Surging Shale Spawns New Financing Structure for Energy Infrastructure

Strong demand for shale oil-and-gas infrastructure is giving rise to an important new financing vehicle for pipeline, processing and storage ventures that are needed to get more shale fuels to market. So-called special purpose acquisition companies, or SPACs, seek to fill the gap left by the declining use of master limited partnerships, which historically have helped finance such capital-intensive midstream projects. U.S. crude output is expected to rise 4.5 percent this year and another 7.5 percent in 2018…

Oil Down on Trader Profit Taking

Expected rise in OPEC supply to weigh; U.S. rig count down to 2009 levels. Oil prices slipped on Monday as traders took profits after three weeks of gains and as a jump in the dollar late last week was priced into fuel markets. Front-month Brent crude was trading at $44.80 per barrel at 1101 GMT, down 31 cents from its last settlement. U.S. West Texas Intermediate (WTI) futures were down 44 cents at $43.29 a barrel. Analysts said the price drops were a result of cashing in after three weeks of rising prices.

U.S. Crude Oil Inventories Keep Rising

Following the path started in 2015, U.S. commercial crude oil inventories have continued to build in early 2016 and are nearing record highs. Stocks in the Gulf Coast reached 256 million barrels for the week ending February 19, while stocks at Cushing, Oklahoma, reached their highest recorded level of 65 million barrels for the week ending February 19 (Figure 1). U.S. commercial crude oil inventory builds at this time of year are not unusual, as planned maintenance at U.S. refiners typically reduces runs in January and February.

'Selfish' Oil Firms Relish New Production Despite Glut

New fields to add 3 mln bpd of oil in 2016; could delay market rebalancing. As oil firms scrap dozens of billions worth of mega projects essential for supplies in decades ahead, fresh output from huge fields already being developed is set to weigh for many more months on an oil market struggling to shake off a glut. A collapse in oil prices over the past 20 months to below $30 a barrel has taken a heavy toll on production around the world, reversing spectacular growth in U.S.

Iran Pushes OPEC Oil Output to New High

OPEC oil production has jumped to its highest in recent history in January as Iran increased sales following the lifting of sanctions and its rivals Saudi Arabia and Iraq also boosted supply, a Reuters survey showed on Friday. Rising output in the Organization of the Petroleum Exporting Countries further aggravates the market share battle between top global producers. In the past year this has flooded the market with new barrels, creating one of the worst oil gluts in history and helping send prices to a 12-year low.

Saudi Arabia's Challenge of Dwindling Oil Revenues

Saudi Arabia faces profound challenges to its economy and political system as a result of the slump in oil prices, which will test the skill of the country's ruling elite unless oil revenues recover in the next two years. Despite frequent official statements over the last four decades about the need to diversify the economy away from dependence on petroleum, Saudi Arabia's economic outlook remains bound up with the price of oil. Gross domestic…

Saudi Arabia's Dwindling Oil Revenues, Challenge of Reform: Kemp

Saudi Arabia faces profound challenges to its economy and political system as a result of the slump in oil prices, which will test the skill of the country's ruling elite unless oil revenues recover in the next two years. Despite frequent official statements over the last four decades about the need to diversify the economy away from dependence on petroleum, Saudi Arabia's economic outlook remains bound up with the price of oil. Gross domestic…

DW: Tired of Turnarounds?

As the end of October saw upstream operators release disappointing Q3 results, with Shell in particular announcing record losses, a completely different picture is being painted in the downstream sector. A host of North American refiners, including Tesoro, Valero Energy, Phillips 66 and Marathon Petroleum have seen profits soar as the low oil price has improved margins; WTI cracking margins for Q3 2015 averaged $22.02 compared to $14.01 in 2014.

China Crude Tanks Operational from End-August

Vopak storage site in Hainan due for start-up next month. State-owned and private companies will start up about 26 million barrels of new oil tanks in southern China in coming months, amid strong demand for storage from traders who expect prices to recover enough to pay for the cost of holding crude. Benchmark crudes recovered from recent losses on Thursday following a large U.S. stock draw, but concerns over a global glut still weigh on prices as OPEC pumped some 3 million barrels a day (bpd) more than demand in the second quarter…

North Dakota Oil Hub Boasts Being 'last great place' for Growth

With oil prices falling, you wouldn't think Williston, North Dakota, was "the last great place for opportunity," but that is the slogan the state's oil hub has come up with to try to shake off its economic downturn. Those lured by that promise will find apartment rents have begun to plunge in Williston after a 50 percent fall in the price of oil caused hundreds of layoffs and put off job seekers in search of the town's legendary six-figure pay packets.

