Oilfield executives sour in Dallas Fed survey

According to a Federal Reserve Bank of Dallas survey published on Wednesday, oil and gas production in Texas, Louisiana, and New Mexico, the three states that produce the most, declined in the third-quarter as executives expressed a more negative outlook. The decline in oil and gas activity is due to the uncertainty surrounding oil prices, as well as increased frustration towards President Donald Trump and his administration.

US refiners are unlikely to spend large amounts to process more domestic crude oil

It can be expensive and time-consuming to change refinery configuration. The margins and yields of refineries can be affected by using different types of crude. By Arathy S. Analysts and industry sources said that U.S. refiners do not plan to invest heavily to process more crude oil domestically and less oil imported from Canada and Mexico. This is a major obstacle to President Trump’s plan to increase oil production. Trump's pledge of unleashing U.S.

Marathon Creates Top U.S. Refiner with Andeavor Acquisition

Marathon paying $152/share to create biggest independent refiner; Andeavor assets include pipelines, refineries, gas stations. Marathon Petroleum Corp said on Monday it would buy rival Andeavor for more than $23 billion, forming a company that would leapfrog Valero Energy Corp as the largest independent U.S. refiner by capacity. Shale oil fields have pushed U.S. crude production to record highs and industry experts…

Oil Trades Strengthen to Mid-2015 Levels on Iranian Unrest

Oil prices posted their strongest opening to a year since 2014 on Tuesday, with crude rising to mid-2015 highs amid large anti-government rallies in Iran and ongoing supply cuts led by OPEC and Russia. U.S. West Texas Intermediate (WTI) crude futures traded flat at around $60.40 by 1200 GMT after hitting $60.74 earlier in the day, their highest since June 2015. Brent crude futures, the international benchmark, were also flat at around $66.80 after hitting a May 2015 high of $67.29 a barrel earlier in the day.

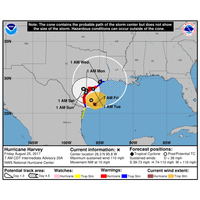

Residents Flee South Texas Ahead of Harvey

Residents fleeing most powerful storm on U.S. mainland since 2005. Businesses closed and lines of cars streamed out of coastal Texas as officials called for residents to evacuate ahead of Hurricane Harvey, expected to arrive about midnight as the most powerful storm to hit the U.S. mainland in more than a decade. The hurricane is forecast to slam first near Corpus Christi, Texas, drop flooding rains along the central Texas coast and potentially loop back over the Gulf of Mexico before hitting Houston…

U.S. Drillers Cut Rigs ahead of Hurricane - Baker Hughes

U.S. energy firms cut oil rigs for a second week in a row ahead of Hurricane Harvey and as a more than year-long recovery in drilling slows down in reaction to soft crude prices. Drillers cut four oil rigs in the week to Aug. 25, bringing the total count down to 759, General Electric Co's Baker Hughes energy services firm said in its report on Friday. That compares with 406 active oil rigs during the same week a year ago. Drillers have added rigs in 56 of the past 65 weeks since the start of June 2016.

Hurricane Harvey Strengthens, Threatens US

Hurricane Harvey intensified early on Friday into potentially the most powerful hurricane to hit the U.S. mainland in more than a decade, as authorities warned locals to shelter from what could be life-threatening winds and floods. Harvey is set to make landfall late Friday or early Saturday on the central Texas coast where Corpus Christi and Houston are home to some of the biggest U.S. refineries. Oil and gas operations have already been disrupted and gasoline prices have spiked.

Shell Plans 400 Job Cuts in the Netherlands

Royal Dutch Shell Plc plans to cut more than 400 jobs in the Netherlands, mainly at its major projects and energy technology operations, as the oil giant shifts its business model in response to lower oil prices, according to an internal document seen by Reuters. The world's second-largest oil company by market capitalisation said in a statement responding to questions from Reuters that "approximately 400 (staff) are potentially at risk of redundancy during the last quarter of 2017/first half of 2018".

BP Doubles Down on Deepwater

About 300 BP workers commute 150 miles here by helicopter, from the Louisiana coast to a deep-sea drilling platform that can produce more oil in a day than a West Texas rig can pump in a year. On the deck of Thunder Horse, they work two-week shifts, drink seawater from a desalination plant, and eat ribs and chicken ferried in by boat. On the ocean floor, robots provide remote eyes and arms as drills extract up to 265,000 barrels per day.

Oil Industry Renews Deepwater Quest

Oil price recovery, low service cost boost offshore exploration; firms slash costs of deepwater projects by 50 pct. Deepwater oil drilling can be expensive, time-consuming and a hard sell to investors. But the world's top energy firms are restarting their search for giant oilfields under the ocean after a two-year lull. A recovery in oil prices to about $50 a barrel from a 12-year low in 2016 is reviving oil majors' appetite for risk.

