US Storm, Weaker Dollar Push Oil to 12-week High

Oil prices edged up to a 12-week high on Monday as a winter storm boosted demand for energy to heat U.S. homes and businesses, and on support from a weaker U.S. dollar and expectations of tighter sanctions on Iranian and Russian oil exports.Brent futures rose 27 cents, or 0.4%, to $76.78 a barrel by 11:33 a.m. EST (1633 GMT), while U.S.

NW Europe Fuel oil Imports at 3-year High

A rush to replenish scarce supply of high-sulphur fuel oil (HSFO) pushed Northwest European imports of residual fuel oil to their highest in three years in November, analysts told Reuters.The Amsterdam-Rotterdam-Antwerp (ARA) area, Europe's main trading and refining hub, received around 450…

Oil Rises as Syria's Assad Departs, China eases Monetary Policy

Oil prices rose by nearly 2% on Monday on increased geopolitical risk after the fall of Syrian President Bashar al-Assad, and as top importer China flagged its first move towards a loosened monetary policy stance since 2010.Brent crude futures were up $1.34, or 1.9%, to $72.46 per barrel at 11:25 a.m. ET (1625 GMT). U.S.

Gunvor chair: Mideast conflict will not affect oil supply but demand is a concern

The CEO of trading firm Gunvor is confident that the conflict in the Middle East won't impact oil supply. He said this on Tuesday. He told the Gulf Intelligence Energy Markets Forum, held in Fujairah that the situation in the Red Sea and Yemen was a nuisance but not disruptive. The market, he said, was more concerned about the weak demand.

New refineries bring down profits for global refiners

Oil refiners across Asia, Europe, and the United States have seen their profitability drop to multi-year-lows. This is a significant downturn in an industry which had previously enjoyed booming returns following the pandemic. It also highlights the global slowdown. This weakness is another…

Sources confirm that Egypt has awarded the tender for 20 LNG winter cargoes to Egypt.

Four trading sources said on Friday that Egypt's recent bid for 20 cargoes (cartons) of liquefied gas to cover winter demand following a sharp decline in domestic production has been fully allocated. It is the first time Egypt issued an tender to cover the winter demand since 2018. This year, the most populous Arab nation has become a net gas importer.

Sources say Egypt is seeking 20 LNG cargoes to meet winter demand, as the gas crisis worsens.

Three trading and industry sources confirmed on Friday that Egypt issued a tender for 20 cargoes (cartons) of liquefied gas to meet the demand for electricity during winter, despite a sharp decline in domestic production. It is the first time Egypt issued an tender to cover the winter demand since 2018.

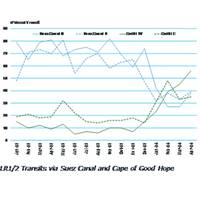

Red Sea Route Diversions Prop Up Tanker Demand

Large scale route diversions as a consequence of the Red Sea/Suez Canal crisis have seen deadweight demand for crude and product tankers increase by 5.5% and 4.5% respectively in 2024.In its Q2 2024 report, MSI finds that the market is currently in an unfamiliar equilibrium after two years of extreme volatility.

Opinion: Egypt Banks on Renewables to Meet Expected Energy Demand Surge

To meet its soaring demand for energy, Egypt is turning to renewable sources. Its targets, if accomplished, will see it become a pioneer in the African energy landscape. But are the plans realistic?Egypt’s population has now passed 100 million. As one of the most populous and fastest-growing nations on the African continent…

Offshore: OSV Market Report

The environment in oil patches onshore and offshore alike has been challenging throughout 2019; worries about an economic slowdown – whether cyclical or induced by a trade war – have weighed heavily on oil prices, even in the face of reduced production by the big producers. Though storm clouds persist…

Shell Aims to Operate Egypt Concessions in 2020

Royal Dutch Shell is aiming to start operating in its concession areas in Egypt in the second half of 2020, a senior executive said.Shell won three oil and two gas concessions in Egypt in February.Eni, BP and ExxonMobil also won some of a total of 12 tenders as Egypt looks to sustain…

Oil Dips on doubts Around Latest U.S.-China Trade News

Oil prices slumped more than 2% on Monday on worries that global crude demand could stay under pressure as a lack of details about the first phase of a U.S.-China trade deal dimmed hopes for a quick resolution to the tariff fight.Brent crude dropped $1.26, or 2.1%, to $59.25 a barrel by 12:19 p.m. EDT (18:19 GMT), while U.S.

Iranian Tanker Hit by Missiles, Oil Rises

Oil prices jumped more than 2% on Friday, October 11, 2019, after Iranian media said a state-owned oil tanker had been struck by missiles in the Red Sea near Saudi Arabia, raising the prospect of supply disruptions weeks after attacks on Saudi oil plants.The Suezmax crude tanker Sabiti…

Suez Canal Accounts for 8% of LNG Trade

Total oil flows through the Suez Canal and the SUMED pipeline accounted for about 9% of total seaborne traded petroleum in 2017, and LNG flows through the Suez Canal and the SUMED pipeline accounted for about 8% of global LNG trade."The Suez Canal and the SUMED Pipeline are strategic routes for Persian Gulf crude oil…

Oil Price Risks Rise

Supply disruptions in the Middle East on top of an already tight crude market could send oil prices violently upward, said the energy research firm Rystad Energy.Two Saudi Arabian oil tankers were reportedly attacked off the coast of the United Arab Emirates this weekend, sending crude futures up sharply May 13.Bjørnar Tonhaugen…

Saudi Arabia Resumes Oil Exports through Red Sea Lane

Top oil exporter Saudi Arabia said on Saturday it has resumed all oil shipments through the strategic Red Sea shipping lane of Bab al-Mandeb.Saudi Arabia halted temporarily oil shipments through the lane on July 25 after attacks on two oil tankers by Yemen's Iran-aligned Houthi movement.A…

Oil Falls Below $73 on Rising Supply, Trade Worries

Oil extended losses on Wednesday to fall below $72 a barrel, pressured by an industry report that U.S. stockpiles of crude rose unexpectedly and higher OPEC production, adding to indications of more ample supply.Concern of an imminent escalation in the trade war between the United Sates and China pressured equities and boosted the U.S.

Supertanker Hauling Saudi Crude U-turns After Recent Attack

A supertanker carrying Saudi Arabian crude has turned around near the Bab El-Mandeb strait, days after the world's top exporter said it was suspending all oil shipments through the strait following an attack by Yemen's Iran-aligned Houthi movement on two other ships.The Khuzama, a Very Large Crude Carrier (VLCC) transporting about 2 million barrels of o

Oil Prices Ease, but Brent Still Set for Weekly Gain

Oil prices eased on Friday but Brent was still set to record a weekly gain helped by easing trade tensions and Saudi Arabia's decision to halt crude transport through a key shipping lane.Brent futures were down 9 cents at $74.45 a barrel by 1349 GMT but on track for the first weekly increase in four.U.S.

Oil Prices Rise, Boosted by Supply Outlook

Oil gained on Monday as investors remained cautious over the supply outlook, having gained nearly 5 percent in price since the middle of July.October Brent crude futures were last up 71 cents at $75.47 a barrel by 1424 GMT. The September contract expires on Tuesday. U.S. crude futures…