Pacific Exploration Seeks Creditor Protection in Canada

Pacific Exploration & Production Corp and its units filed for protection from creditors in Canada after failing to cope with a prolonged slump in oil prices. The company missed an interest payment due on March 28, making it the first Toronto-listed oil and gas company in the past one year to delay a payment. Pacific Exploration reached a deal with debtholders, including Catalyst Capital Group Inc, last week to convert almost all of its debt to equity. The company, formerly known as Pacific Rubiales Energy Corp…

Pacific Exploration Lenders Waive Net Worth Covenant

Canadian oil and gas producer Pacific Exploration and Production Corp said its lenders agreed to waive off a covenant that requires it to maintain above $1 billion in net worth, amid a slump in oil prices. The waivers are effective for about $1.43 billion in debt facility and will terminate on Dec. 28, the company said on Tuesday. The approval of the waivers were in the best interest of the company due to a sharp decline in crude oil prices, as it continues to reduce costs and sell non-core assets, CEO Ronald Pantin said.

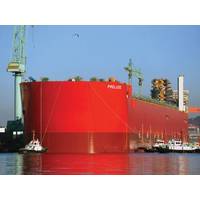

FLNG Birth of a Market

FLNG deal-making has been sporadic since Woodside Petroleum at the end of 2013 delayed a final investment decision for the giant Browse FLNG project off Northwest Australia. The previous year had seen go-aheads for most of the floating liquefied natural gas projects (FLNG) underway today, including Shell’s Prelude FLNG — Woodside’s choice, it seems, of a liquefaction solution for fields 200 kilometers offshore. Yet Prelude, “the first project out”, might not be first to produce. The speed…

Petroperu saw more risk, less profit in large oil block

Peru's state-owned energy company Petroperu opted not to take a stake in the country's biggest oil block as expected because the short-term contract signed this week would mean more risk and less profit, the firm said Friday. Petroperu said in June that it would likely exercise its option to take a stake of up to 25 percent in block 192 as allowed under a law designed to strengthen the company, which has not produced oil in more than 20 years. But an auction for a 30-year concession on the block failed to draw any bids earlier this month amid slumping oil prices and thorny government talks with communities…

Peru Gives Canadian Firm 2-year Contract for Biggest Oil Block

Peru will give Pacific Exploration and Production Corporation a two-year service contract for developing the country's biggest oil block, state regulator Perupetro said Friday. The Canadian company, which changed its name from Pacific Rubiales Energy Corp last week, will take over oil block 192 after current operator Pluspetrol's contract expires in eight days. A deal was reached through private talks after a 30-year contract for the concession failed to draw any bids in an auction last month.

Colombia Reshuffles Crude Exports to Weather Low Prices

Colombia, Latin America's No. 4 oil producer, is changing the slate of crudes it exports in a bid to offset the falling prices that are crimping the revenues of its top oil companies. The country has started to deemphasize exports of several heavier crudes, mainly Castilla, and increase offerings of Vasconia, a medium blend that fetches about $3.50, or 8 percent, more per barrel. But to lift output of Vasconia, Colombia must increase imports of products such as naphtha and natural gasoline, which are used as diluents to lighten the barrels for export.

Peru Delays Bids for Country's Most Productive Oil Block

Peru will delay bidding for the rights to develop the country's largest oil block, which is located in the Amazon jungle, at the request of three companies involved in the process, the government said on Monday. Bidding could restart within two weeks. Argentine energy company Pluspetrol has operated oil block 1-AB, located in Peru's Amazon forest and also known as 192, since 2001, but its contract ends in August. The concession, in Peru's northern Loreto region, now produces about 12,000 barrels per day, about a fifth of Peru's relatively small output.

ICBC Finances EXMAR for FLNG project

EXMAR stated that on June 23rd 2015 under the witness of King Philippe of Belgium and President Xi Jinping, Mr. Jiang Jianqing, Chairman of Board of ICBC and Mr. Nicolas Saverys, CEO of EXMAR, signed the financing agreement for the world’s first floating LNG unit (FLNG – Floating Liquefaction and Storage Unit). ICBC will provide financing to EXMAR for the FLNG project in a total amount of USD 200,000,000. up to now, and also the highest technology project. It is known that Belgium is China’s 5th biggest trading partner in the European Union…

Oil’s Downward Spiral Stalls LNG’s Ascent

As industry embraces gas, emissions regulations loom large and bunker logistics options develop, LNG’s fortunes nevertheless get a boost. For every gleeful consumer at the pump, and stockpiling tanker anchored offshore, there’s a corresponding trail of businesses that are struggling to ride out the worst price drop in crude since the mid-1980s. As oil giants slash CapEx, Halliburton and other industry players layoff thousands and record numbers of oil rigs go offline, less obvious is the impact of the latest oil market blow out on the growth of liquefied natural gas (LNG).

Pacific Rubiales Shareholders Launch Proxy Fight to Stop Alfa Deal

Pacific Rubiales Energy's largest group of shareholders has begun a proxy fight to block the roughly C$2 billion ($1.6 billion) takeover of the Canadian oil producer by Alfa SAB de CV and Harbour Energy Ltd. O'Hara Administration, speaking for a group of shareholders holding about 20 percent of Pacific Rubiales shares, said on Thursday it had filed a proxy circular and letter urging other minority investors to vote against the deal. The group said it was not attempting to unseat the Pacific Rubiales board at this time.

