Prices of gas in Europe are lower than the first session for a second session. Ukraine Peace prospects dominate

The wholesale gas price in the Netherlands and Britain continued to fall on Thursday, after reaching a two-year peak on Tuesday. Market participants were watching for any further developments regarding the efforts of U.S. president Donald Trump to bring an end to the conflict in Ukraine. LSEG data shows that the benchmark front-month contract for the Dutch TTF Hub was lower by 2.85 euros, or $16.21/mmBtu at 1003 GMT. The contract was well below the intra-day peak of 59.27 euro/MWh, reached on Tuesday. This is its highest level since Febuary 2023. The Dutch April contract is down by 2.99 Euros at 52.93 euro/MWh.

Hungary wants Ukraine to resume gas transit as EU sanctions are about to roll over

Viktor Orban, the Prime Minister of Hungary, said that the European Union should persuade Ukraine so it can resume the transit of gas from Russia into Europe. This is a controversial issue as the EU tries to extend sanctions against Russia in the next week. Hungary has yet to decide whether it will support the rollover of sanctions due at the end this month. The EU must renew sanctions every six-months and require unanimity from its 27 members to do so. Orban, who has a government that maintains closer economic and politic relations with Moscow than any other EU country…

Hungary will increase its gas exports to Slovakia starting April

The transmission system operator FGSZ announced on Tuesday that Hungary would increase its gas export to Slovakia from 2.63 billion cubic metres per year to 3.5 bcm by April. Hungary's decision to increase its export capacity to the north follows Ukraine refusing to renew a transit agreement with Russia, as it seeks a reduction in revenue that goes to Moscow for funding the war in Ukraine. The expiration of this deal has stopped a major route for Russian Gas to be shipped into Slovakia and Western Europe. Robert Fico, the Slovak prime minister, has threatened to take retaliatory actions against Kyiv.

Spot prices drop on strong renewable production

German and French power prices dropped on Monday morning, as a result of the strong production from wind and solar farms in the region. At 1030 GMT, the German baseload power day-ahead was trading at 58 Euros/MWh. LSEG data shows that this was a drop of more than 50% compared to the last traded level, 119.25 euro/MWh, on December 27. The LSEG data shows that the French baseload power for day-ahead was 82.50 Euros per megawatt hour, compared to 119.25 Euros/MWh in December. The LSEG analyst Naser Hachemi stated in a daily note that "the…

Prices for European gas rise as renewed Russian focus on gas is renewed

The Dutch and British wholesale gas price rose on Tuesday afternoon due to renewed concerns about Russian gas supplies to Europe starting in January. By 1505 GMT the benchmark front-month contract for the Dutch TTF hub had risen 1.87 euros to 41.83 euros/MWh, or $12.87/mmbtu. This was a continuation of the gains made in the morning. It fell to 39.10 euros/MWh intraday on Monday, its lowest since November 6. The front-month contract in Britain firmed up by 3.85 pence, to 104 pence/therm. Meanwhile, the day-ahead contract increased 3.75 pence, to 100.8 pence/therm.

The German wind is downturning and the temperature is dropping.

The European immediate power prices rose on Thursday as a result of the forecasts that German wind production volumes would plummet, and because colder weather is on its way in France. Riccardo Paraviero, LSEG analyst, said: "Tomorrow’s outlook is bullish. LSEG data show that the German baseload power for the day ahead was 50% higher at 145.5 Euros ($153.40), a record high in two weeks, at 0905 GMT. The French equivalent contract increased by 9.3% to 114.8 euros/MWh. LSEG data shows that the German wind power production is expected to fall by almost three quarters on Friday to 9 gigawatts (9 GW), after having been projected to be 37.4 GW Thursday.

Axpo, a Swiss company, is looking at opportunities in Japan's power and LNG trading

Axpo, a Swiss power producer and trader, is looking at opportunities in Japan's electricity and liquefied gas (LNG), as the changes in Japan's power sector have created a demand for spot LNG and hedging. Japan has set an ambitious target of renewables accounting for 36%-38% of its total electricity mix by 2030. In 2016, the power market was liberalised, leading to a more liquid futures exchange for electricity. Marco Saalfrank is a member of Axpo’s management board. He said that Japan has nine different price zones. As in Europe, Japan is also expected to see a decline in gas demand as its share of renewables, nuclear and other power sources grows.

