US CFTC fines energy traders

The U.S. Commodity Futures Trading Commission ordered TOTSA TotalEnergies Trading SA on August 27 to pay a fine of $48 million for alleged gasoline price manipulation. Ian McGinley, CFTC Director of Enforcement, said that the CFTC had "guarded the integrity of the market in numerous cases during the past 20 years" by detecting these benchmark-related scheme and prosecuting them. The U.S. regulator has fined several companies for what they call oil and gas market malpractice.

Woodside to Boost Vincent Crude Quality to Ride VLSFO Demand

Woodside Petroleum will improve the quality of Vincent crude by increasing its flash point from July so that it can be blended into very low sulphur fuel oil (VLSFO) and capture higher premiums, two sources told Reuters.Among crude grades, heavy sweet oil, with higher density and less sulfur, is most suitable for blending into VLSFO that meets the new marine fuel sulfur regulations dubbed IMO 2020.

Oil Futures Markets Need More Transparency

Recent turbulence in the price of light sweet crude oil futures has highlighted how little is known about the positions of traders and their impact on the formation of prices.Exchanges and regulators see the positions of all members and traders on a daily basis but the information is confidential and not available to researchers even many years afterwards.The most recent comprehensive study of how individual traders’ positions evolve over time in response to prices…

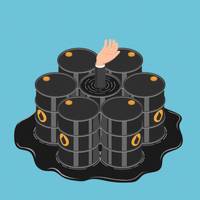

OPINION: Drowning in Oil, Regulatory Measures to Keep Prices Afloat

These days history seems to be in the making on a daily basis. On April 20, 2020, the price of the NYMEX West Texas Intermediate Sweet Crude Oil (WTI) futures contract for May delivery plunged into the negative, forcing sellers to actually pay customers for taking the crude oil off the sellers’ hands. The historic drop came a little over a month after Russia and Saudi Arabia initiated crude oil price war…

CME Adds Two Delivery Points to WTI Houston

CME Group on Thursday said it would add two more delivery points for its WTI Houston crude futures contract, pending regulatory review, as it seeks to provide customers with additional options to hedge physical price risk.* Beginning with the March 2020 contract, customers can take delivery of U.S.

IOC Sells IMO2020-Compliant Marine Fuel in India

State-owned Indian Oil Corp (IOC) said it has commenced delivery of Low Sulfur Furnace Oil (LSFO) for ships that is compliant with International Maritime Organisation's (IMO) mandate.The largest commercial oil company in India said in a press release that it commenced deliveries of LSFO with 0.5 per cent sulfur as marine fuel at ports in the country.The first such supply was made on 26th…

US Offers Oil from Emergency Reserve

The U.S. Energy Department said on Thursday it is offering up to five million barrels of sweet crude oil from the national emergency reserve in a sale mandated by previous laws to raise funds to modernize the facility.Laws passed by Congress in previous years require the department to hold sales to pay for improvements to the Strategic Petroleum Reserve which is held in caverns on the coast…

Gazpromneft Issues Tender for Novy Port Crude Oil Loading in Sept 2018

Gazpromneft issued a spot tender on Friday to sell a cargo of light sweet Novy Port crude oil loading from Murmansk port in September, traders said.The producer is offering 100,000 tonnes of Novy Port crude oil loading from the RPK-Nord offshore terminal in the Murmansk port area on September 16-29, subject to weather conditions, traders added.Tender participants are invited to offer premiums…

U.S. to Sell 7 mln barrels of Crude From SPR

The U.S. Department of Energy said on Thursday it will sell 7 million barrels of sweet crude oil from the country's petroleum reserve as it complies with a 2015 law to help fund the federal government. The DOE will accept offers on the oil until March 21. Delivery of the crude will be from May 1 to May 14, from the Strategic Petroleum Reserve's (SPR) West Hackberry site, and from May 1 to May 31 from its Bryan Mound site, the DOE said.

US DOE Directs $30 Mln to Small Oil, Gas Projects

Six small U.S. oil and natural gas drilling projects will receive about $30 million in federal funding for research and development to help achieve President Donald Trump's policy of boosting output of fossil fuels, the Energy Department (DOE) said on Wednesday. The projects, selected by the DOE under the direction of Congress, are in what is known as unconventional shale development. They currently produce less than 50,000 barrels per day each.

