Offshore Drillers to Lose $3B Due To COVID-19, Low Oil Prices

Offshore drillings contractors leasing drilling rigs to oil and gas companies are set to lose contracts worth $3 billion in combined revenue in 2020 and 2021, Rystad Energy said Thursday, citing the impact of the coronavirus pandemic and low oil prices.According to Rystad, the estimated contract value in 2020–2021 is $30 billion in total; $20 billion in 2020 and $10 billion in 2021. "So far six rig years of contracts have been canceled, translating to approximately $400 million in contract value.

Shelf Drilling Bags Gulf of Thailand Gig

Dubai-headquartered offshore drilling contractor Shelf Drilling has secured a contract for the Shelf Drilling Scepter jack-up rig with Chevron Thailand Exploration and Production for operations in the Gulf of Thailand.The contract for the 2008-built rig is expected to commence in Q1 2020 and run until Q2 2022 and includes a one-year option.David Mullen, Chief Executive Officer, Shelf Drilling, said: “We are pleased to continue our long-standing partnership with Chevron through this award for the Shelf Drilling Scepter.

Petrobel Contracts Shelf Rig

UAE-headquartered offshore drilling contractor Shelf Drilling has received a contract award for one of its jack-up rigs with Belayim Petroleum Company (Petrobel) for operations in the Gulf of Suez, offshore Egypt.According to a press release from the shallow water offshore drilling contractor, the Trident 16 jack-up drilling rig had been awarded a one-year contract.It said that the contract includes mutually agreeable options, and the planned start-up…

Shelf Drilling: Higher Rig Rates, More Consolidation Coming in 2019

Shelf Drilling, the world's largest owner of shallow water rigs, expects to see higher rig rates in 2019 and more consolidation of the fragmented market, Chief Executive David Mullen told Reuters. Following an initial public offering, the Dubai-based company's shares began trading in Oslo on Monday, four years after abandoning plans to list in London in the wake of an oil price downturn. Its shares traded at 64.80 Norwegian crowns ($7.98) per share by 1023 GMT, below its initial offer of 65.35 crowns. Reporting by Nerijus Adomaitis

Top Shallow Water Driller Raises $225 Mln in Oslo IPO

Shelf Drilling, a Dubai-based contractor for shallow water rigs, raised about $225 million by issuing new shares priced at 65.35 Norwegian crowns ($8.09) per share, the company said on Friday, the latest drilling firm to list in Oslo to raise capital.Its initial public offering comes four years after the company scrapped plans to list in London just as the oil market's downturn started.Demand for shallow water or jack-up rigs has been steadily growing through 2017 after hitting a bottom at the end of 2016.

Seadrill Sells Three Jack-ups to Shelf Drilling

Seadrill Limited, announced that it had reached an agreement with Shelf Drilling to sell the West Triton, West Resolute and West Mischief for a total consideration of $225 million subject to customary closing conditions. The West Triton and West Resolute are scheduled to be delivered to Shelf Drilling by the end of May 2017 and the West Mischief during 3Q 2017 after completion of its current drilling contract with NDC in Abu Dhabi. The total debt outstanding on these three units is $102 million providing excess sale proceeds of $123 million.

Statoil Awards Norwegian Continental Shelf Drilling Contract

Statoil has, on behalf of relevant licensees, exercised options for previously awarded drilling service contracts for fixed installations. Options have been exercised for 17 installations on the Norwegian continental shelf. In 2012 Statoil awarded contracts for four years with options for three times two-year extension to Archer, KCA Deutag and Odfjell. The company now extends the contracts with the suppliers, exercising the first option. The option period will last from 1 October 2016 to 1 October 2018, with some changes to the scope awarded.

