Two Russian sources claim that Saudi Arabia and the UAE are possible locations for a Trump-Putin meeting.

Two Russian sources familiar with the discussions said that Russia is considering Saudi Arabia and the United Arab Emirates as potential venues for a meeting between U.S. president Donald Trump and Russian president Vladimir Putin. Trump said that he would end the conflict in Ukraine as quickly as possible, and that he was ready to meet Putin. Putin congratulated Trump for his election, and said he was ready to meet Trump in order to discuss Ukraine and Energy. Russian officials have denied that they had direct contact with the U.S.

Palm oil prices near record highs as Soyoil takes the lead -Braun

Palm oil is not the cheapest oil in the world, despite being the most abundant vegetable oil. Supply concerns have driven up the price by almost 30% this year. Prices for soybean oil, a rival product, have fallen by more than 11 % this year due to record global soybean production. In recent weeks, this has led to a near-record discount in palm oil compared to soybean oil. Palm oil makes up about 40% of the global production of major vegetable oils, including rapeseed, sunflower, and soybean oil. Palm oil is therefore almost always cheaper than soya oil.

Brent Shoots Past $80 a Barrel

Oil markets climbed for a sixth day on Tuesday, boosted by a tighter supply and firm demand outlook, but power shortages in China which hit factory output tempered the rally.Brent crude futures gained 67 cents, or 0.8%, to $80.20 a barrel at 1016 GMT, after reaching their highest level since October 2018 at $80.75. Brent gained 1.8% on Monday.U.S. West Texas Intermediate (WTI) crude futures rose 79 cents, or 1%, to $76.24 a barrel, after hitting a session high of $76.67, its highest since early July. It jumped 2% the previous day.Hurricanes Ida and Nicholas, which swept through the U.S.

Indonesia Weighing Subsidy Options for Biodiesel Program

The Indonesian government is considering alternate plans to increase subsidies for the country's ambitious biodiesel program after crude oil prices tumbled, a finance ministry official said on Wednesday.A historic crash in oil prices this year has widened the cost difference between standard diesel fuel and the fatty acid methyl ester (FAME), making biodiesel more expensive to be subsidized."At the moment, it is impossible to cover for incentives until the end of the year," said Febrio Kacaribu…

Oil Dips on doubts Around Latest U.S.-China Trade News

Oil prices slumped more than 2% on Monday on worries that global crude demand could stay under pressure as a lack of details about the first phase of a U.S.-China trade deal dimmed hopes for a quick resolution to the tariff fight.Brent crude dropped $1.26, or 2.1%, to $59.25 a barrel by 12:19 p.m. EDT (18:19 GMT), while U.S. West Texas Intermediate (WTI) crude lost $1.20, or 2.2%, to $53.50 a barrel.Late on Friday, Washington and Beijing outlined the first stage of a trade deal and suspended this week's scheduled U.S. tariff hikes.

Oil Slips Back Toward 18-month Lows

Oil prices fell on Thursday after rebounding 8 percent in the previous session, as worries over a glut in crude supply and concerns over a faltering global economy pressured prices.Brent crude oil dropped $1.67 a barrel, or 3.1 percent, to a low of $52.80 before recovering to around $53.45 by 1415 GMT. U.S. light crude oil slipped $1.30 to $44.92 and was last 70 cents lower at $45.52.Oil prices reached multi-year highs in early October but are now approaching their lowest levels for…

Oil Prices Climb on OPEC-led Cuts

Oil prices ended more than 2 percent higher on Friday after OPEC members and allies like Russia agreed to reduce output to drain global fuel inventories and support the market, but the gains were capped by concerns that the cuts would not offset growing production.The Organization of the Petroleum Exporting Countries and its Russia-led allies, referred to as "OPEC+," agreed to slash production by a combined 1.2 million barrels per day next year in a move to be reviewed at a meeting in April.This was larger than the minimum 1 million bpd that the market had expected, despite pressure from U.S.

Oil Surges 5 pct as OPEC Agrees Output Cut

Oil prices jumped more than 5 percent on Friday as big Middle East producers in OPEC agreed to reduce output to drain global fuel inventories and support the market.Benchmark Brent crude oil rose $3.26 a barrel to a high of $63.32 by 1355 GMT. In early trade, Brent had fallen below $60 when it looked as if oil exporters might not agree.U.S. light crude rose $2.62 to a high of $54.11 a barrel before slipping to around $53.90.Prices fell almost 3 percent on Thursday after the Organization of the Petroleum Exporting Countries ended a meeting in Vienna with only a tentative deal to tackle weak prices.

Oil Prices Steady Near Year Lows Ahead of G20 and OPEC

Oil prices steadied on Tuesday, depressed by record Saudi production but supported by expectations that oil exporters would agree to cut output at an OPEC meeting next week.Brent crude oil was up 10 cents a barrel at $60.58 by 1445 GMT, not far above a 13-month low of $58.41 reached on Friday. U.S. light crude was up 10 cents at $51.73.Oil prices are down by almost a third since early October, weighed down by an emerging supply overhang and widespread financial market weakness.Prices rallied sharply on Monday…

Venezuela Hoping to Raise Oil Output

Venezuela is hoping to steeply raise oil output next year but will respect any new deal if OPEC agrees to reduce output from December, Oil Minister Manuel Quevedo said on Sunday.The south American OPEC nation's current oil output is 1.5 million barrels per day and it aims to increase that by 1 million bpd "soon", he told reporters in Abu Dhabi.Quevedo was speaking in Abu Dhabi where an oil market monitoring committee was held on Sunday, attended by top exporters Saudi Arabia and Russia.A majority of OPEC and allied oil exporters support a cut in the global supply of crude…