Matrix Global Plans U.S. Crude Storage Deal

Matrix plans sweet crude storage futures at LOOP. Matrix Global Holdings is planning to start up an oil storage futures contract for low-sulphur crude oil that will enable companies to build up supplies for export cargoes, as Asia looks for more crude imports from the United States. The contract will give holders access to low-sulphur, or sweet, crude oil storage space at the Clovelly, Louisiana, terminal operated the Louisiana Offshore Oil Port (LOOP).

U.S. Oil Exports set to Take Off by 2022

Enterprise sees four-fold jump in U.S. crude exports by 2022. Crude oil exports from the United States will increase to meet 5 percent of global demand by 2022, as refiners seek more low-sulphur crude to meet stricter rules for cleaner fuels, an executive from Enterprise Partners LP said on Monday. U.S. oil exports may rise to about 4 million barrels per day (bpd) by 2022, a four-fold jump from this year, said Brent Secrest, a senior vice president at Enterprise Products.

Asia Demand, Hedging Boosts Trading in Forward U.S. Oil Contracts

Trading volumes and open interest in U.S. crude futures soared in 2016, particularly among buyers out of Asia and shale companies locking in output, both of whom have shown an affinity for far-dated contracts, the CME Group Inc said on Thursday. NYMEX light sweet crude oil futures average daily volume hit an all-time high of 1.303 million contracts in November 2016, according to exchange data.

W. Africa Crude-Trading Quiet, Nigerian Delays Dampen Demand

Oil futures were on track for their biggest annual gains since 2009 despite intraday losses, aided by OPEC's agreement to cut production from early next year. Still, demand for West African crude in spot trading was limited by holidays across Europe and uncertain demand in Asia. Gains in U.S. crude stocks showed by the U.S. Energy Information Administration this week also raised doubts over western demand for African oil in the near term.

Canadian Oil Exports Drop, Supply Hunt on Amid Wildfires

In a sign the massive Alberta wildfire is taking a toll on oil transport, Canadian crude exports to the United States dropped 12 percent last week, while another blend of Canadian sweet crude oil rallied as concerns grow about supply. Overall, trading in Canadian crude was quiet, as the second half of the month is generally inactive. Hot and dry weather and strong winds were expected to push the wildfire burning near Fort McMurray…

US Oil Price Manipulation Lawsuit Settled

Oil traders have reached a $16.5 million settlement of a U.S. class action lawsuit accusing Arcadia Petroleum Ltd, its Parnon Energy unit and two traders of illegally manipulating the price of crude oil in early 2008. The preliminary settlement was filed late Wednesday night in Manhattan federal court and requires court approval. It resolves charges that the companies, Arcadia trader Nicholas…

Valero CEO: Low Oil Prices Encourage Global Fuel Demand

Valero Energy Corp Chairman and Chief Executive Joe Gorder said on Wednesday low oil prices are encouraging continued global demand for refined products like motor fuels gasoline and diesel. Speaking at a Houston energy conference, Gorder said many of the company's refineries could run more light sweet crude oil but the downward global price pressure on oil is making all crude grades attractive.

As Oil Price Falls, Funds Looks to Pipelines and Refineries

As the prospect of a global glut of oil sends shares of once-booming U.S. energy companies lower, some fund managers see value in pipeline and refinery companies, whose fortunes are tied more to the volume of oil than to its price. Energy stocks have plummeted in recent months along with the price of oil, with U.S. light sweet crude oil most recently hitting a three-year low of $75.84 a barrel.

Study: Lifting Crude Exports Will Not Raise U.S. Gas Prices

A highly anticipated study by the U.S. Energy Information Administration will show that domestic oil prices will not rise if the U.S. ban on oil exports is lifted, the agency's top administrator said Thursday. Domestic gasoline prices are set in the global market, and the price of U.S. gasoline is tied more closely to the global benchmark price than WTI, the U.S. benchmark, EIA administrator Adam Sieminski said.

Oil Slips Towards $96 as Libyan Output Returns

Oil fell towards $96 a barrel on Wednesday as rising supply from Africa and Iraq offset mounting tensions in the Middle East and better-than-expected data in China. Weak European economic data and a rise in oil exports from Iraq, Libya and Nigeria have weakened the oil price, which is down around 14 percent this quarter, the biggest quarterly drop since the second quarter of 2012. Brent for November delivery fell 55 cents to $96.30 a barrel by 1258 GMT.