Tanzania Builds $30bn LNG Project

Dr Medard Kalemani, Tanzania’s Minister of Energy, has confirmed the recently announced plans for a syndicate of oil companies to commence construction of the $30bn LNG project in 2022.In March, the government stated that it planned to complete negotiations with a group of international oil companies in September to develop the project.Led by Norwegian energy firm, and Platinum Sponsor of the Congress, Equinor, the group also consists of Royal Dutch Shell, ExxonMobil, Ophir Energy and Pavilion Energy.These international companies will work closely on the project…

Genel Energy Names Higgs CEO

Genel Energy Plc named oil veteran and Chief Operating Officer Bill Higgs as its top executive, the oil and gas exploration and production company said on Monday.Higgs' appointment as chief executive officer comes as the company, the largest holder of reserves and resources in Iraq's Kurdistan region, negotiates with the regional government to develop Bina Bawi field after it wrote down $424 million on neighboring Miran oil and gas field in March.The company swung to an operating loss of $254.6 million in the year ended Dec. 31, including the non-cash charge…

Ophir Agrees to be Bought by Medco

London-listed Ophir Energy Plc said on Wednesday it agreed to be bought by Indonesian oil and gas group Medco for a sweetened cash bid of 408.4 million pounds ($539 million) after previously agreeing to a lower offer.Under the terms, Ophir shareholders will receive 57.5 pence per share in cash, the companies said in a joint statement. That is up from the previously agreed 55 pence per share.The increased offer comes after the Financial Times reported that hedge fund Petrus Advisers, which owns 3.94 percent of Ophir, planned to vote against…

Equatorial Guinea to Offer Ophir's Old Blocks

Equatorial Guinea will offer offshore Block R with the related Fortuna gas development project in the April licensing round, after the concession was reclaimed from Ophir Energy Plc, the oil minister said on Tuesday.Gabriel Obiang Lima told Reuters in Cape Town that Block R would be one of up to 13 deepwater and ultra deepwater blocks offered in the licensing round on April 1.Ophir was denied an extension in December to its licence for Block R and its plan for a floating liquiefied natural gas (LNG) project. Losing the block prompted Ophir to say it would report a $300 million non-cash right down in its full-year results.Equatorial Guinea…

Ophir Agrees to Be Bought by Medco for $511 Mln

Ophir Energy Plc said on Wednesday it has agreed to be bought out by Indonesian oil and gas group Medco for a sweetened bid of 390.6 million pounds ($511.02 million) in cash.The offer of 55 pence per Ophir share represents a 65.7 percent premium to Ophir's closing price on Dec. 28, the last trading day before Medco first announced a possible offer for the London-listed company.($1 = 0.7644 pounds)(Reporting by Arathy S Nair in Bengaluru; Editing by Shounak Dasgupta)

Ophir Loses Block R Licence, Equatorial Guinea

London-based oil and gas exploration and production company Ophir Energy said that it has received notification from the Equatorial Guinea Ministry of Mines and Hydrocarbons that the Block R Licence, which contains the Fortuna gas discovery, will not be extended following expiry of the licence on December 31, 2018."As a consequence, there will be an additional non-cash impairment of the asset, expected to be around $300 million, in Ophir’s full year financial results following the impairment taken in the half year results reported in September 2018…

WoodMac on Medco Energi's Potential Takeover of Ophir Energy

Wood Mackenzie Research Director, Angus Rodger, provides insight on a of UK-listed Ophir Energy by Indonesia's Medco Energi."On the first day of 2019, Ophir announced it was in talks with Indonesia's Medco Energi regarding a cash takeover. No amount or other details have yet been released, other than Medco has to make a clear binding offer by the 28th of January if a deal is to proceed. Ophir's upstream portfolio includes assets in Thailand, Vietnam, Indonesia, Malaysia, Equatorial Guinea and Tanzania. It also has exploration acreage in Mexico and Bangladesh…

