Chevron CEO Sees Continued 'Choppy Economic and Price Activity'

The chief executive of U.S. oil giant Chevron Corp on Monday said the uncertainty of the COVID-19 pandemic has it planning for "choppy" oil prices and economic activity globally.Chevron said on Monday it would buy oil and gas producer Noble Energy Inc for about $5 billion in stock, the first big energy deal…

Dominican Republic Kicks Off Licensing Round

The Dominican Republic's first oil licensing round will be a success if it awards more than two of the 14 blocks on offer this year, a government official said at an event disclosing the Caribbean nation's fiscal terms.The licensing round, which began on Wednesday with disclosure of contract terms, comes after Brazil…

Noble Energy Posts Bigger-than-expected Loss

Noble Energy Inc reported a bigger-than-expected quarterly loss on Friday, as the U.S. oil and gas producer was hit by weak crude prices.U.S. crude prices averaged $54.9 per barrel in the first quarter, a 12.8 percent fall compared to the year-ago period.Noble realized $53.46 for each barrel of crude and condensate from its onshore operations in the United States…

US Offshore Drilling Takes Center Stage

U.S. lawmakers will quiz President Donald Trump’s new pick to lead the Interior Department on Thursday, focusing on the former energy and mining lobbyist’s plans to expand fossil fuels production from the United States' public lands and waters.The Interior Department, which oversees more than a fifth of the U.S.

FLNG Market Grows a CAGR of +93%

Global floating liquefied natural gas (FLNG) market is growing at a CAGR of +93% during forecast period 2019-2026 as the demand for natural gas has been rising as it is a preferred fuel in power generation in various industries.According to a report from Research N Reports, the demand comes from mainly for the regions such as North America…

Noble Energy Beats Street

U.S. oil and gas producer Noble Energy Inc reported a better-than-expected quarterly profit on Thursday, as the company boosted oil production and sold at higher prices.Sales volumes from the company's U.S. onshore business, its biggest, rose 17.2 percent in the third quarter to 109,000 barrels of oil equivalent per day.The company said average realized prices for U.S.

Noble Energy Profit Tops Estimates as Production Soars

Noble Energy Inc beat analysts' first-quarter profit estimates on Tuesday, helped by a 30 percent jump in U.S. onshore shale production and higher crude oil prices.West Texas Intermediate (WTI) light crude futures averaged at $62.89 per barrel during the quarter, up 21.5 percent from a year earlier.Noble…

Noble Energy Q1 Profit Beats Street

Oil and gas producer Noble Energy Inc beat analysts' first-quarter profit estimates on Tuesday, helped by a surge in onshore shale production and broadly higher oil prices. The company, which drills oil wells in the DJ Basin as well as the Permian and Eagle Ford shale plays, said its U.S. onshore oil production rose over 30 percent in the first quarter.

Shale Producers Urge FERC to Deny Pipeline's Rate Request

Top shale oil producers asked a U.S. regulator this week to reject White Cliffs pipeline's application to charge market-based rates for shipments from Platteville, Colorado, to the storage hub at Cushing, Oklahoma. U.S. shale producers ConocoPhillips Co, Kerr McGee Oil & Gas Onshore LP, a unit of Anadarko Petroleum Corp…

Noble Energy Profit Beats Estimates

U.S. oil and gas producer Noble Energy Inc reported adjusted quarterly profit on Tuesday that easily beat analyst estimates due to cost cuts and higher crude prices, sending shares surging more than 7 percent in morning trading. The results came as Noble's U.S. shale oil production jumped in the fourth quarter through Dec.

Petrogress Enters Joint Venture with EDT Offshore

Petrogress, Inc. has announced that its Petrogress Int’l, LLC (PIL) subsidiary has entered into a Memorandum of Understanding (MoU) with EDT Agency Services, Ltd. (EDT Offshore) to combine the companies’ operations at the Port of Limassol and additional port facilities in Cyprus. The MoU covers shorebase and offshore support services from the Port of Limassol…

US Shale Producers Promise Higher Output and Returns

U.S. shale producers are telling investors impatient for better returns that they can keep boosting oil output aggressively and do so while still making money for shareholders. Investors have pushed top U.S. shale companies to focus on returns, rather than higher output, a move that threatened to slow the…

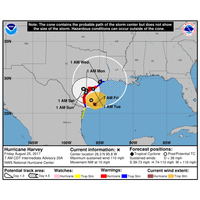

Residents Flee South Texas Ahead of Harvey

Residents fleeing most powerful storm on U.S. mainland since 2005. Businesses closed and lines of cars streamed out of coastal Texas as officials called for residents to evacuate ahead of Hurricane Harvey, expected to arrive about midnight as the most powerful storm to hit the U.S. mainland in more than a decade.

U.S. Drillers Cut Rigs ahead of Hurricane - Baker Hughes

U.S. energy firms cut oil rigs for a second week in a row ahead of Hurricane Harvey and as a more than year-long recovery in drilling slows down in reaction to soft crude prices. Drillers cut four oil rigs in the week to Aug. 25, bringing the total count down to 759, General Electric Co's Baker Hughes energy services firm said in its report on Friday.

Hurricane Harvey Strengthens, Threatens US

Hurricane Harvey intensified early on Friday into potentially the most powerful hurricane to hit the U.S. mainland in more than a decade, as authorities warned locals to shelter from what could be life-threatening winds and floods. Harvey is set to make landfall late Friday or early Saturday on the central…

U.S. Shale Producers Cut CapEx as Oil Prices Lag

U.S. shale producers have started to trim their 2017 capital spending budgets, a tacit acknowledgement that such plans were too aggressive when crafted months ago before commodity prices weakened. This week alone, Anadarko Petroleum Corp, ConocoPhillips, Whiting Petroleum Corp and Hess Corp cut a combined $750 million from their capex plans…

Noble to Sell 50% Stake in Cone Gathering

U.S. oil and gas producer Noble Energy Inc said on Thursday it would sell its 50 percent stake in privately held Cone Gathering LLC along with 21.7 million units to Quantum Energy Partners for $765 million in cash. The limited partnership units represent a 33.5 percent ownership interest in Cone Midstream Partners LP, which owns natural gas pipelines, the company said.

Noble Energy to Shed Shale Assets for $1.23 bln

U.S. oil and gas producer Noble Energy Inc said it would sell all its exploration and production assets in the Marcellus shale field in North West Virginia and South Pennsylvania for $1.23 billion. Noble did not name the buyer. Reporting by Sayantani Ghosh

Noble Energy Narrows Q4 Loss

U.S. oil and gas producer Noble Energy Inc on Monday reported a smaller fourth-quarter loss, compared with a year earlier, when it incurred an impairment charge of $2.2 billion. The net loss attributable to Noble narrowed to $252 million, or 59 cents per share, in the quarter ended Dec. 31, from $2.03 billion, or $4.73 per share, a year earlier.

Noble Energy's Loss Smaller than Expected

Noble Energy Inc on Monday reported a smaller-than-expected adjusted quarterly loss as oil prices ticked up after a more than two-year slump, offsetting a decline in production. Brent crude prices averaged $54.57 per barrel in the first three months of the year, up 55 percent from a year earlier. Noble's total operating expenses fell 12.7 percent to $1 billion.