Europe Dominates LNG Import Story in 2019

Global liquefied natural gas (LNG) production jumped in 2019, triggering oversupply and low prices that are expected to persist in 2020. Initial full-year data from LNG Edge shows exports at 355 million tonnes in 2019, up from 314.9 million tonnes in 2018.

This represents the largest ever increase in production.

While East Asian, especially Chinese, demand increased in 2017 and 2018 to absorb additional production, there was little change this year. Instead, supply pushed into Europe reached a record high, having a major impact on regional hub pricing with price correlations growing between Europe and Asia.

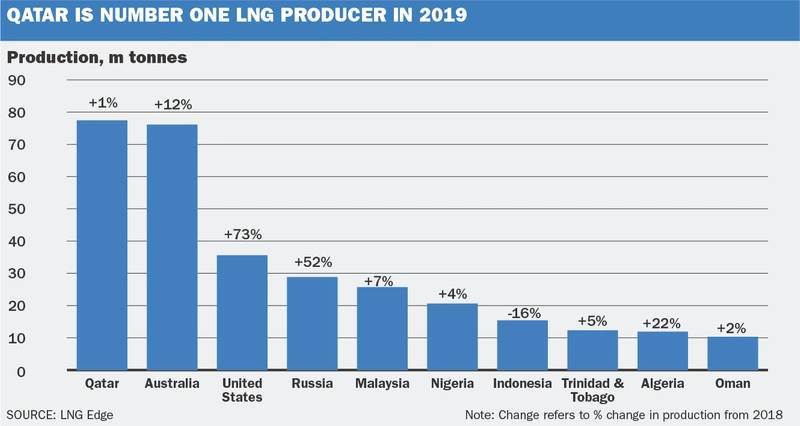

Qatar wins out

In the battle for top exporter, Qatar held onto first place, producing 77.4 million tonnes, according to the provisional LNG Edge data.

(Image: ICIS)

(Image: ICIS)

This was very close to nameplate capacity.

Australia came in a close second, at 76.1 million tonnes, a rise of over 8 million tonnes and should take top spot in 2020, based on the LNG Edge supply forecast.

Of the 40 million tonne increase in supply, the majority – 33 million tonnes – came from Australia, Russia and the US.

Russian production rates at Yamal and Sakhalin were especially impressive in 2019.

But US LNG took center stage, with 35.6 million tonnes produced, up by almost 15 million tonnes year-on-year. The increase will continue next year with the US set to produce almost 57 million tonnes, according to the LNG Edge supply forecast. Much will depend on the successful ramp-ups of remaining new trains at Freeport and Cameron LNG.

Production from several of the more mature producers was higher too in 2019.

Algerian and Egyptian exports both rose by more than 2 million tonnes, with Egypt producing 3.5 million tonnes as its domestic gas supply continued to improve.

Malaysian production improved substantially from 2018 when feedgas issues reduced operating rates, with a similar story from Papua New Guinea where production recovered after the drop in 2018 caused by a nearby earthquake.

Europe to the fore

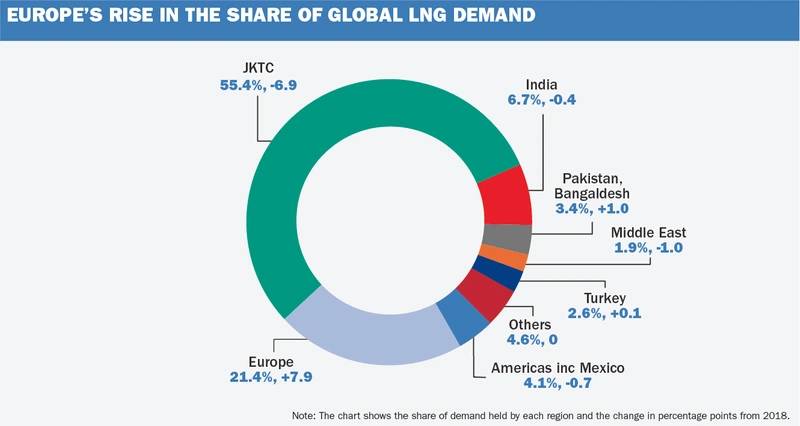

European LNG imports rose close to 76 million tonnes in 2019, by far the highest ever recorded, according to the provisional data.