Medco Energi's Potential Deal with Ophir Seen as Diversification Play

Medco Energi Internasional Tbk PT would boost its valuations and gain access to international assets if its potential takeover of London-listed Ophir Energy occurs, analysts said on Wednesday.Medco confirmed this week that it was in talks with Ophir about a possible cash offer for the oil and gas exploration and production company currently based in Britain. Medco, headquartered in Jakarta, earns the bulk of its revenue from oil and gas operations, mainly in Indonesia."This will help Medco shape up as an international player. It seems to be pursuing a transaction at the bottom cycle of the oil price to try and offer scope to re-rate its stock…

Equatorial Guinea May Strip Ophir of LNG Project Due to Finance Delays

Equatorial Guinea will force Ophir Energy out of the company's flagship liquefied natural gas (LNG) project and may scrap it entirely unless long-delayed financing deals worth $1.2 billion are presented to the government by December.The ultimatum is a blow to UK-listed Ophir, which has set aside $150 million of its own cash to develop west Africa's first deepwater LNG project, Fortuna, by 2022 despite its lack of a track record in LNG and small balance sheet."We have a clear idea of who we would give the license to but at this stage we are not prepared to comment," Gabriel Obiang Lima, minister of mines and hydrocarbons, told Reuters.Ophir declined to comment.Ophir's

Tanzania Seeks Consultancy Service Provider for Delayed LNG Project

Tanzania has invited bids for consultancy services to help the government conclude negotiations with a group of international oil firms on a deal for the construction of a proposed liquefied natural gas (LNG) plant. Tanzania boasts estimated recoverable reserves of over 57 trillion cubic feet (tcf) of natural gas. Construction of an LNG export terminal has however been held up by regulatory delays. BG Group, which was acquired by Royal Dutch Shell in 2016, alongside Statoil, Exxon Mobil and Ophir Energy, plan to build a $30 billion onshore LNG export terminal.

Start of Golar's FLNG in Cameroon May Draw More Africa Clients

Golar LNG said on Monday it had started production at its floating LNG (FLNG) platform in Cameroon, the world's second working example of the nascent technology and a milestone likely to boost its Fortuna project in Equatorial Guinea. As the cost of land-based LNG plants more than tripled in the decade to 2013, Golar pioneered the conversion of ageing LNG tankers into giant refrigerators capable of chilling gas into its liquid form at minus 162 Celsius. Natural gas when liquefied can be shipped and sold around the world on tankers, like oil.

Ophir's COO Higgs to Step Down

British oil and gas explorer Ophir Energy's Chief Operating Officer William Higgs will step down as the company reduces costs by cutting staff positions at its London headquarters, the company said on Friday. Energy companies have cut costs over the past few years due to a fall in oil prices. Ophir has faced further challenges in launching its Fortuna project in Equatorial Guinea - Africa's first deepwater floating liquefaction facility. "The company has no plans to appoint another chief operating officer or executive director (and) a further announcement will be made shortly," Ophir said in a brief statement after markets closed on Friday.

China Cash Boosts African FLNG Projects

China aims to become lowest-cost seller of FLNG plants; its shipyards to build floating plants for African projects. China plans to pour almost $7 billion into floating liquefied natural gas (FLNG) projects in Africa, betting on a largely untested technology in the hope that energy markets will recover by the time they start production in the early 2020s. Western banks are wary due to the depressed state of the shipping and gas markets, as well as the technical difficulties of pumping gas extracted from below the ocean floor, chilling it into liquid form on a floating platform and transferring it into tankers for export.

