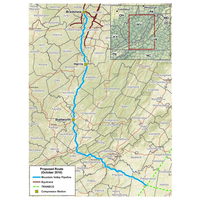

U.S. Court Stops Work on Natgas Pipeline

EQT Midstream Partners will stop construction in West Virginia of parts of its $3.5 billion Mountain Valley natural gas pipeline, after a U.S. federal appeals court issued a stay order last week against a permit, a U.S. regulator and the company said. The pipeline company will not proceed with construction in waters affected by the stay order in West Virginia, the U.S. Federal Energy Regulatory Commission said in a document issued on Monday. Mountain Valley Pipeline told FERC it was consulting on the implications of the stay issued by the U.S. Court of Appeals for the Fourth Circuit with the U.S. Army Corps, which gave the permit in December 2017, FERC said in the notice.

Batteries hasten winds of change for electricity stocks

Bigger, better batteries are speeding up change in the U.S. electricity sector and could help power a rally in Xcel Energy Inc, American Electric Power Co Inc and other utility and renewable energy stocks, Barron's reported.After a decade of steep cost declines, wind and solar installations, often paired with battery storage, are increasingly displacing older coal and gas-fired power plants, benefiting battery makers and some utilities, the Barron's cover story said.Batteries can now store enough electricity to help power small towns when wind and solar supplies ebb, Barron's said.

Buffett Bets Big on Energy with $9 Bln Oncor Buy

Warren Buffett's move to spend $9 billion on his largest energy sector acquisition reflects his long-standing drive to diversify his Berkshire Hathaway Inc and deepens his commitment to electricity as a means to boost profit. Berkshire said on Friday that its Berkshire Hathaway Energy unit will buy a reorganized Energy Future Holdings Corp to get access to Oncor Electric Delivery Co, Texas' largest electricity transmission company. The all-cash purchase reflects a bet by Buffett that he can do what two prior suitors could not: convince Texas regulators that a takeover is in the public interest and deserves approval.

Berkshire Hathaway Nears Deal to Buy Oncor

Berkshire Hathaway Inc's energy unit is nearing a deal to buy utility company Oncor, the Wall Street Journal reported on Thursday, citing people familiar with the matter. Terms of the deal weren't disclosed, but could be announced as soon as Thursday, according to the WSJ report. Berkshire Hathaway was among the leading bidders for Energy Future Holding Corp's Oncor Electric Delivery, Bloomberg had reported in July last year. Power producer NextEra Energy Inc had also bid for Energy Future Holdings' 80 percent stake in Oncor for $18.4 billion. However, Texas regulators in May this year nixed NextEra's deal, saying it was not in public interest.

Wind Briefly Sets Record as Source for U.S. Electricity

Wind briefly powered more than 50 percent of electric demand on Sunday, the 14-state Southwest Power Pool (SPP) said, for the first time on any North American power grid. SPP coordinates the flow of electricity on the high voltage power lines from Montana and North Dakota to New Mexico, Texas and Louisiana. Wind power in the SPP region has grown significantly to over 16,000 MW currently from less than 400 megawatts in the early 2000s and is expected to continue growing. One megawatt can power about 1,000 homes. "Ten years ago, we thought hitting even a 25 percent wind-penetration level would be extremely challenging…

SunEdison's Problems May Impact Solar Yieldcos

SunEdison Inc's decision to halt sales of solar power plants to its dividend-paying "yieldco" units has drawn attention to the company's missteps at a time when the oil price slump has claimed renewable energy stocks as collateral damage. So-called yieldcos are publicly traded entities that house solar and wind projects sold to them by their parent companies. These units have long-term agreements to sell power, giving them stable cash flows, but they are dependent on the transfer of assets from their parents to increase dividends. Yieldcos are supposed to be safe bets for people looking to invest in the volatile solar market…

Texas Power Demand Breaks Record Again in Heat Wave

The Texas power grid operator said electric demand hit another record high on Monday as consumers cranked up their air conditioners to escape a brutal heat wave. Demand reached a record 69,783 megawatts on Monday, topping the previous records of 68,912 MW set on Aug. 6 and 68,459 MW on Aug. 5, the Electric Reliability Council of Texas (ERCOT) said in a statement. ERCOT is the grid operator for most of the state. Before the latest heat wave, the grid's previous peak demand was 68,305 MW set on Aug. 3, 2011. One MW is enough to power about 200 homes during periods of peak demand.

