SandRidge Energy to Buy Bonanza Creek in $746 Mln Deal

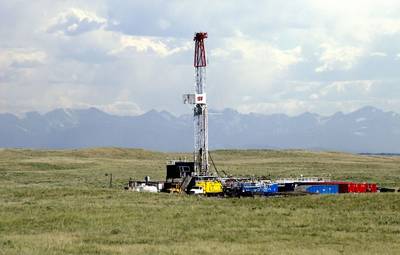

Oil and gas producer SandRidge Energy (SDRXP.PK) said on Wednesday it would buy rival Bonanza Creek in a deal valued at $746 million to expand its presence in the Denver-Julesburg Basin of Colorado.

Shares of SandRidge fell 19.4 percent, while those of Bonanza Creek slipped 2.3 percent and were trading well below the offer price of $36, suggesting investors were skeptical of the deal going through.

Both SandRidge and Bonanza Creek have emerged from bankruptcies after being stung by a slump in oil prices.

"This acquisition greatly enhances our existing portfolio by adding a deep inventory of drill-ready locations in the DJ Basin of Colorado," SandRidge Chief Executive James Bennett said on Wednesday.

The combined entity, SandRidge-Bonanza Creek, will operate over 630,000 net acres in the Rocky Mountains and Mid-Continent regions, producing about 55,000 barrels of oil equivalent per day, the two companies said.

SandRidge, which is based in Oklahoma drills in the U.S. Mid-Continent and Niobrara Shale. Bonanza Creek also drills in the Niobrara Shake in Colorado, as well as in Arkansas.

SandRidge said the deal is expected to close in the first quarter of 2018 and will add to its cash flow from the start of the year.

Morgan Stanley & Co was the financial adviser to SandRidge and Vinson & Elkins LLP its legal adviser.

Evercore acted as financial adviser to Bonanza Creek and Kirkland and Ellis was its legal adviser.

Reporting by Anirban Paul in Bengaluru