Oil Rises as Saudi Arabia Seeks to Tackle Oversupply

Oil prices rose on Monday after Saudi Arabia said OPEC and its partners believed demand was softening enough to warrant an output cut of 1 million barrels per day next year.Saudi Arabia, the world's largest oil exporter, said on Sunday it would cut its shipments by half a million barrels per day in December due to seasonal lower demand.Brent crude futures were up 52 cents at $70.70 a barrel by 1445 GMT, while U.S. crude futures rose 36 cents to $60.55.Saudi Energy Minister Khalid…

Oil Gains after Saudi Paves the Way for an Output Cut

Oil rose by more than 1 percent on Monday, set for its largest one-day increase in a month after Saudi Arabia said OPEC and its partners believed demand was softening enough to warrant an output cut of 1 million barrels per day.Saudi Arabia, the world's largest oil exporter, said on Sunday it would cut its shipments by half a million barrels per day in December due to seasonal lower demand.Brent crude futures rose 80 cents on the day to $70.98 a barrel by 1205 GMT, while U.S. crude…

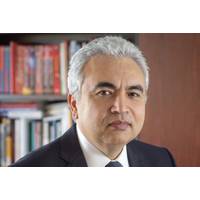

IEA boss urges oil producers to ease supply concerns

Major oil producers must take "the right steps" to ease supply concerns that have lifted crude prices to a four year-high, the head of the International Energy Agency told Reuters on Thursday."It is now high time for all the players, especially those key producers and oil exporters, to consider the situation and take the right steps to comfort the market, otherwise I don't see anybody benefiting," IEA Executive Director Fatih Birol said in a phone interview.A rise in oil prices to more than $85 a barrel coupled with concerns over global trade are putting heavy pressure on emerging economies, he sai

Oil Prices Fall on Record U.S. Output, Stock Build

Oil prices fell on Thursday, pressured by a rising dollar and after official data showed an unexpected rise in U.S. crude stockpiles, U.S. output hit a record high and major oil exporters increased production.Benchmark Brent crude oil fell $1.07 to a low of $71.83 a barrel before recovering to trade around $72.35 by 1304 GMT. On Wednesday, Brent hit a three-month low of $71.19. U.S. light crude was 25 cents lower at $67.51.The U.S. dollar hit its highest level against a basket of other currencies since July 2017 on Thursday, up half a percent on the day."Oil prices are reversing course ...

In Norway's Oil Region, Business Outlook is Up

Business conditions strengthened significantly in Norway's western oil-producing regions during the last three months, while the outlook rose to five-year highs, a sentiment survey showed on Thursday. The price of crude oil, Norway's key export, fell sharply from mid-2014 to early 2016 but has since recovered, while non-oil exporters are boosted by a weak currency. The West Coast Current Conditions Index rose 3.7 points to a four-year high of 64.0 after a slight fall the previous quarter, the survey by Respons Analyse and Sparebanken Vest showed.

Sanctions spell the end of OPEC output deal

President Donald Trump’s decision to withdraw from the nuclear agreement with Iran marks the end of the current output agreement between OPEC and its allies.OPEC is likely to insist the current agreement remains in effect, at least for now, but the prospective removal of several hundred thousand barrels per day of Iranian exports from the market will require a major adjustment.Saudi Arabia has already promised to "mitigate" the impact of any potential supply shortages, in conjunction with other suppliers and consumer countries…

OPEC: Oil Markets Tightening Even as U.S. Shale Booms

The global oil stocks surplus is close to evaporating, OPEC said on Thursday, citing healthy energy demand and its own supply cuts while revising up its forecast for production from rivals who have benefited from higher oil prices. U.S. shale oil output has been booming over the past year since OPEC reduced its own production in tandem with Russia to prop up global oil prices. But as oil production collapsed in OPEC member Venezuela and is still facing hiccups in countries such as Libya and Angola…

OPEC Seeks "very long-term" Cooperation with Other Exporters

A long-term deal with Russia seen as unprecedented. OPEC is seeking "very long-term" cooperation with other crude exporters, the secretary general of the oil exporting group said on Wednesday. Mohammad Barkindo was commenting on news that top OPEC producer Saudi Arabia and non-OPEC Russia were working on a long-term pact that could extend controls over world crude supplies by major exporters for up to 20 years. Saudi Crown Prince Mohammed bin Salman announced the plan in an interview with Reuters on Monday.

Oil Edges Up on Chinese Demand

Strong Chinese imports support crude; U.S. crude output hits highest levels since 1970s. Oil prices edged up on Friday, helped by rising Chinese crude demand and threats of a strike in Africa's largest oil exporter. But prices were still on track for their largest weekly loss since early October amid concerns that rising U.S. production would undermine OPEC-led supply cuts aimed at curbing a glut. By 1039 GMT, Brent crude was up 39 cents at $62.59 a barrel, but still heading for a weekly slide of 1.8 percent. U.S.

U.S. Shale Producers Challenge OPEC Strategy

U.S. shale producers have started adding more drilling rigs in response to rising oil prices and improving confidence about the outlook for 2018. Experience shows changes in the number of rigs drilling for oil in the United States tends to follow changes in WTI prices with a lag of about 16 to 20 weeks. The active rig count peaked in mid-August and then declined through September and October, in response to the earlier peak and fall in prices between February and mid-June. But WTI…