Riverstone Holdings to Sell Rock Oil for $980 Mln

Riverstone Holdings LLC, a private equity firm that focuses on energy and power sectors, said it would sell U.S.-based oil and gas explorer Rock Oil Holdings LLC to SM Energy Co for $980 million in cash. SM Energy said the deal would increase its assets in the Midland Basin in Texas to 46,750 acres and add net production of 4,900 barrels of oil per day (boepd). Rock Oil, founded in 2014, has about 24,783 acres in the Permian Basin in Texas.

With Oil Near $50, U.S. Shale Producers eye Growth

Two years into the worst oil price rout in a generation, large and mid-sized U.S. independent producers are surviving and eyeing growth again as oil nears $50 a barrel, confounding OPEC and Saudi Arabia with their resiliency. That shale giants Hess Corp, Apache Corp and more than 25 other companies have beaten back OPEC's attempt to sideline them would have been unthinkable just months ago, when oil plumbed $26 a barrel and collapses were feared.

U.S. Shale Firms Cut CapEx Again

Three major U.S. shale oil companies have slashed their 2016 capital spending plans more than expected in a bid to survive $30 a barrel oil prices, with one of them saying prices would need to rise more than 20 percent just to turn a profit. The cuts on Monday from Hess Corp, Continental Resources and Noble Energy ranged from 40 percent to 66 percent. This marks the second straight year of pullbacks by a trio of companies normally seen as among the most resilient shale oil producers.

Big Oil Shrinks and Plots the Way Forward

Companies seek to safeguard growth for when market recovers. As oil and gas companies cut ever-deeper into the bone to weather their worst downturn in decades, boards have adopted contrasting strategies to lead them out of the crisis. Crude prices have tumbled around 70 percent over the past 18 months to around $35 a barrel, leading to five of the world's top oil companies reporting sharp declines in profits in recent days.

Texas Governor Signs Law to Prohibit Local Oil Well Fracking Bans

Texas Governor Greg Abbott on Monday signed a bill into law that prohibits cities and towns from banning an oil drilling practice known as hydraulic fracking, giving the state sole authority over oil and gas regulation. Lawmakers in Texas, a state that is home to the two of the most productive U.S. shale oil fields, have been under pressure to halt an anti-fracking movement since November, when voters in the town of Denton voted to ban the oil and gas extraction technique.

Train Lobby Pushes to Weaken Safety Rule

Billionaire investor Warren Buffett is set to be a chief beneficiary of a bid by Senate Republicans to weaken new regulations to improve train safety in the $2.8 billion crude-by-rail industry, a key cog in the development of the vast North American shale oil fields. A series of oil train accidents, including the July 2013 explosion of a train carrying crude in Lac-Megantic, Quebec, that killed 47 people, led U.S. and Canadian regulators to announce sweeping safety rules in May. Among other things, U.S.

Burned by Oil, Some US Fund Managers Still Bet on Rebound

Mutual fund managers who believed the slump in oil prices would be short-lived have been taking it on the chin, but some are not giving up, betting that the market will bounce back and they will have the last laugh. The FPA Capital Fund, the Towle Deep Value Fund and the Mount Lucas US Focus Equity fund are among several that are still plowing money into oil exploration and production companies, even as their performance numbers sank to the bottom 5 percent this year, according to Morningstar.

Some U.S. Fund Managers Still Bet on Oil

Mutual fund managers who believed the slump in oil prices would be short-lived have been taking it on the chin, but some are not giving up, betting that the market will bounce back and they will have the last laugh. The FPA Capital Fund, the Towle Deep Value Fund and the Mount Lucas US Focus Equity fund are among several that are still plowing money into oil exploration and production companies, even as their performance numbers sank to the bottom 5 percent this year, according to Morningstar.

Encana Shugs off Prices, Ups 2015 CapEx

Canada's Encana Corp said it would boost capital spending in 2015 to focus on its more-profitable shale oil fields, bucking an industry-wide move to cut spending as oil prices tumble. The company said it would spend between $2.7 billion and $2.9 billion in 2015, up from the $2.5 billion and $2.6 billion it had estimated for this year. Encana, which is boosting oil and natural gas liquids production under Chief Executive Doug Suttles…

US Wells Shuttered as Prices Better Small Producers

Collapsing crude prices are confronting scores of smaller U.S. oil producers with the grim choice of either shutting older high-cost wells or burning through cash in the hope of riding out the downturn. As oil prices fell by more than half over the last six months from more than $100 per barrel, the U.S. oil industry responded by slowing its blistering growth and dialing back expansion plans. Now, with U.S. crude around $46 a barrel…