TX Power Demand Soars, Prices Spike

The Texas power grid operator said electric demand hit an all-time peak for a second day in a row on Thursday as consumers cranked up their air conditioners to escape a brutal heat wave, and power prices rose to an 18-month high. Next-day power prices at the Ercot North hub <SE-ERCONP-IDX> on the IntercontinentalExchange jumped to $175 per megawatt hour for Friday, the most since February 2014. Demand reached a record 68,912 megawatts (MW) on Thursday, topping the 68,459 MW peak set on Wednesday, the Electric Reliability Council of Texas (ERCOT), the grid operator for most of the state, said in a statement. Before this week, the grid's previous peak demand was 68,305 MW set on Aug.

Texas Power Demand at Record High

The Texas power grid operator said demand for electricity hit an all-time record as consumers cranked up air conditioners to escape a brutal heat wave on Wednesday, breaking the previous record set four years ago. Demand reached 68,459 megawatts, topping the previous record of 68,305 MW, set on Aug. 3, 2011 during an extended period of record high temperatures. One MW is enough to power about 200 homes during periods of peak demand, said the Electric Reliability Council of Texas (ERCOT),the grid operator for most of the state. "With temperatures expected to continue to rise Thursday and Friday…

NextEra Energy Partners to Buy Texas Pipeline Company

Renewable energy company NextEra Energy Partners said it would buy NET Midstream, a privately held company that develops natural gas pipeline assets, for $2.1 billion. The deal will give NextEra seven natural gas pipelines in Texas. NextEra Energy Inc, which formed NextEra Energy Partners to buy and manage clean-energy projects, reported a better-than-expected profit on Monday. (Reporting by Tanvi Mehta in Bengaluru)

NextEra's Hawaii Deal Faces Concerns from Solar Players

NextEra Energy Inc's $4.3 billion plan to buy Hawaiian Electric Industries Inc has made solar companies uneasy, worried that the deal would reverse the island state's push to decentralize its power grid. In documents filed with Hawaii's utility regulator, SunPower Corp, SunEdison Inc and a group backed by SolarCity say they are worried the acquisition would be bad for their businesses, many of which have grown dramatically in the Aloha State in just a few years. The deal, announced in December, needs Public Utilities Commission approval. Hawaii, with its sunny weather and sky-high electricity rates, is one of the world's best markets for solar power.

New England Power Grid Warns of Winter Natgas Constraints

New England should have enough electricity to meet demand this winter but the natural gas pipeline constraints that caused price spikes on the coldest days last winter will be a "concern" again this year, the region's power grid operator said Thursday. ISO New England, the grid operator, warned the region's dependence on gas puts it in a "vulnerable position" because current pipelines cannot deliver all the gas required for both heating and power generators, especially during cold weather. Last winter, gas demand and prices hit record highs because there…

Energy Future Seeks Longer Bankruptcy

Energy Future Holdings, the largest power company in Texas, asked a judge to extend the period in which it controls its Chapter 11 bankruptcy and said it is scrapping its original debt-cutting plan in favor of an auction of its Oncor unit. The company asked Delaware Bankruptcy Judge Christopher Sontchi to extend its exclusive right to seek a creditor vote on a plan of reorganization until April 25, 2015 from its current deadline in October. The company filed for bankruptcy on April 29, 2014 with a restructuring support agreement, or RSA, with some creditors that aimed to get a plan to cut its $40 billion in debt approved by Sontchi before February.

Key Hearings in Energy Future Bankruptcy Extended

Court hearings to determine if Energy Future Holdings Corp, Texas's biggest power company, can adopt a refinancing package that is key to its massive bankruptcy have been extended through July 11 from the original schedule to end on Tuesday. "I'm worried about that amount of time being sufficient," Judge Christopher Sontchi of the U.S. Bankruptcy Court in Wilmington, Delaware said at the start of Tuesday's session. "We have a lot of witnesses," said Sontchi, who scheduled time in court on Wednesday and July 10 and July 11. The hearings started on Monday.

Florida Plan To Add 2 Nuclear Reactors

Florida Governor Rick Scott and members of the Cabinet on Tuesday approved plans by the state's largest electric company to add two nuclear reactors to a plant in the Miami area, despite an outcry by environmentalists and some surrounding communities. Florida Power & Light Co, a unit of NextEra Energy Inc, wants to add two new 1,100-megawatt units to its vast Turkey Point power complex near the city of Homestead. The company has been working on the project in the Miami-area suburb since 2006, winning approval by the state's Public Service Commission, which regulates utility rates, and the Department of Environmental protection.