Shell Sells $1.3 Billion of Oil and Gas Assets

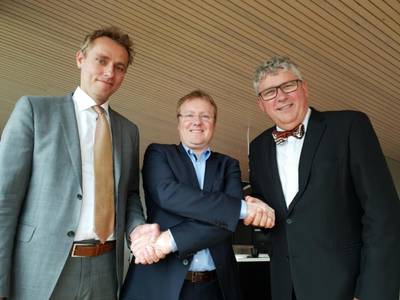

Picture taken after today’s signing. From left: Ola Borten Moe (OKEA CCO), Rich Denny (Managing Director A/S Norske Shell) and Erik Haugane (OKEA CEO)

Royal Dutch Shell announced the sale on Wednesday of oil and gas assets in Norway and Malaysia for over $1.3 billion, bringing it closer to a target of $30 billion in disposals by year-end.

The Anglo-Dutch company agreed to sell to OKEA, a Norwegian producer backed by private equity firm Seacrest Capital, its 45 percent interest in the Draugen Norwegian offshore field and a 12 percent in the Gjoa block for a total of $566 million, the two companies said.

Earlier, Shell announced the completion of the sale of a 15 percent stake in Malaysia LNG (MLNG) Tiga to the Sarawak State Financial Secretary for $750 million.

Shell committed to the ambitious three-year sale plan following the decision to acquire BG Group (BRGXF) in 2015, a deal that was completed in February 2016 for $54 billion.

The latest announcement bring the total assets Shell has sold or agreed to sell since 2015 to around $27 billion, according to Reuters calculations.

Shell will remain present in oil-rich Norway through its stakes in several fields, including Ormen Lange and Knarr, which it operates.

For OKEA, co-founded by the county's former oil minister Ola Borten Moe in 2015, the deal provides the first sizeable stakes in a producing field on the Norwegian continental shelf.

OKEA said the two fields will deliver around 22,000 barrels of oil equivalent per day net to the company.

Bangchak Corporation PCL, a Thai downstream oil and gas company, had entered into a strategic partnership with Seacrest Capital Group to finance the acquisition, OKEA said.

OKEA also said it had launched a $180 million, 5-year, fully underwritten senior secured bond to help finance the deal.

Shell-operated Draugen, which has been producing oil since 1993, had about 24 million barrels in reserves left at end-2017, data from the Norwegian Petroleum Directorate (NPD) shows.

The Gjoa field, operated by Neptune Energy, had 13 million barrels of oil and 13.5 billion cubic metres of natural gas at end-2017, according to NPD data.

OKEA has a tiny stake in Aker BP-operated Ivar Aasen field, and a 15 percent interest in Repsol-operated Yme field, which is expected to start producing oil again in late 2019.

The Norwegian government approved Yme's more than 8 billion crown ($978 million) redevelopment project in March.

A previous attempt by Talisman Energy (TLM) to restart the field, which was shut in 2001, failed in 2016 due to structural problems with its new production platform.

(Reporting by Ron Bousso; Editing by Adrian Croft)