difficulties. It also accused the West for undermining global merchant shipping. Sovcomflot stated that the company's ships do not form part of a "shadow fleet". The sanctions against Sovcomflot were not based on any violations by the company or legal basis. They were motivated solely by political interests, including those of the United States. Sovcomflot, the largest shipping company and major tanker operator in Russia is a leading tanker operator.

Biden Administration will not finalize the clean fuel tax credit guidelines

Three sources have confirmed that Biden administration officials won't finalize the highly anticipated guidelines for new clean fuel production credits targeted at the airline industry and biofuel industries by the time they depart in January. This casts doubt on the future success of this key part of the U.S. President's climate agenda. The tax credit was to go into effect on Jan. 1 but, due to a lack detailed guidelines from the U.S. Treasury, it would have been rendered dormant. The global emissions of greenhouse gases from air travel are around 2.5%, which makes it an important target in the fight to combat climate change.

WiseTech shares soar after the CEO of WiseTech takes on a new role.

Australian shares rose Friday, with mining and technology stocks leading the way. WiseTech surged after its former CEO moved into a consultant role, and Whitehaven Coal soared on higher-than-expected quarter output. As of 2347 GMT, the S&P/ASX 200 rose 0.3% to 8231.3. The benchmark is expected to lose 0.6% per week, the biggest loss since late September. Even as iron ore fell, miners gained 0.3%, and they were on course for a weekly increase of 0.1%. This is their first gain in four weeks. BHP gained 0.2% and Rio Tinto 0.9%. Fortescue, however, continued to lose money, dropping 0.1%, after it announced higher costs on Friday.

Palantir, Trafigura to Track Carbon Emissions for Oil, Metals industry

Palantir Technologies Inc and global commodities trader Trafigura have set sights on a new market, their chief executives told Reuters on Monday: tracking carbon emissions for the oil, gas, refined metals, and concentrates sector.The companies are building a platform for oil majors and other commodities firms to vet the environmental impact of their supply chains, applying Trafigura's data to Palantir's operating system, known as Foundry.The effort represents a potentially lucrative long-term opportunity at a time when Palantir's revenue outlook has fallen short of expectations…

U.S. Crude Hits 18-year Low as Lockdowns Spread

Oil prices fell for a third session on Wednesday, with U.S. crude futures tumbling to an 18-year low and Brent hitting a more than 16-year low as travel and social lockdowns to counter the coronavirus raised prospect of the steepest ever annual fall in oil demand.U.S.

Total CEO: Governments Not Oil Firms Must Drive Carbon Curbs

It is up to governments to drive decarbonisation and consumers will have to pay more to achieve carbon neutrality, Total's chief executive said, adding the French firm has no intention of moving away from oil and gas production.Oil firms should not be seen as "villains" amid growing pressure from investors and climate activists, chief executive and chairman Patrick Pouyanne told Reuters at Total's headquarters in the Scottish oil hub of Aberdeen.Giving up on oil and gas would be "a huge mistake", partly because it pays for investment in green technology…

Efficient Wave-Generated Power … Really!

Wave-generated power could be considered the Rodney Dangerfield of offshore renewable energy sources; it gets no respect. There have been a number of high-profile, expensive failures that have conspired to give the sector a poor reputation despite a number of engineering advances. A new entrant is SurfWEC offering a patented “surf-making” Wave Energy Converter which has been in development since 2007. Its developers promise it will stand out from the field and perform where others have failed. How? The SurfWEC design improves upon a generation of 'lessons learned…

SurfWEC to Tap Ocean Wave Power

New Jersey based marine engineering firm Martin & Ottaway together with industry partners, has formed a new company, SurfWEC LLC, that will develop Wave Energy Converters (WECs) using patented features that are expected to increase energy recovery rates by an order of magnitude over legacy WEC systems.The marine consultancy firm said in a press release that SurfWEC has broken through the barriers holding back wave energy recovery technologies from successfully and economically harnessing power from ocean waves.SurfWEC avoids wave damage associated with equipment located in surf zones and stationary mooring systems offshore.