Equatorial Guinea Eyes New FLNG Plants

Equatorial Guinea, which is developing Africa's first deep-water floating Liquefied Natural Gas (LNG) platform, sees scope for another two similar platforms by December, the petroleum minister said on Monday. The former Spanish colony is developing the multi-billion dollar Fortuna floating LNG project in partnership with Ophir Energy and has selected seven companies for as many blocks in its 2016 licensing round, minister Gabriel Obiang Lima told delegates attending an African oil conference in Cape Town. (Reporting by Wendell Roelf)

Ophir Energy Concludes Tanzania Drilling

Ophir and its joint venture partners, BG Tanzania (Shell) and Pavilion Energy, have concluded the drilling of two exploration wells offshore Tanzania, safely and on time. The programme comprised Kitatange-1 in Block 1 and Bunju-1 in Block 4. After evaluation, Shell, the operator of Blocks 1 and 4, has confirmed that good quality reservoir was encountered in both wells, however hydrocarbons were not found. The Noble Globetrotter 2 rig has been demobilised from site. The two wells fulfil the final exploration commitments as per the exploration licences issued by the Ministry of Energy and Minerals (MEM).

Ophir inks JV with Schlumberger for Equatorial Guinea project

British oil and gas explorer Ophir Energy Plc said it had signed an agreement with OneLNGSM, a joint venture between units of Golar LNG Ltd and Schlumberger, to develop the Fortuna project in Equatorial Guinea. Shares in the company rose as much as 13.8 percent, before trading at 77.75 pence at 0956 GMT on the London Stock Exchange on Thursday. Ophir said earlier this month that it could go forward without new partners for the Fortuna floating liquefied natural gas project as the cost estimates had halved to around $450 million. Schlumberger had walked away from the deal in June.

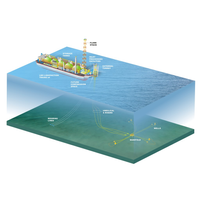

Ophir, OneLNG JV to develop Fortuna FLNG Project

Ophir Holdings & Ventures LTD ("Ophir"), a wholly owned subsidiary of Ophir Energy plc, and OneLNGSM, a joint venture between subsidiaries of Golar LNG Limited and Schlumberger, announce that they have signed a binding Shareholders' Agreement to establish a Joint Operating Company ("JOC") to develop the Fortuna project, in Block R, offshore Equatorial Guinea utilising Golar's FLNG technology. OneLNG and Ophir will have 66.2% and 33.8% ownership of the JOC respectively (with economic entitlements materially consistent with the equity interest in the JOC).

Ophir Energy Expects Fortuna LNG Project Decision in 2016

Oil and gas explorer Ophir Energy expects to finalize sales agreements and make a final investment decision on its Fortuna floating liquefied natural gas (FLNG) project by mid-2016. Ophir's chief operating officer Bill Higgs said the firm is in talks with six or seven buyers representing a mixture of end users, oil majors and traders, and expects heads of agreements will be signed by the end of the month. Heads of agreements are preliminary contracts that can be confirmed when full approvals are received and a final investment decision (FID) made on a project.

Tanzania to Finalise Land Acquisition for LNG Project

Tanzania plans to spend 12 billion shillings ($6 million) in the next fiscal year to buy land for the planned construction of a liquefied natural gas (LNG) terminal, raising hopes it is speeding up progress of the long-delayed project. The two-train onshore LNG export terminal, which the government says could cost up to $30 billion, has run into delays mainly due to complex land acquisition procedures and an uncertain legal and regulatory framework. Along with neighbouring Mozambique, Tanzania is in a race with Russia, Australia, the United States and Canada to build LNG export plants, aiming to exploit a gap in global supply that is expected to open up by 2020.

Golar Appointed as Midstream Partner for Fortuna FLNG Project

Golar LNG has signed a binding Heads of Terms with Ophir Energy Plc for the provision of the GoFLNG vessel Gimi. The Heads of Terms has been approved by Ophir's Equatorial Guinea, Block-R upstream partner GEPetrol, and will be formally ratified by GEPetrol next week. The agreement will be structured as a 20-year tolling contract, commencing commercial operations in the first half of 2019. Block R's 2.5 tcf of high purity 2P gas resources, situated in an area of benign sea states, are suited for the application of Golar's GoFLNG technology.