WER December Floating Production Report

The December WER report examines whether OPEC’s decision to limit crude production will accelerate deepwater project starts over the next 12 to 24 months, given 3 billion barrels of oil stocks in global inventory, 5,000+ drilled-but-uncompleted shale wells in the U.S. ready to be fracked and likelihood that producers will cheat on output quotas. As we discuss in the report, the output cut could stimulate deepwater orders – but with a time lag.

We also assess whether Hoegh and Maran’s orders for seven speculative FSRUs (two firm, five options) is a replay of the 2007/08 FPSO speculative ordering binge that left some investors holding worthless stock. And we review BP’s decision to sanction the Mad Dog 2 deepwater GOM project, discuss Petrobras continuing difficulties getting back to orderly business conditions and profile the energy industry “dream team” about to take cabinet positions in the incoming U.S. administration.

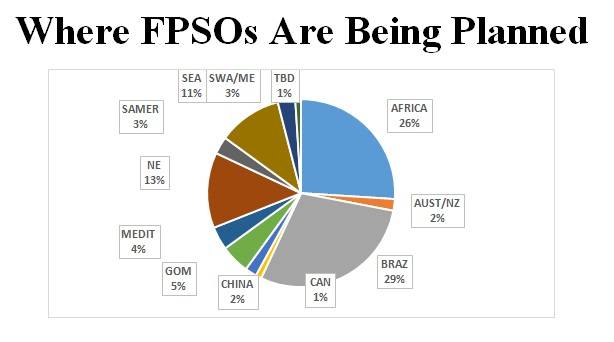

In the data section of the report are details for 200 floater projects in the planning stage, 54 production or storage floaters now on order, 284 floating production units currently in service and 29 production floaters available for redeployment contracts. Charts in the report update the location where floating production and storage systems are being planned, operating, being built and to be installed.

Accompanying excel spreadsheets provide the report data in sortable format. Information is current as of December 20.

The Author

Jim McCaul is the founder and manager of IMA, a consulting firm providing market analysis, competitive benchmarking and business planning support in the maritime and offshore sectors. Over the past 40 years IMA has performed more than 350 business consulting assignments for 170+ clients in 40+ countries.

One of the firm's specialties is analyzing requirements for floating production systems. IMA has published more than 60 reports since 1996 analyzing the floating production business and has been engaged by numerous clients to assist in analyzing specific market opportunities in this sector. Please visit www.imastudies.com for more information about IMA.

McCaul is also the co-founder of IMA/World Energy Reports, a New York based business intelligence service for the floating production industry.