Haddad, Brazil's Haddad, supports research on oil deposits near the mouth of Amazon

Fernando Haddad, the Finance Minister of Brazil, said that while the search for oil near the mouth the Amazon River must continue in Brazil, any discoveries made should not slow down the country's transition towards cleaner energy. The mouth of the Amazon, a vast area stretching between Rio Grande do Norte (Northern Brazil) and Amapa (Southern Brazil), is the area that has the most potential for oil discovery in Brazil's Equatorial Margin. "I'm in favor of doing research. I think it is important to find out what there is.

Mexican tycoon Slim targets two of Pemex’s key fields to gain clout within the energy sector

Sources familiar with the matter say that the Mexican state energy company Pemex has been in contact with Carlos Slim, and the billionaire could be asked to help fund two of the most promising crude oil fields and natural gas deposits in the country. These negotiations, which were not previously reported, show Slim's increasing influence in Mexico's energy sector. His business empire, which includes telecommunications and banking, retail, insurance, and hospitality, is expanding.

Gazprom Neft, Mubadala Sign Tech Pact

Gazprom Neft, is the third largest oil producer in Russia, and Mubadala Petroleum (Abu Dhabi, UAE) have entered into a memorandum of understanding in the field of technological cooperation.The partners agreed to work together to create new technologies that include the development of innovative solutions in oil production and digitization of production processes.Gazprom Neft and Mubadala Petroleum are partners in the Gazpromneft-Vostok joint venture, which manages the development of 12 fields in the Tomsk and Omsk regions of Western Siberia.

Brazil Okays Shell, Total, BP, Others for Pre-Salt Bids

Brazil's oil industry regulator ANP said on Wednesday it has approved six energy companies to bid for four pre-salt blocks in the Campos and Santos Basins to be auctioned on Sept. 28.The companies approved to bid are Shell, Total, BP, Germany's DEA, QPI from Qatar and Chinese-owned CNODC Brasil Petróleo e Gás Ltda.

Johan Castberg PDO Approved

The plan for development and operation of the Johan Castberg field in the Barents Sea was approved by the Norwegian Parliament on Monday, June 11. The plan will now be submitted to the Ministry of Petroleum and Energy for formal approval.With first oil scheduled for 2022, the field has a production horizon of 30 years. Capital expenditures for the project are NOK 49 billion ($6.2 bln), and recoverable resources are estimated at 450-650 million barrels of oil equivalent.

US Oil Industry Set to Break Record, Upend Global Trade

Surging shale production is poised to push U.S. oil output to more than 10 million barrels per day - toppling a record set in 1970 and crossing a threshold few could have imagined even a decade ago. And this new record, expected within days, likely won't last long. The U.S. government forecasts that the nation's production will climb to 11 million barrels a day by late 2019, a level that would rival Russia, the world's top producer. The economic and political impacts of soaring U.S.

Vitol Bets on Retail Model as it Hopes to Grow

Vitol invests in gas stations from Turkey to Pakistan; increases presence in growing consumer markets. From Pakistan to Turkey, the world's largest independent oil trader Vitol is betting on a spike in gasoline and diesel demand in young and growing nations by snapping up filling stations that disappointed oil companies are prepared to sell. With the sharp drop in global oil prices, major integrated oil companies have been shedding assets, including the marginally profitable retail outlets, to cut costs.

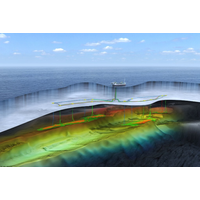

Mexico Deep Water Push Leverages Geophysical Data

The data rush of the past two years by many top geophysical companies has sparked some of the biggest imaging projects ever for technology also used to hunt for the ruins of ancient civilizations and explain the fate of the dinosaurs. "What they're doing is literally rewriting the geological model of the Gulf of Mexico," Juan Carlos Zepeda, head of the national hydrocarbons commission (CNH), Mexico's oil regulator, said ahead of Monday's deep water auctions where the likes of Chevron and BP are expected to participate.

Russian Oil Output Jumps 4% in September

Russian oil output jumped by almost 4 percent in September from the previous month to 11.11 million barrels per day (mbp), a new post-Soviet record-high, as companies ramped up drilling amid improved oil prices, Energy Ministry data showed on Sunday. The oil output rose amid the talks between the leading global producers, including Russia, to curb production in order to support oil prices, depressed by oversupply. output. His comments were aired as OPEC agreed on Wednesday modest oil output cuts in the first such deal since 2008…

Ecuador Pays $112 mln Award to Chevron

Ecuador has paid $112 million to energy company Chevron Corp over a four-decade-old contract dispute, even though it remains in disagreement, the head of the central bank has said. A Hague arbitration court awarded the U.S. company $96 million in 2011 in a dispute stemming from a 1973 deal that called for Texaco, later acquired by Chevron, to develop fields in exchange for selling oil to Ecuador at below-market rates. Various appeals by Ecuador against the ruling failed.