Saudi Aramco Restructures Non-oil Assets ahead of IPO

Saudi Aramco has created a subsidiary to house its multibillion-dollar pension fund and could spin off its aviation division, sources said, as it restructures some assets not related to oil and gas ahead of its planned initial public offering (IPO).The move is designed to streamline Aramco's operations and could make it easier to value since its business risk would be clearer and that may help it achieve a higher price for its shares, financial and industry sources told Reuters."This makes Aramco a leaner company," said one…

AerCap CEO Expects Some Airlines to be Stretched by Oil at $80

The head of the world's largest independent aircraft leasing company, AerCap, said the business models of some airlines would be stretched if the oil price rises to $80 per barrel, nudging fleet planners towards newer planes. The global Brent benchmark briefly climbed above $70 per barrel earlier this month for the first time in three years. Rises in oil price tend to increase the attractiveness of new, more fuel-efficient aircraft. "No one is rushing to change their fleet strategy on the basis of it just getting towards the $70 mark," AerCap chief executive Aengus Kelly told the Airline Economics conference in Dublin on Monday.

Norway's $1 Trillion Fund Curbs Holdings in Biggest CO2 Emitters

Norway's sovereign wealth fund has trimmed the proportion of its $1 trillion fortune that is invested in companies that emit the most greenhouse gas, a Reuters survey has shown. Environmental campaigners hope the move by the world's biggest state-owned investment fund signals the start of a trend for investors shifting their money away from activities blamed for climate change. The review of the top 150 corporate greenhouse gas emitters showed that the proportion of their emissions that can be ascribed to Norway, based on the percentage of market cap it owns in the firms, fell to 0.74 percent in 2016 from 0.78 percent in 2014.

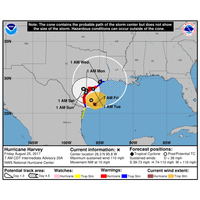

Residents Flee South Texas Ahead of Harvey

Residents fleeing most powerful storm on U.S. mainland since 2005. Businesses closed and lines of cars streamed out of coastal Texas as officials called for residents to evacuate ahead of Hurricane Harvey, expected to arrive about midnight as the most powerful storm to hit the U.S. mainland in more than a decade. The hurricane is forecast to slam first near Corpus Christi, Texas, drop flooding rains along the central Texas coast and potentially loop back over the Gulf of Mexico before hitting Houston, some models showed. "My urgent message to my fellow Texans is that if you live in a region where evacuation has been ordered…

Hurricane Harvey Strengthens, Threatens US

Hurricane Harvey intensified early on Friday into potentially the most powerful hurricane to hit the U.S. mainland in more than a decade, as authorities warned locals to shelter from what could be life-threatening winds and floods. Harvey is set to make landfall late Friday or early Saturday on the central Texas coast where Corpus Christi and Houston are home to some of the biggest U.S. refineries. Oil and gas operations have already been disrupted and gasoline prices have spiked. "Now is the time to urgently hide from the wind.

Elliott Presses BHP to Shed Petroleum

BHP petroleum business has value of more than $20 billion. Activist investor Elliott Management raised the pressure for strategic changes at BHP on Tuesday, calling for an independent review of the mining giant's petroleum business. Elliott, which has built up a 4.1 percent stake in BHP's London-listed arm and is urging changes to boost shareholder value, said there were clear signs the market was receptive to a new strategy for BHP. "There is extremely broad and deep-rooted support for pro-active steps to be taken by management to achieve an optimal value outcome for BHP's petroleum business following a formal open review…

Once Critical, Gulf Executives Want to Do Business with Trump

Gulf executives who were upset by Donald Trump's campaign trail comments about Muslims took a conciliatory tone following his election victory and said they were open for business with the United States. In Dubai, boards displaying the President-elect's name and his support for a DAMAC project to build a gated community, spa and Trump-branded golf course can be seen from a road on the edge of the city. Gulf business links with Trump and other U.S. firms are strong. The United States imported $32.4 billion of goods including oil from the six Gulf countries in 2015 and the region is the most important client base for Boeing and a number of U.S.

PIRA Expects $50-60/barrel Oil from OPEC Deal

The Organization of Oil Exporting Countries' decision to embrace production cuts will help move crude prices toward a target of $50 to $60 per barrel, Gary Ross, chairman of consultancy PIRA Energy Group, told reporters on Wednesday. OPEC's policy has shifted as Saudi Arabia is targeting that price range and Iran has become more willing to accept an agreement. Ross said at a news conference that U.S. shale producers were likely to hedge future output more selectively after OPEC decided to limit output. Shale producers and oil-consuming companies were under-hedged, he said, adding that industrial and airline buying would support prices.