Moment of Truth for Brazilian Oil Auction is Here

Executives from many of the world's biggest oil companies gathered in Rio de Janeiro on Wednesday to compete in Brazil's long-awaited transfer-of-rights (TOR) oil bidding round, the largest offer of crude and gas reserves in the nation's history.

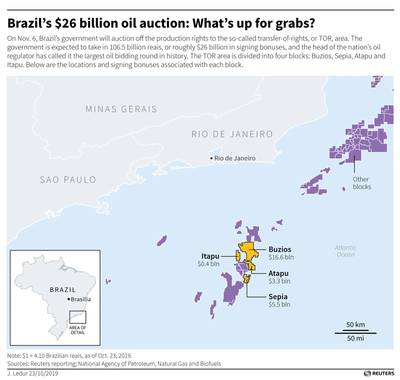

Lawyers and executives have been working feverishly in recent weeks to sort out terms of consortia that will place bids on the four blocks available in the TOR area — offshore fields with billions of barrels in confirmed reserves.

If all the areas receive a bid, Brazil's government will net 106.5 billion reais ($26.7 billion) in signing bonuses, offering breathing room for a tight federal budget and cementing Brazil's ascendance as Latin America's oil powerhouse.

The bidding is set to start at 10 a.m. local time (1300 GMT). Firms will first submit offers for Buzios, the largest of the four areas, and will then bid on Itapu, the smallest.

In both fields, Brazil's state-run Petroleo Brasileiro SA , or Petrobras, has exercised preferential rights to be the operator, with at least a 30% stake in any winning consortium. Those two fields together have a minimum signing bonus of roughly 70 billion reais ($17.5 billion).

Still, much is up in the air, particularly in the two blocks where Petrobras has not exercised preferential rights: Sepia and Atapu.

On Wednesday, Brazilian Mines and Energy Minister Bento Albuquerque even raised the possibility that those two blocks could fail to receive a bid. If that occurs, he said bidding terms would be adjusted, and those areas would be put up for sale again in eight to nine months.

The sale of Buzios and Itapu alone would make the auction a success, government officials have said.

A number of companies, including Total SA (TTFNF) and BP Plc, have withdrawn from the auction or said the terms are expensive. Others have been more sanguine.

Among the smart-money bets, according to industry sources, are Petrobras itself, as well as Exxon Mobil Corp and China's CNOOC Ltd and CNODC, a subsidiary of CNPC.

One Rio de Janeiro-based lawyer who is following the auction closely said he expected some parties would have spent Tuesday night hashing out final terms.

"I think we're only going to know what's going on" on Wednesday, said a high-ranking Petrobras source on Tuesday, who requested anonymity due to the sensitivity of the negotiations. "There are always talks at the last minute."

(Reporting by Gram Slattery, Marta Nogueira and Marianna Parraga)