Iran Floats Surplus Oil as Demand Falls Ahead of US Sanctions

Two tankers carrying Iranian condensate, a type of ultra-light oil, have been floating off the United Arab Emirates for about a month as demand for the oil fell ahead of U.S. sanctions.The tankers, carrying about 2.4 million barrels of South Pars condensate combined, have been floating off the UAE since August after South Korea halted imports from Iran while China's demand dropped during summer, according to several industry sources and shipping data.The build-up in Iranian oil supplies underscores the pressure that Iran is facing as Washington aims to…

Moody's Cuts Outlooks for 4 Gulf States, Lowers Bahrain to Junk

Moody's Investors Service has cut its outlook for the debt ratings of Saudi Arabia and three other Gulf states while lowering Bahrain's rating to junk, citing concern over the impact of low oil prices on their finances. Saudi Arabia's Aa3 rating was placed on review for a possible downgrade, Moody's said late on Friday, adding that it would study whether Riyadh's efforts to expand its non-oil revenues and diversify its economy were likely to work. "At around $650 billion (or roughly 95 percent of forecast 2016 gross domestic product) at the end of September 2015, the country's foreign currency assets are large," it said.

Dubai's ENOC Plans Regional Expansion after Fuel Deregulation

Dubai's Emirates National Oil Co (ENOC) plans to expand in the region after the United Arab Emirates deregulated fuel prices, lifting financial pressure on the company, it said on Wednesday. The firm has struggled in recent years, losing hundreds of millions of dollars annually because it was obliged by UAE rules to sell gasoline at a fraction of international market rates. But the UAE government said this month it was abandoning fixed, subsidised fuel prices and would let gasoline and diesel prices float in response to global trends. In August, the price of a litre of octane 95 gasoline will climb 24 percent while diesel will fall 29 percent.

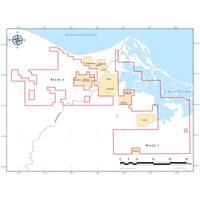

Dana Gas Signs GPEA in Egypt

Dana Gas’ wholly-owned subsidiary, Dana Gas Egypt, has concluded a Gas Production Enhancement Agreement (GPEA) with the Egyptian Natural Gas Holding Company (EGAS) and the Egyptian General Petroleum Company (EGPC). This landmark agreement forms the basis for an important development program to eventually increase production from current levels of over 40,000 BOEPD from the Company’s Development Leases in the Nile Delta. Further, Dana Gas Egypt has reached a notable milestone having produced 100 million barrels of oil equivalent in Egypt since it started operations in 2007.

Dana Gas Receives $53m from Egypt

Dana Gas received from the Egyptian Government authorities $53m from the current total outstanding receivables of $330m. Payment of $42 million has been received in US dollars and the balance in equivalent Egyptian pounds. Including this tranche, during 2013, Dana Gas has received a total of $130m from the Egyptian Government authorities. The Egyptian Government has committed to work with the company on a plan to repay the remainder of the outstanding receivables over an agreed time frame. While Dana Gas has had on-going discussions with the Egyptian authorities to resolve the issue of outstanding payments…