CERAWEEK - Australia's Santos will increase investment in the US due to pro energy policy - CEO

Kevin Gallagher, CEO of Santos Australia, said that the company will increase its investments in the United States due to the energy-friendly policies of President Donald Trump and his administration. Trump wants to maximize the domestic oil and natural gas production, and has reverted many of Joe Biden's policies that were meant to encourage a shift to a low-carbon economy. Gallagher, in remarks made at the CERAWeek Conference in Houston, said: "We will increase our investment in the U.S.

Santos Australia targets higher output in 2025, pinning hopes on Barossa Project

Santos, Australia's largest oil and gas company, forecast higher production for fiscal 2025 based on the expectation that Barossa will start production this year. The company also reported a sequential increase in its fourth quarter revenue on Thursday. Santos is the second largest independent gas producer in the country. Santos, the country's no. Visible Alpha's consensus was 89.9 million mmboe. If gains continue, shares could rise as high as 1.7% at A$7.250.

Australia's Santos signs LNG deal with TotalEnergies

Santos, an Australian gas supplier, announced on Wednesday it had signed a contract for a midterm supply of liquefied gas with TotalEnergies Singapore. Santos said that under the contract which lasts a little more than three years it will provide 20 LNG cargoes or about 500,000 tons of LNG each year. The contract is expected to begin in the fourth quarter 2025. Santos will provide the LNG delivered ex-ship basis (DES) to TotalEnergies Gas & Power Asia.

Santos' new CFO shines spotlight on succession in top jobs

The Australian energy giant Santos announced on Thursday that Sherry Duhe, a former Woodside and Newcrest executive, has been appointed as its chief financial officer. This announcement comes amid heightened market speculation regarding a possible change in the top position. Duhe will replace Anthea McKinnell as chief financial officers. McKinnell leaves Santos after more than half a century. Kevin Gallagher, CEO of Santos in 2021…

Santos LNG from Australia to Glencore Singapore

Santos, an Australian company, announced on Wednesday that it had signed a contract for a midterm supply of liquefied gas with Glencore Singapore. Glencore Singapore is a subsidiary of the London-listed Glencore. Santos has agreed to supply 19 LNG cargoes or approximately 0.5million tonnes of LNG annually over the course of three years plus a quarter. The contract will begin in the fourth fiscal quarter of 2025, with LNG coming from the company's global portfolio.

Woodside Energy's earnings to drop as investors focus on strategic deals

Woodside Energy is Australia's largest independent gas producer and on course to report a decline in its interim earnings on February 2, with investors focused on the company's deal-making strategies after a failed $52 billion merger between Santos. According to Jarden's Visible Alpha consensus, Woodside, based in Perth, is expected to report a underlying net loss after tax of $1.11billion for the six-month period ended June. This compares to $1.90billion reported a year earlier.

Santos Posts Record High Output

Australia's number two independent gas producer Santos Ltd on Thursday said third-quarter production and sales volumes peaked to record levels, benefiting from higher output from its Western Australia assets.Revenue of $1.03 billion was the second highest quarterly sales on record, the company said in a statement, while production surged 32% to 19.8 million barrels of oil equivalent (mmboe), beating an estimate…

Santos Acquires ConocoPhillips’ Northern Australia Interests

Santos announced it has acquired ConocoPhillips’ northern Australia business with operating interests in Darwin LNG, Bayu-Undan, Barossa and Poseidon for US$1.39 billion plus a $75 million contingent payment subject to FID on Barossa.Matt Fox, ConocoPhillips executive vice president and chief operating officer, said, “While we believe the Darwin LNG backfill project remains among the lower cost of supply options for new global LNG supply…

Santos Posts Record Production in Q1

Australia's No.2 independent gas producer Santos Ltd on Wednesday posted record quarterly production, boosted by its acquisition of Quadrant Energy assets, while sales revenue jumped 28 percent.Santos said production for the quarter ended March 31 rose to a record 18.4 million barrels of oil equivalent (mmboe), up from 13.8 mmboe last year.Revenue came in at $1.02 billion, the second-highest quarterly revenue on record…

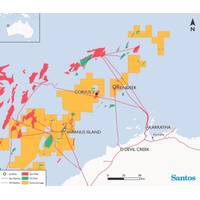

Santos Finds Gas Off Western Australia

Santos announced Tuesday it has confirmed significant gas resource in the Corvus-2 appraisal in the Carnarvon Basin, offshore Western Australia.Corvus-2 is located in 63 meters water depth, approximately 90 kilometers northwest of Dampier in Commonwealth waters within petroleum permit WA-45-R, in which Santos has a 100% interest.The well was drilled approximately 3 kilometers southwest of Corvus-1 (drilled in…

Santos Broadens Offshore Exploration in N.Australia

The oil and gas producer in the Asia-Pacific region Santos has struck a joint venture (JV) agreement with fellow-listed Beach Energy to partner over four exploration permits in the Bonaparte basin, offshore northern Australia.The two companies will each hold a 50% JV interest in the four permits, with Santos acting as operator.Santos’ position in the Bonaparte basin already includes an 11.5% interest in the Bayu-Undan gas-condensate field and the Darwin LNG plant…

Australia's Gladstone LNG Plant to Take Unit Offline for Maintenance

Australia's Gladstone liquefied natural gas (LNG) export plant will take one of its production lines out of service for planned maintenance for several weeks in October, industry sources said. The Santos-operated plant will take one of its two production facilities, known as trains, off for maintenance from early October to about Oct. 23, they said. The planned nature of the outage means it is likely to have a limited impact on spot LNG prices in Asia, a trader said.

Santos in the Red on LNG Project

Australia’s third-biggest oil and gas producer Santos Ltd reported a first-half net loss of $1.1 billion after taking a $1.05 billion charge on its Gladstone liquefied natural gas (LNG) export project in Queensland, reports Bloomberg. However, Santos Chief Executive Kevin Gallagher said the company may run its Gladstone liquefied natural gas plant (LNG) below its 7.8 million tonnes a year capacity, but said there was no plan to mothball one of its two production units, reports Reuters.

Santos Reports $1.93 bln Loss, Core Profit Misses Forecasts

Australian oil and gas producer Santos Ltd, which rejected a A$7.1 billion takeover last year, slid to a loss in 2015, hit by hefty writedowns, and its new boss said he was working on a strategy to shore it up against weak oil prices. Chief Executive Kevin Gallagher, who took the helm on Feb 1 days after the company's shares hit a 23-year low, said he was confident its assets, including stakes in liquefied natural gas (LNG) projects in Australia and Papua New Guinea…