O Globo reports that Brava Energia, a Brazilian company, will sell Potiguar's assets to PetroReconcavo.

The newspaper O Globo, citing reliable sources, reported that Brava Energia, a Brazilian company, had reached an agreement with PetroReconcavo to sell assets in the Potiguar Basin for a total of around 13 billion reais (2.13 billion dollars). According to the report, the acquisition of the assets in Brazil's oil basin would enable PetroReconcavo reduce costs and could also lead to better agreements with suppliers.

Coterra Energy will spend $3.95 billion to expand its Permian Basin footprint

Coterra Energy announced on Wednesday that it will buy certain assets from privately-held Avant Natural Resources, and Franklin Mountain Energy. The deal is worth $3.95 billion and includes cash and stock. The Permian Basin is a popular place for producers to expand their stock. The Permian Basin, located between Texas and New Mexico is a highly productive shale-oil basin with undeveloped reserves, a robust infrastructure, and large production.

U.S. Drillers Add Rigs for first Week in Eight

U.S. energy firms added rigs for the first time in eight weeks even as producers follow through on plans to reduce spending on new drilling.Companies added 4 oil rigs in the week to Dec. 13, bringing the total count to 667, energy services firm Baker Hughes Co said in its closely followed report on Friday.In the same week a year ago, there were 873 active rigs.That keeps the oil rig count on track to fall for the first year since 2016.

Enterprise Products to Build GoM Crude Terminal

Enterprise Products Partners LP said on Wednesday it expects to take about two years to construct its oil export project called Sea Port Oil Terminal, or SPOT, in the U.S. Gulf of Mexico.Permitting for the terminal was expected to reach the final stages by the end of the first quarter of 2020 and final approval was expected during the second quarter, a company…

Schlumberger to Manage Equinor Project in Brazil

Schlumberger signed a contract worth over $200 million with oil major Equinor to manage an offshore rig as part of a drilling program in Brazil's offshore Campos oil basin, a person familiar with the matter said on Thursday.The deal would be the first time an oil services company replaces a drilling-rig contractor, the person said, adding pressure to offshore…

Total Bought 25% in Orinduik Block Offshore Guyana

Total says has exercised option to buy a 25 pct interest in Orinduik exploration block offshore Guyana.* Orinduik operated by Tullow Oil off Guyana contains an estimated 3 billion barrels of oil and gas, its partner Eco Atlantic said on Tuesday, as the two firms prepare to drill in the Latin American oil basin.* Tullow plans to begin drilling in the block in the third quarter of 2019, with Eco indicating it will begin "early" in the quarter.* Guy

U.S. Drillers Robustly Boost Rig Count

U.S. energy companies added the most oil rigs in both a week and a month since February as drillers continued to return to the well pad with crude prices at their highest since late 2014. The total oil rig count rose by 15 to 859 in the week to May 25, the highest level since March 2015, General Electric Co's Baker Hughes energy services firm said in its closely followed report on Friday.

UK North Sea Output Could Resume its Decline

North Sea production has recovered slightly since 2015 as new fields, more drilling helped reverse declines. The UK North Sea is set to resume a two-decade decline in oil production next year, snapping a brief period of growth since 2015, consultancy Bernstein said in a report on Monday. Production in the North Sea, home to the Brent global crude benchmark, peaked in 1999 at 2.6 million barrels per day (bpd) and had steadily slipped until 2014…

Trafigura Moves Hedging from Europe, Leads U.S. Exports Race

Firm moves away from new tighter EU regulations and becomes largest exporter of U.S. crude. Trading giant Trafigura has moved its commodities hedging operations to the United States and Asia and away from Europe to avoid being subject to new, tighter MiFID II market regulations. "We moved our hedging business away from Europe into the U.S. and Singapore and other locations," Chief Financial Officer Christophe Salmon told reporters.

US Drillers Add Oil Rigs for 16th Week

U.S. energy firms added oil rigs for a 16th week in a row, extending a drilling recovery into a 12th month even as the pace of those additions has slowed in recent weeks as crude prices have held below $50 a barrel. Drillers added six oil rigs in the week to May 5, bringing the total count up to 703, the most since April 2015, energy services firm Baker Hughes Inc said on Friday.

