Mubadala Energy acquires Kimmeridge LNG and gas projects in the US

Mubadala Energy is an arm of Abu Dhabi’s sovereign wealth fund. It signed a deal with Kimmeridge, a US-based energy investor, on Thursday that gives it stakes in American gas assets. This marks its entry into the United States market, as part of the company’s growth plans. Mubadala Energy announced that the deal to purchase 24.1% of Kimmeridge’s SoTex HoldCo would give Mubadala Energy direct access to Kimmeridge’s unconventional gas production and to a Louisiana liquefied gas export project.

Wood Mackenzie reduces 5-year US Wind Energy Outlook by 40% due to Trump policies

On Tuesday, a prominent energy research company slashed their five-year forecast for new U.S. Wind Energy Projects by 40%, citing Trump Administration policies and concerns over the economy. Wood Mackenzie predicts that the United States will install 45.1 gigawatts (both onshore and off-shore) of wind power through 2029. The firm had initially forecast 75.8 GW of installations over this period. The Energy Information Administration announced last month that the U.S. electricity consumption will reach record levels in 2025 and beyond.

As Trump tariffs cause demand concerns, refining stocks plummet to levels not seen in two years.

Investors were rattled by fears about a slowdown in oil and fuel consumption and a decline in refining margins after President Trump announced new tariffs. According to LSEG data, the market capitalization of top refiners Marathon Petroleum and Valero Energy, as well as Phillips 66, has dropped by more than 20 billion dollars since Trump announced new tariffs Wednesday afternoon. Alan Gelder is vice president for refining chemicals and oil markets, Wood Mackenzie.

As Chinese demand slows, mining consolidation will accelerate.

The mining industry is expected to consolidate due to the decline in industrial metals demand, especially in China, the top consumer. Investors said that for now, the high costs of mergers and acquisitions among diverse miners and the significant chance of rejection could hinder full-scale activity. This is ahead of the global gathering of the Copper Industry for the CESCO in Santiago, Chile, next week. LSEG data shows that M&A activity…

As Chinese demand slows, mining consolidation will accelerate.

The mining industry is expected to consolidate due to the decline in industrial metals demand, especially in China, the top consumer. Investors say that for the moment, mergers and acquisitions among diversified miners may be hindered by prohibitively high costs and a significant chance of rejection. LSEG data shows that M&A activity in the mining sector dropped 27% in terms of value to $15 billion during the first quarter compared with the same period in 2024. BHP shares are down 26% since the beginning of 2024.

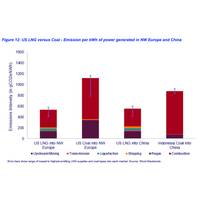

Wood Mackenzie: LNG for Power Generation Emits 'Significantly' Less Than Coal

Wood Mackenzie has published a new report comparing the life cycle emissions of LNG with those of coal for power generation, finding the combustion of coal is related to significantly higher emissions.Wood Mackenzie’s analysis in the report titled 'Shining a light on the ‘coal versus LNG emissions’ debate' reveals the lifecycle emissions of U.S. LNG are typically around 48% of the coal equivalent. This difference is not just related…

Trump hosts top US oil executives as trade wars threaten

Donald Trump, the U.S. president, will be hosting top oil executives in the White House this Wednesday to discuss plans for boosting domestic energy production amid falling crude prices and trade wars. This will be Trump's first meeting with oil and gas executives since he returned to the White House in January for his second term. According to a source familiar with planning the event, it will include members of American Petroleum Institute (API)'s executive committee.

Experts say that Trump's tariffs against steel and aluminum will increase costs for US energy companies

The proposed U.S. steel and aluminum tariffs will increase costs for U.S. Oilfield Services companies that rely on this metal for their operations. Oilfield service firms like ChampionX and Patterson UTI are the backbone for the North American oil and natural gas industry. They provide essential equipment and services to drill, produce and maintain. Steel is the lifeblood of these industries - drilling platforms, pipelines and refineries, compressors and storage tanks, offshore platforms, and offshore platforms.

Report: Solar power will account for 84% of the new US electricity added in 2024.

A report released on Tuesday stated that solar energy contributed 84% of the new electricity generation capacity to the U.S. grid in the past year. However, the industry will face challenges with the new energy policies adopted by the U.S. government. In a report, Wood Mackenzie and the Solar Energy Industries Association (SEIA), said that the country will install 50 gigawatts of new solar power in 2024. They added that this is the largest growth year for any energy technology over the past two decades.

Local news reports say that Equinor is planning to sell its assets in Argentina.

Mas Energia, a Mas Energia-published online magazine, reported that the Norwegian oil and gas company Equinor was looking to sell their onshore assets located in Argentina's Vaca Muerta Region, citing anonymous sources. Equinor has appointed Bank of America as the agent to sell its 30% stake in Bandurria Sur and 50% in Bajo del Toro Norte. However, no decision on the divestment has been taken yet, according to the report. Mas Energia said that the Norwegian company has no plans to sell its stakes offshore licenses in Argentina.

