REFILE-ConocoPhillips plans layoffs as part of broad restructuring

ConocoPhillips plans to reduce staff. The company announced this on Tuesday. This is part of a broader effort to control costs and streamline operations following its $23 billion purchase of Marathon Oil. Job cuts are a sign of the pain that the oil and gas…

ConocoPhillips is looking to sell assets in Oklahoma worth more than $1 billion, according to sources

People familiar with the situation said that ConocoPhillips has begun exploring the possibility of selling oil and gas assets it acquired from Marathon Oil when it bought the company for $22.5 billion last year. Sources said that the energy producer hired Moelis…

NEO Energy and Repsol to Merge UK Oil and Gas Assets

NEO Energy and Repsol Resources UK have entered into strategic merger, creating one of the largest U.K. North Sea independent oil and gas companies under the name of NEO NEXT.Under the terms of the transaction, the combined business will be jointly owned by…

Chevron is struggling to replace its oil and gas reserves amid uncertainty surrounding the Hess deal

Chevron’s oil and natural gas reserves are at their lowest level in more than a decade. This highlights the importance of its planned acquisition of oil producers Hess, which has been stalled by a legal battle with Exxon Mobil. Investors in energy companies use reserve replacement as a key metric.

Sources say that RPT-Encino owner is considering a $7 billion sale and IPO.

CPP Investments, a Canadian pension fund, is considering strategic options for Encino Acquisition Partners, such as a sale or an initial public offering that could value Encino Acquisition Partners at up to $7 billion including debt. The energy industry has…

Sources: Encino's owner is considering a $7 billion sale and the IPO of an energy producer.

CPP Investments, a Canadian pension fund, is considering strategic options for Encino Acquisition Partners, such as a sale or an initial public offering that could value Encino Acquisition Partners at up to $7 billion including debt. The energy industry has…

India is likely to increase its purchases of US gas and oil following Trump's announcement

After President Donald Trump announced that he would increase U.S. production of oil and natural gas, India will likely increase its purchase of U.S. gas and oil. The Indian Oil Minister Hardeep Singh Puri said to reporters at the sidelines of an event that…

China's CNOOC sold US assets to Britain’s INEOS

CNOOC Ltd, a Chinese company, has sold its U.S. subsidiaries, along with its upstream oil assets and gas assets, in the Gulf of Mexico to British chemicals group INEOS. This was announced by CNOOC on Saturday. CNOOC Energy Holdings U.S.A., a subsidiary of INEOS…

APPEC-India ONGC Videsh focuses on stakes in oil and gas assets amid energy transformation

The head of finance at ONGC Videsh said that the company is focusing on acquiring stakes overseas in oil and gas producing companies, as the shift to renewable energy will likely reduce the demand for conventional fuels. We are not interested in long-term projects, due to the energy transition.

Sources say that the owner of energy producer Maverick is interested in selling it for $3 billion.

According to sources familiar with the situation, the private equity owner of Maverick Natural Resources has been exploring the possibility of selling the U.S. oil-and-gas producer for a price that would be around $3 billion including debt. Sources said that the Houston-based exploration company…

Shell Exits Permian with $9.5B Sale to ConocoPhillips. Its U.S. Output Now Mostly Offshore

Royal Dutch Shell said on Monday it would sell its Permian Basin assets to ConocoPhillips for $9.5 billion in cash, an exit from the largest U.S. oilfield for the energy major shifting its focus to the clean energy transition.For ConocoPhillips, it is the second sizable acquisition in a year in the heart of the U.S.

Offshore Oil Firm Eco Atlantic Launches Renewables Division

Eco Atlantic, an oil company with offshore oil and gas acreage in Guyana and Namibia, said Tuesday it had formed a new solar energy-focused company Eco Atlantic Renewables, citing, in part, a lack of oil and gas acquisition opportunities.Formed with Nepcoe Capital Partners Ltd.

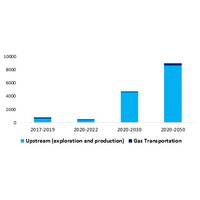

Rolling the Dice in Chaos: The Prospects of Investment in the Gas Industry

As stated in the Declaration of Malabo at the 5th Summit of Heads of State and Government of the GECF Member Countries, in order to sustain the security of demand and supply of natural gas, it is necessary to ensure sufficient investments through the entire…

Woodside's Revenue Slumps More than Expected

Australia's Woodside Petroleum Ltd reported a worse-than-feared 29% drop in quarterly revenue, hit by weak spot liquefied natural gas (LNG) prices, but said it still expected to book a net profit in the first half.The hit came due to the double whammy of a…

Occidental Posts $2.2B Loss, Deepens Spending Cuts

Occidental Petroleum Corp on Tuesday swung to a first-quarter loss on writedowns and charges, and the troubled U.S. oil producer cut its budget for the third time since March in response to a historic oil-price crash.The company has been struggling with debt…

Equinor Sticks to 2019 Output Forecast

Equinor's third-quarter profit fell by more than expected on Thursday after a significant decline in the volume and price of natural gas sold to Europe, although the Norwegian firm reiterated its forecast for flat 2019 production.Shares in Oslo-listed Equinor…

Var Energi Buys Exxon's Norway Assets for $4.5 Bln

ExxonMobil said on Thursday it will sell its Norwegian upstream oil and gas assets to independent exploration and production company Vår Energi for $4.5 billion as part of an ongoing large-scale global divestment plan.The deal, which is expected to close in the fourth quarter…

Mitsui Looks to Sell BassGas Stake

Japan's Mitsui & Co has put its 40% stake in the BassGas project off southeastern Australia up for sale, the company said on Thursday.Mitsui's stake in the BassGas project, which includes the undeveloped Trefoil gas project, could be worth about A$360 million ($244 million), according to Credit Suisse.

Schlumberger CEO Outlines Digital Strategy

Schlumberger NV's newly-appointed Chief Executive Officer Olivier Le Peuch on Wednesday outlined his vision for the world's largest oilfield services company, vowing to exit unprofitable businesses, restructure some units and focus on returns.In his first public remarks since taking office in July…

Centrica Extends Stork Contract

Fluor Corporation announced that Stork, part of Fluor’s Diversified Services segment, was awarded a contract extension by Centrica Storage Limited to continue providing fabric maintenance and associated services for the company’s UK onshore and offshore oil and gas assets.