West Africa Oil Projects Face Yet Longer Delays

Oil firms have put major projects in West Africa on hold because of low prices - as they have across the globe - but when the market finally picks up, development is likely to recover much more slowly in the region than elsewhere. High costs bedevil the region, which includes established producers such as Nigeria and newer entrants like Ghana. Add to this long-standing problems of poor infrastructure, complex bureaucracy and politics, and West Africa may be well down the list for any investment revival.

Saudis to Keep Controlling Aramco Stake

Saudi Arabia's government will keep a controlling interest in state-owned Saudi Aramco if it decides on a share offering of the world's largest oil firm, its chief executive said. Aramco has crude reserves of about 265 billion barrels, over 15 percent of all global oil deposits. "A range of options are being considered, including the listing in the capital markets of an appropriate percentage of Saudi Aramco shares with the government retaining a controlling interest…

Aramco Chairman: No Concrete Listing Plan

Saudi Arabia's giant national oil company is weighing various ideas regarding the possible listing of the world's largest oil company or its subsidiaries, Saudi Aramco Chairman Khalid al-Falih told the Wall Street Journal on Monday. Falih told the WSJ that there was no specific timeline yet for the listing, saying it "cannot be done overnight". "There is no plan that is concrete at this stage to do the listing. There are studies ongoing. Serious consideration," Falih said. "We are considering a listing at the top.

Pemex: New Oil Discoveries to Add 40,000 bpd

Mexico's state-owned oil company Pemex has discovered two new shallow water oil deposits that will eventually produce 40,000 barrels per day, the company's top executive said on Tuesday. Pemex CEO Emilio Lozoya said the discoveries were made during the second half of this year, adding 180 million barrels of oil equivalent to the company's proven, probable and possible reserves. Lozoya did not detail the exact location of the discoveries, the type of crude oil found or how long it will take to bring the deposits into commercial production.

California's Monterey Oil Deposits Seen at 21 mln bbls

Unconventional oil and gas deposits in deeper portions of California's Monterey formation may not be as prolific as once estimated, the U.S. Geological Survey said on Tuesday. A new study by the agency estimated that 21 million barrels of oil and 27 billion cubic feet of gas can be recovered from the Monterey shale in the San Joaquin Basin using existing technology for hydraulic fracturing. Though the Monterey shale was once seen as holding great promise for unconventional oil extracted by fracking…

Uganda Shortlists 17 firms for Bidding on Exploration Blocks

The Ugandan government said on Wednesday it had shortlisted 17 oil companies to bid for six exploration blocks in the east African nation, which has found commercial quantities of oil and aims to pump crude in 2018. Uganda in February announced its first competitive bidding round for exploration blocks, with six of them covering 3,000 square kilometres on offer, and aims to issue licenses to successful bidders by the end of this year. A…

Argentine Judge Orders Seizure of Falklands Drillers' Assets

An Argentine judge has ordered the seizure of assets of oil drilling companies operating in the Falklands Islands, including property held by U.S. firm Noble Energy, as the country takes a firmer line on the disputed territory ahead of October elections. Lilian Herraez, a federal judge in Tierra del Fuego, ordered the seizure of $156 million in bank accounts, boats and other property, the government said on Saturday. The companies named in the order were Premier Oil Plc…

Brazil to Announce New Oil Auction

The Brazilian government will seek to raise as much as 2.5 billion reais ($850 million) with its 13th-round auction of oil and natural gas exploration rights in October, newspaper Valor Econômico said on Wednesday. Terms of the plan will be outlined by Mines and Energy Minister Eduardo Braga next week at an international conference in Houston, Valor added. Braga told the paper that projections for the bidding round are based on a price of $65 for crude oil.

U.S. Oil Rig Count Cull Eases, Approaches Low Point

Two weeks of thin declines in the U.S. rig count have raised expectations that drilling activity is nearing a pivotal level that could dent production, bolster prices and coax idle rigs back to the field after a precipitous cull since October. Energy producers responded quickly to a steep drop in oil prices over the last six months, idling nearly 800 rigs, or 50 percent, since a peak of 1,609 rigs in October. In the last week of January, rigs fell by 94, the biggest drop on record, according to a weekly survey by oil service firm Baker Hughes.

Midland Braces for Impact as Drilling Slows

Sales tax receipts in the thriving oil town of Midland, Texas, fell this month, only the third decline in five years and one of the first signs of how low oil prices are beginning to ripple beyond oil company bottom lines and into the wider economy. Midland's sales tax revenues, which reflect commercial and residential spending, dipped to $5.119 million in March from $5.126 million in March 2014, according to data from the Texas Comptroller released last week.