Local news reports say that Equinor is planning to sell its assets in Argentina.

Mas Energia, citing anonymous sources, reported that Norwegian oil and gas company Equinor was looking to sell their onshore assets located in Argentina's Vaca Muerta Region. Equinor has appointed Bank of America as the agent to sell its 30% stake in Bandurria Sur and 50% in Bajo del Toro Norte. However, no decision on the divestment has been taken yet, according to the report. Mas Energia said that the Norwegian company has no plans to sell its stakes offshore licenses in Argentina. A spokesperson for Equinor declined to comment.

Winds of Change Blew Through Offshore Wind, and Denmark Missed It

Analysts said that the failure of Denmark to receive any bids for an offshore wind energy tender this week is due to a rigid auction system, a failure adapt to a changing economic reality and increased competition.It was a major blow for Denmark, the home of turbine manufacturer Vestas, and offshore developer Orsted. Both companies have been pioneers in both onshore and offshore wind power.The Danish North Sea tender, for a minimum of 3GW of capacity, did not offer any subsidies.

Solar tariffs in the US will increase prices and reduce profit margins for Southeast Asia

Analysts said that a new round of U.S. import tariffs against Southeast Asian solar panel producers will likely increase consumer prices while reducing producer profits. However, the industry had anticipated this move. The Commerce Department announced new duties on Friday that extend the United States anti-dumping regime to solar cells in Southeast Asia, instead of just finished modules. Citi analyst Pierre Lau wrote in a report that the tariff increase was in line with what had been expected.

Sources say that Chinese exporters will increase prices and renegotiate after the tax rebates are cut.

Analysts and traders said that Chinese exporters will increase prices on a variety of products, from used cooking oil to aluminium, and renegotiate their contracts to pass the cost of Beijing’s tax incentives. On Friday, the world's second-largest economy announced that it would reduce its export tax rebate rates for certain refined oil products, solar panels, batteries, and non-metallic minerals from 13% down to 9%. It also said that it would cancel the rebates for products made of aluminium…

Net zero target needs $3.5 trillion in annual green energy investment, Wood Mackenzie says

Wood Mackenzie's report on Tuesday said that the investment in green energy must double every year to $3.5 trillion if we are to reach the Paris Agreement goal of net zero emissions by the year 2050. The consultancy's report said that, in addition to the investment gap, global efforts to switch to cleaner energy are under pressure due to concerns about energy security and tariffs and barriers to trade, which are stunting the electrification of growth globally.

Chevron sells assets worth $6.5 billion to Canadian Natural Resources

Chevron announced on Monday that it would sell its assets in the Athabasca Oilsands and Duvernay Shale fields to Canadian Natural Resources at a price of $6.5 billion. This is part of its divestment plan. The cash-only transaction is part of the company's strategy to sell assets worth $10 to $15 billion by 2028. Chevron will be able to produce 84,000 barrels equivalent per day (boepd), based on the assets located in Alberta Canada. Wood Mackenzie reported in January that the Duvernay was one of Canada's most important shale plays…

New Industry Minister: Japan will keep nuclear but boost renewables as part of its energy mix

Japan will continue to restart nuclear power plants safely and use as much renewable electricity as possible, said Industry Minister Yojimuto on Wednesday. This indicates that the policy of newly appointed Prime Minister ShigeruIshiba is not likely to change significantly. Ishiba had promised to eliminate nuclear power before he was elected leader of the Liberal Democratic Party. He was sworn into office on Tuesday. He was the sole candidate who opposed nuclear power in Japan.

Analysts say that Colombia must develop a natgas plan soon to prevent blackouts.

If it wants to prevent power blackouts in Colombia, the head of Wood Mackenzie’s Americas Gas and LNG division said that Colombia needs to decide quickly whether it will focus on LNG imports or promote domestic production of natural gas. Colombia, under leftist president Gustavo Petro has moved away fracking in order to develop its reserves shale oil and gas. A Santa Marta court judge ordered earlier this month that work be suspended on a major offshore gas project run by Ecopetrol, the state-controlled company and Brazil's Petrobras.

Kiewit: Equipment shortages increase costs of LNG plants

Tom Shelby, Kiewit Energy's President, said that the boom in U.S. LNG plant construction has caused shortages of electric motors, transformers and generators. This has contributed to increased costs and construction delays. Shelby noted that equipment shortages, rising costs of wages, cement and other materials have increased the cost to build new LNG plants between 25 and 30 percent over the past five years. Wages have also increased by 20 percent in line with inflationary costs. Kiewit is one of the largest U.S.

Chinese demand drives up global wind turbine orders in H1 of 2024

Wood Mackenzie reported in a Monday report that global onshore wind turbines orders reached 91.2 gigawatts in the first half, an increase of 23% on the previous year. This was due to a higher demand from China's north region in the second quarter. China has the largest wind turbine production capacity in the world compared to Europe or the United States. Western OEMs are struggling to keep up with China's pricing and availability advantages.