U.S. Shale Gas Shipment to Arrives in Britain

The first shipment of gas fracked from U.S. shale will arrive in Britain next week, upping pressure on Scotland to reassess its opposition to fracking. Chemicals giant Ineos will be importing ethane, obtained from rocks fractured at high pressure, in a foretaste of larger deliveries of liquefied natural gas (LNG) from shale set to reach Europe in 2018. The shipment of ethane…

$50 Crude Stirs Signs of Life in West Texas

As crude prices plummeted last summer, Steve Pruett, chief executive of a small west Texas oilfield developer, idled a drilling rig, opting to pay $21,000 a day to store it rather than dig more wells and risk bigger losses. Now as oil prices rise again, the third-generation oil man is offering his only rig crew bonuses to drill wells as fast as they can, but says his company, Elevation Resources, will wait until next year to deploy a second rig.

Shell Job Cuts Eyed as China Okays BG Deal

Chinese ministry of commerce gives green light; Shell sees further 3 pct cuts in group's workforce. Royal Dutch Shell expects to slash thousands more jobs to save costs if its takeover of BG Group goes through as planned early next year following a final green light from China. The acquisition, which was announced on April 8 and is biggest in the sector in a decade…

U.S. Highway Bill Should Include Oil Export Provision

The U.S. ban on crude oil exports stands the best chance of being lifted when linked to highway funding legislation, said U.S. Senator John Hoeven, a Republican from North Dakota. The 1970s-era ban on most oil exports is deeply unpopular in North Dakota and other crude-producing U.S. states, with energy executives chafing at the limited access to global markets.

US Oil Drillers Pull 7 Rigs, Biggest Drop Since Late May

The market has been waiting for the slowdown in the rig count to stop as crude prices have rebounded over the past few months, but this week's slowdown showed oil drillers were not yet done cutting the number of rigs. Energy firms pulled another seven rigs from U.S. oil fields this week, the most since late May, oil services company Baker Hughes Inc said on Friday in its closely followed report.

US Oil Drillers Add Rigs in Key Formations

U.S. oil drillers boosted activity in four key basins this week, bringing the promise of additional oil to a market that faces OPEC's Friday decision to leave production caps unchanged. Oil drillers added rigs in Texas's Permian and three other U.S. shale basins, data showed on Friday, the strongest sign yet that higher crude prices are coaxing producers back to the well pad after a six-month slump in activity. Overall, however, U.S.

US Shale Cutbacks to Bring Quick Output Dip

Shale oil producers are throttling back so quickly on drilling that U.S. crude output could fall sooner than expected, within months, executives say as they slash costs to cope with tumbling crude prices and compete with Persian Gulf rivals. About a dozen chief executives who talked to Reuters or who spoke publicly, acknowledged they were taken aback by the scale and speed of the cutbacks…

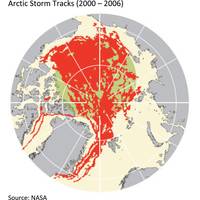

An Open Arctic and its Impact on Oil Drilling

William Cho, Head of MatthewsDaniel Weather, a division of the Bureau Veritas Group, explains why improvements in drilling technologies and weather monitoring systems have made offshore shelf drilling operations in the Arctic Circle increasingly attractive to upstream oil and gas companies and their investors. Rising crude oil prices motivate not only technological innovators to explore cheaper alternative energy sources…

Mexican Landowners Pose Threat to Energy Investors

When foreign investors begin to pour into Mexico's overhauled energy sector in the coming months, they will face a potent force well-known to miners: Mexico's ejidos, or rural landowner groups. The product of revolutionary land reform - almost a century ago - that redistributed more than 100 million hectares from large landowners to small farming groups, the ejidos control surface rights to large swaths of Mexico.

Tullow Oil Exploration and Appraisal Update in Kenya

Tullow Oil plc announces the successful results from a series of exploration, appraisal and testing activities conducted in Blocks 10BB and 13T onshore Kenya. The Etom-1 well in Block 13T is the most northerly well drilled to date in the South Lokichar basin, 6.5 km north of the previous Agete-1 discovery. The well encountered approximately 10 metres of net oil pay, extending the proven oil basin significantly northwards.