Fieldwood Hungry for US Offshore Output

The Chief Executive of offshore oil and gas driller Fieldwood Energy LLC, Matt McCarroll, says he is not scared of the hurricanes, geological risks and costs that keep some oil companies out of the Gulf of Mexico. Instead, he is doubling down. The private equity-backed company - already the largest operator on the U.S. outer continental shelf - announced on Thursday it is closing a $480 million acquisition of Noble Energy’s assets in the Gulf of Mexico that will add 25,000 barrels per day (bpd) to its current net production of 72,000 bpd of oil equivalent.

Riverstone Unit Mulls Sale of WA Refinery

TrailStone Group, a start-up commodity merchant backed by private equity firm Riverstone Holdings LLC, has retained Tudor Pickering & Holt to sell or find strategic alternatives for its Tacoma, Washington refinery, two people familiar with the transaction said on Thursday. The refinery, known as U.S. Oil, needs a capital infusion to pursue additional projects, including plans to expand into renewable energy, one of the people said. "We hope to identify a partner/investor with…

Waterous Targets Canadian, U.S. Energy Assets

Private equity firm Waterous Energy Fund is seeking investment opportunities in the Canadian oil and gas sector as valuations turn attractive after a prolonged slump in the oil price, making a contrarian bet as global players pull back, its top executive said. Calgary-based Waterous Energy, which invests C$100 million to C$400 million ($75 million to $300 million) per deal in energy assets, is targeting companies in Canada and the United States, and is finding Canada particularly appealing, said Adam Waterous, head of Waterous Energy and a former top investment banker at Bank of Nova Scotia.

Petrobras to Gain $11 Bln on Sale of Brazil Oil Rights to Statoil

The sale of a stake in Carcara, the giant Brazilian offshore oil prospect, to Norway's Statoil ASA will gain Brazil's state-led oil company Petrobras as much as $11 billion to pay debt or invest in other projects that promise to generate cash more quickly, Petrobras' chief executive said on Tuesday. Petroleo Brasileiro SA, as Petrobras is formally known, sold its 66 percent stake in the prospect in July for $2.5 billion. But the sale will also free it from the need to invest its share of the area's estimated $12 billion to $13 billion development cost…

Riverstone Holdings to Sell Rock Oil for $980 Mln

Riverstone Holdings LLC, a private equity firm that focuses on energy and power sectors, said it would sell U.S.-based oil and gas explorer Rock Oil Holdings LLC to SM Energy Co for $980 million in cash. SM Energy said the deal would increase its assets in the Midland Basin in Texas to 46,750 acres and add net production of 4,900 barrels of oil per day (boepd). Rock Oil, founded in 2014, has about 24,783 acres in the Permian Basin in Texas. Riverstone Holdings' British unit, Riverstone Energy Ltd, said it would realise cash proceeds of $237 million from the sale.

Private Equity Mulls U.S. Energy IPOs

Private equity funds are looking to sell shares in two U.S. energy companies, people familiar with the plans said this week, deals that could end a year-long drought for Initial Public Offerings (IPOs) in the oil and gas sector. Denver-based Extraction Oil & Gas LLC, an oil explorer and driller in Colorado's Denver-Julesburg (DJ) basin backed by private equity firm Yorktown Partners LLC, has filed a confidential registration with the U.S. Securities and Exchange Commission (SEC) indicating it is planning on going public, people familiar with the matter said.

Barra to Study Buying Petrobras Asset Sold to Statoil

Brazil's Barra Energia do Brasil Petróleo e Gás, which owns 10 percent of the giant Carcara offshore oil prospect, will study invoking its right of first refusal over Petrobras' sale of its 66 percent stake in the area to Norway's Statoil, a source with direct knowledge of the situation told Reuters on Friday. Earlier on Friday Petroleo Brasileiro SA, as Petrobras is known, said it agreed to sell its stake in the BM-S-8 license block, home to Carcara, to Statoil for $2.5 billion. Barra is part owned by two U.S. investment funds Riverstone Holdings LLC and First Reserve Corp.

Statoil buys Petrobras stake in Brazil oil find

Statoil aims to offset declining output from mature fields. Norway's Statoil agreed on Friday to buy Petrobras' stake in an exploration licence off Brazil for $2.5 billion, a rare deal in an oil industry struggling with low prices. The purchase of the 66 percent stake from Brazil's state-led Petroleo Brasileiro SA (Petrobras) will help Statoil secure future production as output from its mature fields declines. The deal, Statoil's biggest in several years, will give it the bulk of oil and gas resources in the key Carcará field…

Silver Run Takes Majority Stake in Oil Producer Centennial

Silver Run Acquisition Corp, run by energy industry veteran Mark Papa, said on Friday it had taken a controlling stake in oil producer Centennial Resource Development LLC, with plans to develop its acreage in the Permian basin of Texas. The deal, which was first reported by Reuters on Tuesday, comes as private equity and other investors have begun to scoop up acreage across U.S. shale fields as crude prices climb off 2016 lows. Shares of Silver Run jumped about 5 percent after the news on Tuesday. The stock gained further on Friday, adding another 5 percent to reach $11.10.