Norway: Growth Outlook Cut on Oil Sector Worries

Mainland GDP growth to slow to 1.3 pct in 2015. Norway will dip into its saved-up oil wealth more than expected this year as the energy sector shrinks and growth slows, but plans no major policy adjustment as the economy is seen rebounding next year, the government said. Growth will take a hit as oil investment falls more than expected, the budget loses more than $10 billion in energy income and unemployment will hover around ten-year highs both this year and next, the government predicted in a mid-year budget update.

UK Warns Off BP Suitors Now Shell Unavailable as 'White Knight'

Britain's warning to potential suitors of BP is a sign of the oil major's vulnerability to a takeover bid and that a more politically palatable tie-up with Royal Dutch Shell no longer seems to be an option, banking and industry sources said. Despite championing a laissez-faire policy towards takeover deals, Britain has always had a special interest in BP, dating back to the creation of the company via an unusual government investment master-minded by Winston Churchill.

Offshore Accommodation Market – A Focus on Welfare

The global offshore accommodation market has seen significant growth over the past five years, with PoB requirements increasing by 27% between 2009 and 2014. Although the recent oil price decline has negatively impacted the accommodation market to some extent, the affect thus far has been largely limited to demand for units supporting Capex-related activities. However, Capex support is proportionally smaller in terms of total accommodation demand; of greater significance are the Opex markets which will account for 69% of PoB requirements in 2015.

Total Puts Prime North Sea Field on the Block

French oil major Total is selling its stake in the North Sea Laggan-Tormore oil and gas field as it seeks to shed assets after a steep fall in the oil price, banking sources said. Total is hoping to get up to $1.5 billion for its 80 percent operating stake in the field, located approximately 125 km north-west of the Shetland Islands in Britain's North Sea, the sources said. The company aims to complete the deal in June, according to the banking sources. Many oil companies are trying to sell assets in the ageing and high-cost North Sea oil province.

Oil Prices Sag on China, Iraq Data

China faces significant downward pressure on economy; Iraq announces record oil production for December. Brent crude oil prices fell below $50 a barrel on Monday after the global economic outlook darkened and Iraq announced record oil production. The world's biggest energy consumer, China, faces significant downward pressure on its economy, its premier Li Keqiang was quoted by state radio as saying on Monday. China is expected this week to report growth slowing to 7.2 percent from a year ago…

US Shale Oil - The Big Question

The US oil production surge, more crude returning to the market from Iraq and Libya, slowing Chinese demand & a lack-lustre European economic recovery, all followed by Saudi’s decision not to cut production have conspired to cause Brent crude to drop some 40% since June. The real killer issue is, however, US shale oil and its producers will be watched closely by traders waiting for the impact of low prices to hit production. So the big question is how resilient are the US tight oil plays to lower prices?

Energy Sector Volatility Affects Middle Market M&A Activity

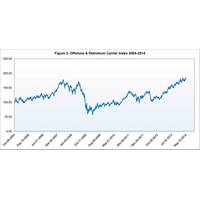

Market volatility for the petroleum sector provides a backdrop to an evolving Merger & Acquisitions environment for the Offshore Sector. In the 3Q edition of Maritime Professional, this series of articles examined the overall evolution of maritime and offshore M&A activity since 2010, tracing the flow of deals in the post-financial crisis era. In this edition, we take a closer look at relevant U.S. offshore energy industry deal flow and market movements as they relate to oil prices over time, and highlight some recent middle market transactions.

Asian Airlines Pause Before Hedging on Fuel

Oil fell to four-year low of $72 on Thursday; Airlines hope the price will slip below $70 a barrel. Airlines in Asia-Pacific are holding off from hedging their fuel costs as they wait for oil to dip below $70 a barrel in hopes of securing lower prices, industry executives said on Friday. The benchmark Brent crude oil price fell more than $6 to under $72 a barrel on Thursday, its lowest since July 2010, after the Organization of Petroleum Exporting Countries opted against cutting production even though a supply glut is pulling down prices.

Europe Might Save $80 billion as Energy Prices Drop

EU energy imports cost over $500 billion in 2013; costs to fall to $425 bln in 2015 if oil remains below $90. The European Union could save up to $80 billion in energy imports if oil prices remain low, providing some relief to households and companies in a region that has been laid low for the last five years. The price of oil has dropped over a quarter since the summer to below $85 per barrel, a level last seen in June 2010. Energy imports for oil…