UK's Serica Energy reduces production forecast for 2025 due to 'frustrating Triton' issues

Serica Energy, a British oil and natural gas company, lowered its production forecast for 2025 on Tuesday due to delays at its Triton floating storage and offloading unit (FPSO) in the North Sea. The shares of the London listed firm dropped as much as 7.5%, to 124.2 pence. Serica increased its production in recent years through acquisitions, investments and other means. However, in 2024 it will face challenges due to a failure at the Triton FPSO. Triton's problems have made the start of this year frustrating.

EnQuest pays its first dividend after a swing to an annual profit

EnQuest, a North Sea oil producer, declared its first ever final dividend of 15 million dollars on Thursday. The higher oil prices helped to boost the company's annual profit after tax. The shares of the London listed energy group rose by 3.4% at 13.8 pence as of 0830 GMT after it announced that it would pay its first dividend of 0.616 penny per share in June. It reported a profit after tax of $93.8 millions for 2024. This follows a loss of $30.8 million the year before. EnQuest has declined to provide an update about the discussions ahead of EnQuest's deadline to submit an offer on April 4.

Serica delays North Sea's Triton production restart due to ongoing repairs

Serica Energy, a UK-based company, said Wednesday that production at its Triton floating storage and offloading unit (FPSO) in the North Sea would not resume until May due to delays with repairs. Prior to the storm Eowyn damage in January, it was expected that repairs would be completed by mid-to late March, allowing production to resume. Serica has revised the timeline following discussions Serica had with Dana Petroleum about necessary repairs. Serica's production was affected by the Triton outages last year.

Serica Energy UK forecasts production increase for 2025

Serica Energy, a UK oil and gas company focused on the North Sea, expects to increase production by 15.6% in 2025, thanks to improved reliability, the company said Tuesday. Serica has increased production by acquiring and investing in the past few years. The company's output was affected by an outage on its Triton floating storage and offloading vessel (FPSO) in the North Sea, in 2024. Serica stated in a press release that production has increased since the resumption. Chris Cox,…

Serica Energy, UK, restarts production on Triton vessel

Serica Energy, a UK-based company, announced on Tuesday that the production of its Triton floating storage and offloading vessel (FPSO) in the North Sea had resumed on December 27. The wells are still being restarted and the process is ongoing to phase-in the new and existing producing wells. It reported that its annual production in 2024 would average 34,600 barrels equivalent per day (boepd), a little below its previous estimate of 35,000-36,000. Serica reported a problem in late October with a single compressor on the FPSO vessel.

Serica Energy expands its North Sea operations with the acquisition of assets from Parkmead Group

Serica Energy, a North Sea-focused company, announced on Thursday that it will purchase exploration and production assets of Parkmead Group Plc at an initial cost of 6 million pounds (5 million pounds). Serica acquired all shares of Parkmead Ltd., including a 50% stake on the Skerryvore license in central North Sea, and a working interest of 50% in Fynn Beauly, an undeveloped UK oilfield. Serica stated that an additional 9 million pounds deferred will be paid in the next three-year period, as well as contingent payments based upon certain development milestones.

Serica Energy reduces full-year production forecast due to Triton Outage

Serica Energy, a UK-based company, said Tuesday that it expected full-year production will be lower than previous estimates following an outage in its Triton hub located in the North Sea. Serica stated in a press release that following the suspension of Triton production on October 26, there was an extended outage due to problems with the compression capability for gas export. Last month, the company reported that the Triton floating storage and offloading vessel (FPSO), had an issue with its single gas compressor.

Serica Energy's UK first-half profits and production fall

Serica Energy, an oil and gas company, reported a lower profit for 2024's first half on Tuesday. A tax charge of $106 million was to blame. A planned shutdown of the Triton Hub, located in UK Central North Sea, also affected production. Serica reported that it produced 43.700 barrels equivalent to oil per day (boepd), down from 49.350 boepd last year. Serica said that due to unplanned downtime, its full-year production average is expected to fall below the previously stated range of 41-46,000 boepd, according to a company statement.

UK North Sea Tax Changes Mean $12 Billion Revenue Drop, Industry Body Says

An industry group warned on Monday that the British government's plans to raise a windfall-tax on North Sea oil producers will result in a drop of nearly 16 billion pounds in state revenue and accelerate a fall in production. The Labour government elected in July has stated that the changes will assist in achieving a ramp up in renewable energy and a shift away from oil and natural gas in order to reduce carbon emission and help curb global climate change. Offshore Energies UK, an industry group…

NEO Energy reduces UK investment plans due to fiscal and regulatory uncertainty

NEO Energy announced on Monday that it would slow down its investment in all of its portfolios due to the uncertainty surrounding fiscal and regulatory issues in the British oil sector. NEO is the owner of half the Buchan Horst project in the UK North Sea. Serica Energy, Jersey Oil & Gas and NEO are the joint venture partners. They own 30% and 20% respectively. The British government has decided to delay the assessment of environmental statements as it plans to launch a consultation for new environmental guidelines on oil and gas project.