Oil Steadies as Sverdrup Restart eases Geopolitical Jitters

Oil prices traded steady on Tuesday as Norway's Johan Sverdrup oilfield restarted production and there were reports of Iran offering to cap its uranium stockpile, factors that offset investor concerns about escalation of the Russia-Ukraine war.Brent crude futures LCOc1 fell 0.1%, or 7 cents, to $73.23 per barrel by 1:30 p.m. EST (1830 GMT). U.S. West Texas Intermediate crude futures CLc1 gained 0.1%, or 5 cents, to $69.21 per barrel.Equinor resumed partial production from the Johan Sverdrup field in the North Sea, Western Europe's largest oilfield…

Prices for gas in Europe are lower due to a revised forecast but concerns about supply persist.

The Dutch and British wholesale gas prices fell slightly on Tuesday morning due to small changes in weather forecasts. They had risen more than 2% on Monday, mainly because of colder forecasts. LSEG data shows that the benchmark front-month contract for the Dutch TTF hub fell by 0.09 euros to 39.90 Euro per megawatt hour at 0756 GMT. The Dutch day-ahead contracts was down by 0.21 euros at 39.67 Euro/MWh. The day-ahead contract in the British market was down by 0.10 pence, at 99.00 pence/therm, and the front-month contract was also down by 0.50 pence, at 99.90 pence/therm.

Chinese demand drives up global wind turbine orders in H1 of 2024

Wood Mackenzie reported in a Monday report that global onshore wind turbines orders reached 91.2 gigawatts in the first half, an increase of 23% on the previous year. This was due to a higher demand from China's north region in the second quarter. China has the largest wind turbine production capacity in the world compared to Europe or the United States. Western OEMs are struggling to keep up with China's pricing and availability advantages. According to the Wood Mackenzie Report, the global order intake for windmills in the second quarter was 66 GW, mainly due to Chinese demand.

Prices of nuclear spot prices fall on increased availability

The European power price fell from its multi-month highs Tuesday, as French nuclear availability increased and residual load is expected to fall. Karsten Walke, ICIS analyst for power markets, says that in Central-Western Europe the risk of prices being higher than normal is still present, due to the stable forecasts on demand and the generally low expectations regarding wind. He added that the spikes in day-ahead prices, such as the one on Monday, are only temporary and will not become the norm. Instead, they should fall in line with the forward contracts over the coming weeks and months.

Starmer, the UK's ambassador to Berlin, is there for talks on resetting ties with Europe

On Wednesday, British Prime Minister Keir starmer will discuss an economic and defense accord with German leaders. He hopes to use his two-day trip to Europe's leading powers Germany and France as a chance to reset the relationship with the rest. Starmer stated that he wanted Britain move past the previous Conservative Government's fractious relationships with European allies, and place improved ties as the core of his efforts in order to boost Britain's economy. Starmer was in Berlin on Tuesday and visited the Brandenburg Gate before meeting with President Frank-Walter Steinmeier on early Wednesday morning.

Starmer wants to help Europe reset its ties by pursuing a defence deal with Germany

British Prime Minister Keir Starmer will discuss a landmark economic and defence accord with German leaders on Wednesday, hoping to use a visit to pursue a "once-in-a-generation opportunity" to reset relations with the rest of Europe. Starmer, who is on a two-day trip to Germany and France to promote Britain's economy, said that he wanted to see Britain move past the fractious relationship with European allies of the previous Conservative government and place improved relations at the center of his efforts. Starmer, who will be visiting Berlin to begin his trip…

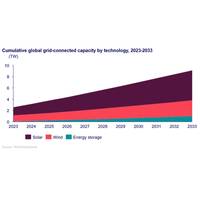

Solar, Wind Uptake to Reach 5.4 TWac from 2024 to 2033, Says Wood Mackenzie

Global solar deployment to add 3.8 TWac of new project capacity by 2033 compared to 1.6 TW of wind power, while 640% growth is forecast for energy storageFrom 2024 to 2033, developers will bring more than 5.4 terawatts (TWac) of new solar and wind capacity online, increasing the cumulative global total to 8 TWac, as the world endeavours to electrify economies and meet decarbonisation targets, according to latest analysis by Wood Mackenzie.Energy storage capacity (excluding pumped hydro) will grow by more than 600%, with nearly 1 TW of new capacity expected to come online in the same period.

