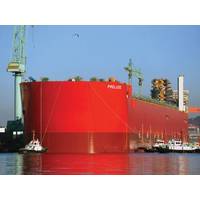

Demand Grows for OSVs in the Offshore Floating Production and Storage Energy Sector

Over the last year we have seen an upswing in floating production and storage systems ordering after many years of low activity. According to our colleagues at World Energy Reports, “The global oil and natural gas markets are contending with rebounding energy demand on top of supply disruptions from Russia’s invasion of Ukraine. As a result, activity and business sentiment in the floating production sector has seldom been stronger.” This increased activity in the floating production and storage segment…

Intelatus: The long-tenured, New Name in Market Intel & Planning

Intelatus Global Partners is a new name in energy, marine and industrial market analysis and strategic planning, a ‘new name’ with nearly 50 years of experience and proven results.Founded by the merger of International Maritime Associates (IMA) and World Energy Reports (WER), Intelatus is a firm of business consultants with unique experience of nearly five decades across the entire maritime supply chain, producing multi-client analytical studies for sectors including offshore oil and gas, renewables and the energy transition…

Market Signals Fast Rebound in Floating Production Orders

The deepwater market is rapidly returning to pre-COVID-19 activity levels, and the recovery appears to be gaining strength, according to a recent in-depth analysis completed by International Maritime Associates (IMA) and World Energy Reports (WER).“Lots of green shoots have appeared,” says Jim McCaul, head of IMA/WER. “Oil inventory has been brought down to seasonal average, crude remains in the mid-$60s, bullish forecasts are being heard from key industry players and an upward trend in issuance of equity…

Video: The Floating Production Market Faces Headwinds, But Opportunities Exist

There are around 200 offshore oil and gas projects currently being planned for development using a floating production system, however, at around $2B apiece – some up to $5B – final investment decisions will depend on the market situation and the outlook for oil and gas doesn’t seem too bright. Still, around 60 units are expected to be ordered by 2025, per World Energy Reports.In an interview for Offshore Engineer TV on the outlook for floating production systems, Jim McCaul, head of International Maritime Associates and World Energy Reports…

Floater Sector Active Despite Market Volatility

Activity in the floating production sector has not been slowed by the recent volatility seen across global oil markets, according to a recent report by World Energy Reports (WER).Brent oil, which had reached as high as the mid $70 range earlier this year, fell 17% from mid-May and mid-June on demand growth fears and swelling crude inventory, only to rebound back to current levels in the mid $60 range following several tanker attacks and a drone downing near the Strait of Hormuz. The production floater market has kept pace regardless…

Oil Markets Rattled by New Demand/Supply Imbalance

Fear of a new oil demand/supply imbalance has rattled the oil market.Market sentiment has suddenly shifted. Fear that Iran sanctions will cause oil prices to spike to $100+ has been superseded by concern that prices are heading south with no bottom in sight.Iran sanctions were expected to take a substantial volume of supply from the market. Anticipating this, the Saudis and Russians increased production to offset (take advantage of) the expected loss of Iranian supply. But granting of waivers weakened the sanctions impact and oil demand growth unexpectedly slowed.

LNG Investment Set to Grow

Following years in the pricing doldrums, LNG is hot again, with business prospects for floating production and regasification looking strong through 2023. We talk to Jim McCaul of International Maritime Associates (IMA) for his insights, as he is fresh off of a 12-month stint investigating the market in depth."We wanted to take a fresh look at the market, to identify opportunities both in the production and regassification of LNG" is how McCaul, founder of IMA, best describes his team’s 12-month effort to study and report on the industry.

LNG Report: Floating Liquefaction & Regasification

International Maritime Associates has completed a 12-month study of the global market for floating gas liquefaction plants and floating LNG regasification terminals. The 150+ page study, published by World Energy Reports, is the most detailed analysis yet made of this growing business sector. Project Success EvaluationThe IMA study is the first professional effort to systematically look at the universe of FLNG and FSRU projects in the planning stage – and categorize the likelihood of each making the development investment hurdle.

IMA Completes 12-month Study of the Floating Liquefaction and Regasification Market

International Maritime Associates has just completed a 12-month study of the global market for floating gas liquefaction plants and floating LNG regasification terminals. The 150+ page study, published by World Energy Reports, is the most detailed analysis yet made of this growing business sector.Project Success EvaluationThe IMA study is the first professional effort to systematically look at the universe of FLNG and FSRU projects in the planning stage – and categorize the likelihood of each making the development investment hurdle.

What's next from Maritime Reporter TV?

Jim McCaul, founder of International Maritime Associates, sat with Maritime Reporter TV's Greg Trauthwein in Washington, D.C. to discuss key market trends affecting the global energy and maritime sectors. With inimitable insight, McCaul offers a candid look into the state of U.S. shipbuilding, the condition of the floating production industry, potential for an energy sector rebound, and the incoming Trump administration. In the first segment, McCaul identifies signs of hope within the global energy markets and provides an update on the state of floating production.

Oil’s Downward Spiral Stalls LNG’s Ascent

As industry embraces gas, emissions regulations loom large and bunker logistics options develop, LNG’s fortunes nevertheless get a boost. For every gleeful consumer at the pump, and stockpiling tanker anchored offshore, there’s a corresponding trail of businesses that are struggling to ride out the worst price drop in crude since the mid-1980s. As oil giants slash CapEx, Halliburton and other industry players layoff thousands and record numbers of oil rigs go offline, less obvious is the impact of the latest oil market blow out on the growth of liquefied natural gas (LNG).

Floating Production Systems: US$11+ Billion on Order

The floating production sector has been especially active over the past several months. Ten production floaters have been ordered since March, reports International Maritime Associates Inc. (IMA). 269 floating production units now in service or available – This figure is 22% greater than five years ago, almost 80% higher than ten years back. FPSOs account for 61% of the existing systems. The balance is comprised of production semis, tension leg platforms, production spars, production barges and floating regasification/storage units.