Serica Hires WilPhoenix Offshore Rig for Rhum Well

Serica Energy has hired Awilco Drilling's WilPhoenix semi-submersible drilling rig for the intervention work on the Rhum-3 ("R3") well in the UK North Sea.The 3rd-Generation, Enhanced Pacesetter, harsh-environment, mid-water, semi-submersible drilling rig will start operations in the fourth quarter of 2020 and last approximately 70 days. The contract follows a letter of intent the two companies signed in February.The work program will involve recovering debris left in the well by…

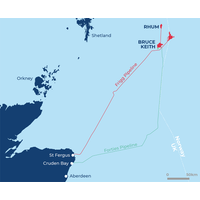

Serica Energy to Buy BHP Stake in North Sea Fields

North Sea operator Serica Energy has struck a deal with commodities giant BHP Billiton to up its stakes in two North Sea fields, taking it above 90 per cent ownership of the assets.Under the a sale and purchase agreement (SPA), Serica UK will acquire a 16.00% interest in the Bruce field and a 31.83% interest in the Keith field and associated infrastructure (BHP Assets) from BHP Billiton Petroleum Great Britain Limited.The structure of the Transaction is the same as the deals entered into by Serica with BP and Total whereby Serica will acquire interests variously in the Bruce…

Serica Energy Restarts Production at Erskine Field

Serica Energy said that efforts to remove gas hydrates in pipeline between Erskine and the Lomond platform had been successful and it has resumed production for the first time since January." Production from Erskine has restarted and flow rates are being optimised. Further updates will be provided once the re-commissioning process is complete," said a press note from the company.Erskine, in which Serica holds an 18% interest, was suspended in mid-January due to a blocked export pipeline which carried condensate from Erskine to the neighbouring Lomond platform.

US Grants BP, Serica Licence to Run Iran-owned North Sea Field

BP and Serica Energy received a conditional licence from U.S. authorities to continue operating a North Sea gas field partly owned by Iran's national oil company, Serica said in a statement.The U.S. Office of Foreign Assets Control extended a licence for U.S.

BP North Sea Field to Test U.S. Iran Policy

Serica acquires Rhum field from BP, co-owned by Iran; seeks U.S. licence to operate in Rhum field. A small gas field on the edge of the British North Sea could become a litmus test for U.S. policy towards Iran. London-based BP this week agreed to sell to North Sea producer Serica Energy three fields in the ageing offshore basin, including the Rhum field which is co-owned by a subsidiary of Iran's national oil company. For Serica, the $400 million deal will increase its production sevenfold. It nevertheless hinges on the British company receiving a licence from U.S.

A BP North Sea field to test U.S. policy on Iran

A small gas field on the edge of the British North Sea could become a litmus test for U.S. policy towards Iran. London-based BP this week agreed to sell to North Sea producer Serica Energy three fields in the ageing offshore basin, including the Rhum field which is co-owned by a subsidiary of Iran's national oil company. For Serica, the $400 million deal will increase its production sevenfold. It nevertheless hinges on the British company receiving a licence from U.S. sanctions enforcement authorities at a time when President Donald Trump is flexing his muscles against Tehran.

BP to Shed North Sea Bruce Field Stakes

BP said on Tuesday it had agreed to sell stakes in three fields in its Bruce assets in the North Sea to Serica Energy plc. The company said it expects to receive around 300 million pounds ($398 million), with a majority of it in the next four years. Serica said it would buy a 36 percent interest in Bruce, 34.83 percent in Keith and 50 percent in Rhum. BP will retain a 1 percent stake in Bruce. BP currently operates the Bruce assets, which comprise the Bruce, Keith and Rhum fields and related infrastructure assets.

International Expansion leads to success for Exceed

Well management and performance improvement specialist Exceed has reported a positive year in 2016, including a recruitment drive resulting from increased activity both internationally and in the North Sea. Exceed has also seen an increased requirement for engineering studies in 2016, with pre-feasibility engineering work, late life asset management and liability studies conducted on behalf of clients such as Faroe Petroleum, Boskalis, Verus Petroleum, The Oil & Gas Authority, Serica Energy and Houlder Marine.

Dana Gas Announces New Senior Management

Dana Gas PJSC, a publicly listed natural gas company in the Middle East, has announced several key senior management appointments. Chris Hearne was appointed as the Chief Financial Officer of the company on January 4, 2016. Prior to joining Dana Gas, Hearne was with Serica Energy plc, an international oil exploration and production company listed on the AIM market in London, where he served as Chief Financial Officer and Director from 2005. Hearne has over 20 years’ experience within the oil industry having been CFO and Senior Vice President of Erin Energy…

Genel, Partners Find Oil off Morocco

Genel Energy and two partner firms said on Monday they had discovered oil off Morocco, giving a boost to the region whose oil and gas drilling results have so far been mixed. Genel's minority partners in the Sidi Moussa-1 well, Serica Energy and San Leon, announced they had drilled nearly 3,000 metres below the sea and encountered oil. "We are at a very early stage and the presence of hydrocarbons in this frontier block will require further evaluation," said Tony Craven Walker, chief executive of Serica, which holds a five percent interest in the block.