Coronavirus, Consolidation Taking Toll On Energy Jobs

Oil and gas companies worldwide are taking an axe to their employment rolls, shedding workers to survive what is expected to be a prolonged stretch of weak demand.Exxon Mobil Corp said it will cut its workforce by 15%, or about 14,000 people, along with oil majors Chevron Corp and Royal Dutch Shell Plc.All told, more than 400,000 oil and gas sector jobs have been cut this year, according to Rystad Energy, with about half of those in the United States…

Woodside Says It's on the Lookout for Acquisitions

Australia's Woodside Petroleum is looking for acquisitions, ideally close to its existing assets or offering it control over assets that are already producing or close to producing, its boss said on Thursday."We're clearly scanning the landscape very closely looking for opportunities," Chief Executive Peter Coleman told analysts on a conference call.He said the company does not want to acquire assets that would require heavy capital spending as it already has undeveloped world-class assets.Coleman said the company has another week and a half to

Santos Flags $560 Mln Impairment Charge on Virus-led Oil Slump

Australia's Santos said on Tuesday it will book non-cash impairments of up to $560 million after tax, joining a number of global energy majors forced to write down assets after a coronavirus-induced slump in oil prices.The country's second-largest independent gas producer expects to record non-cash charges of between $490 million and $560 million after tax in its 2020 interim results, it said in a statement.Most of the impairment charges relate to Santos's Gladstone Liquefied Natural Gas (LNG) project in its Cooper basin fields in Queensland…

Woodside's Revenue Slumps More than Expected

Australia's Woodside Petroleum Ltd reported a worse-than-feared 29% drop in quarterly revenue, hit by weak spot liquefied natural gas (LNG) prices, but said it still expected to book a net profit in the first half.The hit came due to the double whammy of a global gas glut and a slump in demand with the coronavirus pandemic, and sent the company's shares down more than 2% while its peers were all trading higher."It's been a very difficult time for our industry and some external challenges are just simply beyond our control…

Asian LNG Prices Steady on Ample Supply despite U.S. Cargo Cancellations

Asian spot liquefied natural gas (LNG) prices remained steady this week on a continued stream of spot supply even though traders continued to cancel cargoes loading from the United States due to poor economics. The average LNG price for August delivery into northeast Asia was estimated to be about $2.20 per million British thermal units (mmBtu), slightly lower than the previous week, trade sources said. Buyers of LNG are expected to cancel…

Woodside to Boost Vincent Crude Quality to Ride VLSFO Demand

Woodside Petroleum will improve the quality of Vincent crude by increasing its flash point from July so that it can be blended into very low sulphur fuel oil (VLSFO) and capture higher premiums, two sources told Reuters.Among crude grades, heavy sweet oil, with higher density and less sulfur, is most suitable for blending into VLSFO that meets the new marine fuel sulfur regulations dubbed IMO 2020. However, crude with a low flash point could…

Virus Lockdowns Pummel Global Gas Demand, Force LNG Output Cuts

Lockdowns to slow the coronavirus pandemic are pummelling gas demand in the world's biggest buyers of liquefied natural gas (LNG), pushing Asia's spot prices to record lows and forcing some suppliers to start cutting output. Economies worldwide have ground to a halt as virus containment measures have taken their toll, slashing gas demand for power generation, heating, cooking, vehicles and chemical manufacture. The world's biggest LNG markets - Japan, China, South Korea, and India - are all seeing a drop in demand.

Woodside Watching Supermajors' Woes for Opportunities

Woodside Petroleum is keeping a close eye out for assets that might come up for grabs from the oil supermajors amid the oil market rout, seeing itself in a position to bid, Chief Executive Peter Coleman said on Friday.The head of Australia's top independent gas producer said, however, deals were unlikely until the third or fourth quarter of this year."We are watching closely the super majors," Coleman told reporters on a conference call…

Coronavirus Paralyzes Oil, Gas Sales into China

Short-term sales of crude oil and liquefied natural gas into China almost ground to a halt this week as the coronavirus slows economic activity and cuts demand and buyers ponder legal action to avoid having to honor purchase agreements, trade sources said.Typically, trade would have revived after the Lunar New Year holiday at the end of January, but China has extended the break into February to try to contain the fast-spreading coronavirus…

Woodside Finalizes Gas Deal with Uniper

Oil and gas producer Woodside Petroleum Ltd said on Tuesday it has signed an agreement to supply liquefied natural gas (LNG) to German utility Uniper SE for 13 years starting 2021.Under the agreement, Woodside said it would initially supply up to 0.5 million tonnes per annum (Mtpa) of LNG, which could increase to 1 Mtpa from 2025.However, supply from 2025 remains conditional upon a final investment decision related to the company's Scarborough project off northwestern Australia.Woodside is looking to develop Scarborough to feed a new 5 Mtpa pro