U.S. Shale Oil Needs $80 to Grow

U.S. oil production growth will stop this month and begin to decline early next year due to low oil prices, the former head of oil firm EOG Resources, Mark Papa, said on Tuesday. Papa, now a partner at U.S. energy investment firm Riverstone Holdings LLC, told an industry conference in London that the U.S. shale oil industry needed oil prices of at least $80 a barrel to resume production growth. "We are about to see a pretty dramatic decline in U.S. production growth," said Papa, who was a key figure helping to spur the U.S. shale oil boom when he was at EOG Resources. U.S.

Proserv Acquires Nautronix

Proserv Group LLC, an energy services company, has acquired Nautronix, a supplier of subsea digital acoustic communication products and positioning services to the oil and gas industry, based in Aberdeen. Proserv is a portfolio company of Riverstone Holdings LLC, an energy-focused private equity firm based in New York. Employing 120 people, Nautronix is headquartered in Aberdeen where the main research and development, and manufacturing facilities are located. The company is internationally recognized for its through-water digital acoustic wireless communications and positioning systems…

Proserv Wins Offshore Achievement Award

Proserv has won a third industry accolade in as many months after being named Great Large Company at the Society of Petroleum Engineers’ Offshore Achievement Awards (SPE OAA) Thursday, March 12. The company was honored with the top title in recognition of its performance in the offshore energy sector including its business growth and clear strategy for continued expansion. Proserv’s chief executive officer, David Lamont, said the award was a further endorsement of the company’s…

Vens Cancels Citgo Auction

Venezuela has taken U.S. refining unit Citgo Petroleum Corp off the auction block and it will now seek to raise $2.5 billion in the debt market to provide funding for the cash-strapped country, a source familiar with the matter said on Tuesday. The auction was canceled in the last 48 hours on the advice of Citgo's lawyers after they told Citgo that if the company wished to raise funds in the debt market, it should remove itself from the auction block, the source added. Deutsche Bank has announced plans for a $1.5 billion bond to be issued by Citgo Holdings…

Proserv Acquired by Riverstone

Energy services company Proserv has reinforced its ambitious growth plans after announcing it has signed a definitive agreement to be acquired by major US private equity investor Riverstone Holdings LLC. Proserv will continue to operate as an independent company under the deal announced today to which Riverstone Global Energy and Power Fund V, L.P., in partnership with Proserv management, has agreed to acquire 100% of the shares of Proserv from Intervale Capital (“Intervale”), Weatherford International (“Weatherford”) and certain minority shareholders.

SBM Offshore Announces Thunder Hawk Tiebacks

SBM Offshore is pleased to announce it has signed a Production Handling Agreement (PHA) with Noble Energy to produce the Big Bend and Dantzler fields to the Thunder Hawk DeepDraft (TM) Semi located in 6,060 feet of water in the Gulf of Mexico (GoM). Production fees associated with produced volumes are estimated to lead up to projected revenue of US$400 million to be delivered over the ten year primary contract period. First oil from Big Bend and Dantzler are expected in late 2015 and first quarter 2016 respectively.

U.S. Merchant Bank Buys Aging Newfoundland Refinery

A New York-based commodities merchant bank run by veteran energy traders, Neal Shear and Kaushik Amin, announced on Friday plans to buy the aging Come by Chance refinery in Newfoundland from South Korea's state-run oil company. Korea National Oil Corp said it will sell the 115,000-barrel-per-day refinery to SilverRange Financial Partners LLC for an undisclosed price following a months-long search to find a buyer. The deal also includes 53 gas stations and convenience stores. SilverRange is a New York-based merchant bank focused on energy and natural resources owned by SilverPeak Partners…

Pembina Buying Vantage Pipeline, Ethane Plant

Canada's Pembina Pipeline Corp said it would buy the Vantage pipeline system and Mistral Midstream Inc's interest in the Saskatchewan ethane extraction plant from Riverstone Holdings LLC for $650 million. Vantage pipeline system will provide Pembina access to North Dakota's Bakken play, considered one of North America's most prolific shale formations, where more than 1 million barrels of oil are extracted daily. Pembina said the deal was expected to add to cash flow per share in 2016.

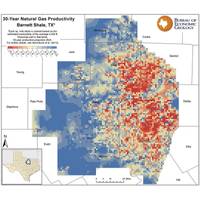

New Joint Venture to Enter Texas' Barnett Shale

Private equity firm KKR & Co LP and energy-focused peer Riverstone Holdings LLC will form a U.S. oil and natural gas venture that would be one of the largest producers in the Barnett Shale in Texas, they said on Wednesday. The new entity, Trinity River Energy LLC, will be headquartered in Fort Worth, Texas, and led by Chris Hammack, who heads Legend Production Holdings LLC, the Riverstone entity that is contributing assets to the joint venture. The Barnett region is known for its shale oil and natural gas resources.

Wisconsin Energy to Buy Integrys

Wisconsin Energy Corp said it would buy Integrys Energy Group Inc for $5.71 billion to create a larger, more diverse Midwest electric and natural gas delivery company. The combined company, to be named WEC Energy Group Inc, will serve more than 4.3 million gas and electricity customers in Wisconsin, Illinois, Michigan and Minnesota. The deal, which will help Wisconsin Energy sell more power at stable rates set by regulators, is the latest in a series of utility transactions aimed at minimizing exposure to the volatile open market for electric power.