Colombia Oil Reserves Down 5.6%

Colombia's reserves of crude oil were down 5.6 percent to 2.3 billion barrels at the end of last year, the mines and energy ministry said on Friday, due to attacks by leftist rebels on infrastructure and the global fall in crude prices. Reserves, equal to 6.4 years of output at the country's current production rate, were down from 2.4 billion in 2013. The Andean nation, where taxes and royalties from oil make up 20 percent of government revenue, has been battered by the global fall in prices. Crude is the country's largest export and source of foreign exchange.

Energy Debt Investors Reap Gains On Oil Rise, But Risks Loom

The rebound in oil prices since mid-March is paying off for holders of corporate bonds of energy companies, and investors are confident that they will outperform Treasuries this year, despite lingering risks. U.S. crude oil prices have rallied more than 32 percent to near their highest levels of the year, last trading at about $59.25 a barrel, after a more than 50 percent drop from June 2014 through mid-March. The gains helped the Barclays High Yield Energy Index rise 4 percent in April, its second-best month since 2011.

Pacific Rubiales Shares Soar after Alfa-Harbour Takeover Bid

Shares in oil company Pacific Rubiales listed in Toronto and Bogota rose close to 28 and 26 percent respectively on Wednesday after the company confirmed Mexico's Alfa and Harbour Energy Ltd were planning to acquire it, paying C$6.50 per share ($5.42). (Reporting by Peter Murphy)

Shares in Mexico's Alfa Drop Nearly 5 pct

Shares in Mexican conglomerate Alfa fell nearly 5 percent on Wednesday, the day after the company made a take-over bid for oil producer Pacific Rubiales. The Canadian oil and gas company said on Tuesday that Alfa and Harbour Energy Ltd had offered C$6.50 per share, valuing the oil and gas company at about C$2.05 billon ($2.08 billion). Alfa shares dropped as the market opened, falling nearly 5 percent, but later paring gains to around 32.40 pesos per share. (Reporting by Miguel Angel Gutierrez)

Petrobras, Vale Underperform in Quiet Market

Brazilian corporates including Petrobras and Vale extended losses on Tuesday, as investors sought to lock in profits after the recent rally in Latin American credits. "As far as we understand, people are just hitting bids and getting out of stuff that had rallied a lot," said a corporate bond trader in New York. Bonds of state-run oil company Petrobras were ending some 16bp-17bp wider, with the 2024s and 2044s quoted at spreads of 424bp-419bp and 460bp-455bp respectively, the trader said.

Latam Primary Market Showing Signs of Life

The Latam primary markets were showing signs of life on Thursday with Chilean utility Guacolda out with IPTs of Treasuries plus 300bp area on a will-not-grow US$500m 10-year bond. Argentine oil company YPF is also out with guidance of 8.75% area(+/- 1/8) on an up to US$1.5bn 10-year. The deals are being marketed on a day when sentiment was lifted by Brazilian oil company Petrobras which avoided a covenant breach with the release of its long-awaited audited results for 2014. Petrobras's curve tightened by up to 50bp this morning with the 2024s being quoted at 410bp, according to a New York based trader.

Markets Drift Higher as YPF Makes Opportunistic Tap

Market focus remained firmly on upcoming Petrobras results and Argentina's latest market foray as Latin America credits drifted higher Wednesday morning. Bonds issued by Brazilian oil company Petrobras were flat with the 2024s being quoted at a spread of 450bp as investors braced for the much anticipated release of audited financial results after the market close today. Investors are largely keeping their powder dry in what remains a vulnerable Brazilian credit market given that any bad news could spark a sell-off in Petrobras debt.

Argentina, Petrobras Drive Price Action in Slow Session

The looming release of Petrobras's financials and a local bond sale from Argentina were the main drivers of price action Tuesday in what was otherwise a quiet session for Latin American credits. The beleaguered Brazilian oil company confirmed today that it would disclose its long-awaited audited 2014 financials after the close Wednesday, providing more support to bond prices. Petrobras bonds were closing off their highs but spreads were ending tighter, with the 2024s being quoted at 450bp-440bp, tighter on the day by 5bps.

Nearly Half Colombia Oil Companies at Risk of Insolvency

Forty-three percent of companies in Colombia's oil sector are at high risk of going bankrupt as the industry reels from the recent halving of oil prices, according to a survey presented to the Andean country's congress this week. The survey by the Colombia's companies' regulator polled 53 companies with total assets of about $10 billion but it did not include state-run oil producer Ecopetrol or two Toronto-listed companies, Pacific Rubiales Energy Corp and Canacol Energy Ltd. The regulator did not say why those three companies were excluded…

Colombia Oilfield Move Seen Challenging Ecopetrol

Ecopetrol's decision to take back control of the Rubiales field will imply heavier investment for it to sustain output and now raises the pressure on Canada's Pacific Rubiales to replace the future loss of nearly half its production, analysts say. Ecopetrol announced on Friday it would not renew a contract in mid-2016 under which Pacific Rubiales operates the field, putting the latter's 65,000 barrel per day share of output back in the Colombian state-run company's hands. Rubiales is the single most valuable asset of the Canadian company whose total output is around 145…