When is a Cargo of Oil Certified "Carbon Neutral"? Ask Lundin Energy

Sweden's Lundin Energy has sold to Italian refiner Saras what it said is the world's first oil cargo certified as carbon neutral at the point of production, the two companies said on Monday.Oil companies are increasingly trying to market their products as cleaner in an effort to secure a future for the fossil fuel industry in a world where investors, activists and regulators are demanding action to halt climate change.While Lundin's crude from the Norwegian Edvard Grieg field was certified as carbon neutral from exploration, development and so-called scope 1 and 2 emissions…

Lundin Energy Chief Schneiter: Output Trending Upward at Sverdrup

Norway's Johan Sverdrup oilfield, the largest in western Europe, is ramping up production in the fourth quarter after the government increased its production permit, Lundin Energy, a partner in the field, said on Friday.Equinor-operated Sverdrup increased its production capacity to 470,000 barrels of oil equivalent per day (boed) in March from an original 440,000 boed, but output was soon after capped by government-imposed limits.Norway in May joined OPEC and other producers in voluntary output curbs to help prop up oil prices as the novel coronavirus pandemic undermined demand.Maintenance work and technical problems at some fields cut output more than expected in th

Norway to Keep Oil Production Cut Unchanged after OPEC+ Deal

Norway, Western Europe's largest oil producer, has no plans to modify its existing plans for production cuts, following the OPEC+ group's agreement to extend a deal on record output cuts to the end of July, the oil ministry said on Monday.On Saturday, OPEC+ agreed to extend the deal to withdraw almost 10% of global supplies from the market by a third month to end-July, sending Brent crude price to over $43 a barrel."OPEC+ has played a key role in the ongoing stabilization of the oil market. Their last decision underscores their efforts in these unprecedented times for the world economy.

Lundin Cuts 2020 Oil Output Goal, Raises Long-term Target

Lundin Energy has cut its 2020 oil and gas output target after Norway's decision to reduce production along with OPEC+ producers, the Swedish company said on Monday.The company has a 20% stake in the Equinor-operated Johan Sverdrup field, which reached phase-one plateau output of 470,000 barrels of oil equivalent per day (boepd) in April. It also operates the Edvard Grieg oilfield.Lundin is now targeting daily volumes of 157,000 boepd day this year, down from a previous 160,000-170,000, owing to production restrictions imposed by the government after OPEC+ agreed to cut supplies in an effort to support prices.Norway…

Norway Gov't Cuts Its Oil Price Assumption for 2020

The Norwegian government has cut its oil price assumption for 2020 to 331 Norwegian crowns ($32.17) per barrel from 476 crowns last October, a revised budget showed on Tuesday.Norway is Western Europe's largest oil and gas producer, with petroleum accounting to about 40% of its exports and about a fifth of the state's revenues.Oil prices fell as global oil demand has slumped by about 30% as the coronavirus pandemic has curtailed movement across the world, leading to growing inventories globally. ($1 = 10.2875 Norwegian crowns) (Reporting by Nerijus Adomaitis, editing by Terje Solsvik)

Equinor Suspends 2020 Production Guidance

Equinor has suspended its 2020 oil and gas output guidance amid government-imposed curtailments and a glut of supply, and could take further action to scale back activity this year, the Norwegian energy firm said on Thursday.With operations from the North Sea to Africa, the Americas and Asia, Equinor had expected 7% output growth this year before Norway, Brazil and others joined OPEC+ in ordering curtailments amid the COVID-19 pandemic."We will continue to prioritise value over volume and have already reduced activity, particularly in the U.S. onshore.