(Image: ICIS)

(Image: ICIS)

LNG sellers used the European market to absorb the global oversupply with a rise in spot sales and portfolio sellers bringing more cargoes into their own European terminal positions.

Among the list of records was the 8 million tonnes imported by Europe in December, the highest on record, with the UK importing more than 2 million tonnes.

Europe absorbed over 21% of all LNG produced globally in 2019, up from 13% in 2018 in what was by far the most significant change across all regions.

This trend of higher European imports will likely continue in 2020 unless there is a major shift in short-term demand in Asia over the rest of the winter and the following summer.

The volume of LNG coming to Europe pushed down traded hub prices and supported storage injection over the summer, putting the market in good shape as the winter began.

Sharp import increases were recorded across most European countries, with Dutch and Belgian imports both more than doubling.

In volume terms, the most significant increases were in France where imports rose by over 6.5 million tonnes to 16 million tonnes, and the UK which received over 13 million tonnes, up by more than 8 million tonnes from 2018.

Qatar pushed a lot more LNG into European markets, especially the UK, with more from the US and Russia too.

East Asia in decline

In a major reversal from the preceding two years, total East Asian LNG imports fell in 2019 year-on-year, with weakness from Japan and South Korea.

Combined imports into those two countries, China and Taiwan stood at 196.5 million tonnes, still by far the most significant importing area. But this figure was down by around 1 million tonnes from 2018.

In both 2017 and 2018 the region’s imports rose by around 20 million tonnes which helped to absorb a large portion of rising global supply.

Japanese LNG imports fell by 7% in 2019, with South Korea down by 8%.

The LNG Edge demand forecast shows a small rise in Japanese LNG demand in Japan in 2020 linked to lower nuclear power generation, but further declines from South Korea.

Most important was the slowdown in the growth of Chinese LNG imports as coal-to-gas switching eased and economic growth struggled. Chinese LNG imports were up by over 8 million tonnes to 61.9 million tonnes but this was a lesser increase than over the previous three years.

Utilization at a number of China’s key import terminals was very high, with others still lacking sufficient linkage to the grid to support larger send-out.

How China’s new independent gas pipeline and infrastructure operator develops in 2020 will be an important factor in the evolution of LNG imports and the ability that new companies have to take import positions.

East Asia as a whole accounted for 55% of global LNG demand, compared with 62% in 2018.

South Asia evolves

Beyond East Asia and Europe, south and southeast Asia are the two key import regions that sellers are focusing on. There is substantial gas demand in the region, at the right price, but progress to open up new markets has been slow in recent years.

Across the existing importers, Pakistan and Bangladesh imported a combined 12 million tonnes in 2019, up from 7.4 million tonnes in 2018.

The growth in Indian imports is restricted by the lack of new available infrastructure, but demand did rise by over 1 million tonnes to 23.8 million tonnes in 2019.

The addition of more import capacity in 2020 could boost Indian imports to over 26 million tonnes, according to the LNG Edge demand forecast.

Middle East, Americas

Rising domestic gas production and competing power generation meant that LNG imports into the Middle East and Americas both fell in 2019, despite the oversupply and low spot prices.

Americas’ demand accounted for just 4.1% of global supply, down from 4.8% in 2018.

While Brazilian LNG imports held up well, demand from both Argentina and Mexico fell.

The Middle East absorbed 1.9% of global supply, down from 2.9% in 2018, largely a result of Egypt stepping away from imports.

But while Kuwait will continue as the most significant importer in the region – especially with the start of Al-Zour terminal due for 2021, Jordanian imports fell by half.

This came just as the first Israeli pipe gas from the Leviathan gas field arrived in Jordan at the end of the year.

The Author

Ed Cox is Editor, Global LNG, I.C.I.S.