Woodside Sees Reserve Base Tripling

Australia's Woodside Petroleum on Tuesday laid out plans to triple its gas and oil reserve base as it pursues projects worth over $36 billion in Australia, Senegal and Myanmar.Success in those projects would result in its reserve base reaching 3.7 billion barrels over the next seven years and help Woodside expand production by 6% a year over the next decade, it said."We believe we now have a compelling growth story," Woodside Chief Executive…

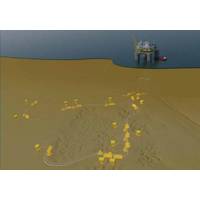

Woodside Targets Scarborough FID in Early 2020

Woodside Petroleum Ltd has pushed out the final approval date for its mammoth Browse gas project but slightly brought forward plans to sign off on its smaller Scarborough project as it races to fill an anticipated global supply gap.Woodside, Australia's top independent gas producer, said on Thursday it is now targeting a final investment decision on the $20.5 billion Browse project in the first half of 2021 as it continues to wrangle with its partners.

ExxonMobil Looks to Sell Australian Assets

Exxon Mobil Corp said on Wednesday it was looking to sell its 50% stake in the Gippsland Basin oil and gas development in Australia's Bass Strait as part of a broader review of its global portfolio of assets.The sale could fetch up to $3 billion, however decommissioning costs for the ageing fields could dent the price tag, analysts and bankers said.The Gippsland Basin joint venture, off the state of Victoria, has long been the mainstay oil and gas supplier for southeastern Australia…

Woodside H1 Profit Slumps

Woodside Petroleum flagged a challenging near-term outlook on Thursday as it grapples to win over its partners to back $34 billion worth of new oil and gas projects amid a souring global environment.Australia's biggest independent oil and gas producer reported a worse than expected 23% drop in first-half profit, hurt by extended maintenance at its Pluto LNG plant, which took longer than planned.Its shares fell as much as 7% to a seven-month low…

Beach Energy to Boost Drilling Spend

Beach Energy, Australia's third-largest independent oil and gas producer, ended the 2019 financial year more cashed up than expected and plans to step up spending on drilling while keeping an eye out for acquisitions, its boss said on Wednesday.Beach paid off debt on its A$1.6 billion ($1.1 billion) acquisition of Lattice Energy within just 18 months, two years earlier than originally planned, with the help of an asset sale and strong cash flow from its expanded portfolio.The company ended the year to June 30 with net cash of A$172 million…

Woodside Q2 Revenue Slides 32%

Australia's Woodside Petroleum Ltd reported a 32% drop in second-quarter revenue on Thursday, the first decline in six quarters, as it was hit by an extension of planned maintenance at its Pluto liquefied natural gas facility and weaker prices.The country's largest listed oil and gas explorer said production for the quarter ended June 30 fell to 17.3 million barrels of oil equivalent (mmboe), from 22.1 mmboe a year earlier. The latest quarter…

Woodside Plans Maintenance at Karratha Gas Plant

Australia's Woodside Petroleum has planned maintenance at its Karratha gas plant, part of the North West Shelf liquefied natural gas (LNG) export project, in the third quarter of the year, according to a notice on the company website.The first scheduled maintenance will affect one unidentified LNG train at the Woodside-operated plant in Western Australia from July 26 to Aug. 13, according to the notice.The second maintenance will be carried out on multiple LNG trains from Sept. 5 to Oct.

Shell Sees More FLNG Opportunities

Royal Dutch Shell sees more opportunities for floating liquefied natural gas projects, but not necessarily like its $17 billion Prelude operation off Australia, which shipped its first cargo last week, over two years behind schedule.Shell Australia Chair Zoe Yujnovich said on Wednesday that it was too early to tell whether Prelude, one of two floating LNG (FLNG) projects in the world, would be replicated in future, as the company was still commissioning the project."I think that there's an opportunity for the floating concept.

Woodside Q1 Revenue Rises 4%

Australia's Woodside Petroleum Ltd on Thursday posted a 4 percent rise in first-quarter revenue on higher realized prices for its oil and gas.Revenue rose to $1.22 billion for the three-months ended March 31, compared to $1.17 billion a year ago.Australia's largest listed oil and gas explorer said total production for the quarter came in at 21.7 million barrels of oil equivalent (mmboe), down from 22.2 mmboe a year earlier.The average realized price for the quarter ending March 31 rose to $56 per boe from $51 per boe a year ago.The Wheatstone v

Woodside Inks LNG Supply Deal with ENN

Australia's Woodside Petroleum WPL.AX has signed a Heads of Agreement (HOA) to supply liquefied natural gas (LNG) to China's ENN Group for 10 years from 2025, both companies said on Friday.Woodside, Australia's biggest listed oil and gas explorer, said in a statement the volume covered by the HOA is 1 million tonnes per annum (mtpa), to be sourced from Woodside's portfolio of gas supply. Signed at the LNG 2019 conference in Shanghai, the…