ASRY Rig Division’s Deliveries All on Time in 2014

In 2014, ASRY Offshore Services completed every one of its repair scopes within schedule, on-budget, and with leading safety standards. ASRY, a ship and rig repair yard in the Arabian Gulf, has confirmed that its Offshore division, which specializes in rig repairs, achieved 100% on-time delivery of all the rig projects completed in 2014. Global clients including Saudi Aramco, Saipem, Nabors Drilling, Egyptian Drilling Company and more chose ASRY for their rig repair projects last year…

Record Rig Berthing at Drydocks World

Drydocks World, the international service provider to the shipping, offshore, oil, gas and energy sectors, have simultaneously berthed 11 rigs in the Dubai yard, breaking its record of nine rigs at the yard set in February this year. Clients contributing to the record include Saipem, Saudi Aramco, Shelf Drilling, Aban Offshore and the National Drilling Company. Drydocks World said it has focused its efforts to cater to the offshore market and rig requirements through establishing a dedicated rig division which has worked to market the yard facilities…

Small Oil Firms Hunt for Cash as Crude Slump Shuts IPO Door

Slumping oil prices are shutting the door to stock market listings for small oil and gas firms, forcing many to tap more costly forms of financing or to shelve projects and wait for better times. Initial public offerings (IPOs) in the oil and gas sector worldwide have dwindled since crude started sliding in June. The amount raised through listings in the second half of 2014 fell 63 percent from the first six months of the year to $3.8 billion, Thomson Reuters data showed.

Lamprell Issues Pre-close Trading Update

Lamprell published a trading update ahead of its results for the year ending December 31, 2014, stating it has delivered a robust operational and financial performance in 2014 as a result of strong project execution, favorable phasing of rig construction cycles and some one-off elements. The group reports it has seen a strong rate of conversion of its bid pipeline with six new build jackup rig orders won and several smaller awards signed recently. In the second half of the year…

Shelf Drilling Sings 5-Yr Contract For 2 Newbuild Jackups

Shelf Drilling, Ltd. today announces that one of its subsidiaries has been awarded contracts for two newbuild jackup rigs by Chevron Thailand, a subsidiary of Chevron Corporation (NYSE : CVX). The two drilling contracts are for a five-year term each and the newbuild rigs are scheduled to commence operations offshore Thailand during the first and third quarter of 2017 respectively. The estimated revenues which could be generated over the five-year contract term are approximately USD 281 million for each rig…

Offshore Rig Operator Shelf Drilling Aims for IPO

Offshore oil rig operator Shelf Drilling said on Thursday it plans to raise $500 million in an initial public offering in the London Stock Exchange. The Dubai-based contractor, which said revenues totalled $1.2 billion and net income reached $232 million in 2013, specialises in shallow water offshore drilling services to oil and gas customers. The company plans a payout ratio of between 40 to 60 percent of net income, Chief Executive Officer David Mullen said.

Lamprell First Half Results Beat Expectations

Lamprell today announced its financial results for the first half of 2014, reporting results ahead of expectations due to strong operational performance and early results from savings initiatives, generating improved margins. Revenues rose by $125.7 million against H1 2013 as a result of the high H1 activity levels and phasing of construction activity during the period. According to Lamprell, successful rights issue and refinancing provides a strong financial platform and enables delivery of long-term growth strategy.

Drydocks World to Repair “High Island IV”

Drydocks World, the international service provider to the shipping, maritime, offshore, oil, gas, and energy sectors, has been chosen to carry out the drydocking and repairs of the jack-up “High Island IV” for Shelf Drilling, one of the major players in the shallow water drilling market, and owners of 40 rigs worldwide. Drydocks World-Dubai has a successful past with Shelf Drilling, previously completing a variety of work on six of their rigs, ranging from Saudi Aramco specifications to major upgrades and re-activation.

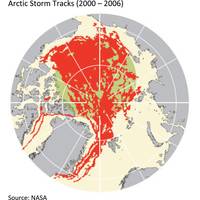

An Open Arctic and its Impact on Oil Drilling

William Cho, Head of MatthewsDaniel Weather, a division of the Bureau Veritas Group, explains why improvements in drilling technologies and weather monitoring systems have made offshore shelf drilling operations in the Arctic Circle increasingly attractive to upstream oil and gas companies and their investors. Rising crude oil prices motivate not only technological innovators to explore cheaper alternative energy sources, such as solar panels and wind turbines…

Australia's CHAMP Drilling to List on London Bourse

Reuters – Australia 's CHAMP Private Equity said it plans to bypass the local share market to list Shelf Drilling Ltd, the company it formed 16 months ago to run $1 billion worth of shallow water oil rigs, on the London Stock Exchange in May. "We're in the process of moving for a listing of that business on the London Stock Exchange hopefully in mid-May," Nathaniel Childres , CHAMP managing director, told an Asian Venture Capital Journal conference on Friday.