Aker BP's top shareholder claims that the company has opportunities for acquisition.

Aker BP is a Norwegian oil exploration and production firm that was formed through a series mergers and purchases in the past decade. Its top shareholder stated on Friday that there are opportunities to consolidate further on Norway's Continental Shelf. Aker BP is aiming to increase its production to over 500,000 barrels of oil-equivalent per day by 2028. This will be a significant improvement from the few thousand barrels produced daily in 2013. Oeyvind Ericsen, CEO of Aker ASA, which owns 21.16 percent of Aker BP shares…

Aker Energy IPO May be in Late 2019 or 2020

Norwegian investment firm Aker could launch its planned initial public offering (IPO) of Aker Energy in late 2019 or in 2020, depending on when Ghana approves the development plan of its Pecan oilfield, the CEO said.The company, controlled by Norwegian billionaire Kjell Inge Roekke, has said it wants to make Aker Energy a leading exploration and production company on Ghana's continental shelf."My educated guess is a late 2019 or during the course of next year," Aker Chief Executive Oeyvind Eriksen told Reuters when asked about the IPO plans.Ghana's authorities are expected to approve Aker Energy's revised $4

Aker Energy Eyes IPO

Norwegian oil company Aker said on Thursday that its exploration start-up in Ghana will submit development plans to Ghanaian authorities in March and the parent will then decide whether to sell stakes via an initial public offering or other means.The subsidiary, Aker Energy, plans to develop the deepwater Pecan field off Ghana."Depending on the approval process in Ghana, we believe the first oil is achievable in late 2020 or early 2021," Aker's Chief Executive Oeyvind Eriksen told Reuters…

Aker BP Raises Dividend, Q4 Profit Lags

Norwegian oil company Aker BP posted a smaller-than-expected increase in fourth-quarter earnings due to higher production costs and lower oil prices, but raised its dividend.The company said on Wednesday earnings before interest and taxes rose to $403 million from $305 million in the same quarter a year earlier, lagging the $491 million expected by analysts in a Reuters poll.The Oslo-listed firm's shares opened down 2 percent, lagging a 0.5 percent fall in the European oil and gas index."Revenues were impacted by low oil prices at the end of the quarter…

Aker BP Plans Output, Dividend Hike

Norway's Aker BP will boost dividend payments between now and 2023 and step up investment in developing offshore oil and gas fields next year, the independent oil company said on Thursday.The result of a 2016 merger between the Norwegian operations of BP and the Det norske oil firm owned by Norwegian billionaire Kjell Inge Roekke, Aker BP has become the second largest licence holder on the Norwegian continental shelf.While Aker BP expects its output to be broadly flat year-on- year in 2019 at between 155…

Ghana Exploration Licensing Round Attracts Global Majors

Sixteen oil and gas firms have submitted applications for one or more of five Ghanaian offshore blocks in the West African country's first exploration licensing round, its energy ministry said.The interest is a major vote of confidence in Ghana, which is keen to unlock more resources after it began pumping from its flagship offshore Jubilee field in 2010.The companies that have submitted applications are Tullow Oil, Total, ENI, Cairn, Harmony Oil and Gas Corporation, ExxonMobil, CNOOC , Qatar Petroleum…

Aker Bets on Software Engineers for Its Oil Business

When the owners of Norwegian oil firm Aker BP decided to digitise its assets and operations, they searched high and low for the right software company. But they failed to find a suitable one.So instead they set up their own, Cognite, to create digital maps of Aker BP's oil industry assets, integrating data from equipment such as pumps, heat and pressure sensors, maintenance records and even staff rotas to improve efficiency and safety.Less than two years later, Cognite is selling its software to Aker BP's rivals and one competitor…

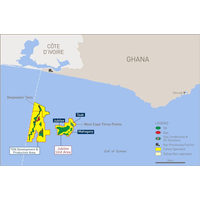

Aker Energy to Start Ghana Drilling in Oct

Norwegian oil firm Aker Energy will delay submitting a plan for development of its block off Ghana until early next year in order to first complete appraisal drilling, expected to start in October, its chief executive said on Thursday.The unlisted firm, controlled by Norwegian billionaire Kjell Inge Roekke, bought a 50-percent stake in Ghana's Deepwater Tano Cape Three Points block from Hess for $100 million in February.Aker had initially intended to summit a development plan in the second half of 2018, but has since changed its mind."The forecast now is to start drilling in October...

Aker BP Adds More Acreage off Norway

Norway's independent oil firm Aker BP has agreed to buy stakes in 11 production licenses off Norway from French Total for a cash consideration of $205 million, the company said on Tuesday.The portfolio includes four discoveries with net recoverable resources of 83 million barrels oil equivalents based on estimates from the Norwegian Petroleum Directorate (NPD), it added."With this transaction, we get access to new tie-back opportunities in the Alvheim and Skarv areas, we strengthen our resource base in the NOAKA area, and we increase our interest in exploration acreage near the Ula field," Aker BP's Chief Ex

Aker to explore options for Aker Energy after Ghana plan filing

Norwegian investment firm Aker will consider options for its stake in oil startup Aker Energy after the unit has appraised its offshore field in Ghana and submitted a development plan for the site to the Ghanaian government.Aker Energy bought a 50-percent stake in Ghana's ultra deepwater Tano Cape Three Points block from Hess for $100 million in February.Options for the stake include listing Aker Energy separately, offering it for sale to oil companies in the area or those seeking to enter Ghana…

Aker BP Beats Street, May Increase Drilling

Norway's Aker BP, partly owned by oil major BP, beat quarterly earnings forecasts on Monday, helped by record output and higher oil prices, and said it may drill more wells this year than previously planned. The company, controlled by a Norwegian billionaire Kjell Inge Roekke, is focusing more on developing its existing business after growing via a series of acquisitions, including last year’s purchase of Hess assets for $2 billion. Thanks to the latest purchase, which included a stake in the Valhall field…

Odfjell Drilling to Expand Fleet

Offshore rig firm Odfjell Drilling plans to expand its floating rig fleet to between six and 10 from four now, it said on Friday, the latest sign of recovery in the energy industry.After cuts in exploration spending following an oil price plunge that began in 2014, energy firms are now hiring rigs as crude prices have recovered some ground.Odfjell raised $175 million via a new share issue on Thursday to help buy semi-submersible Stena Midmax Rig from Samsung Heavy Industries for $505 million.

Ghana to Launch First Exploration Licensing Round in Q4 2018

Ghana will launch its first exploration licensing round in the last quarter of this year offering about six offshore blocks, deputy energy minister Mohamed Amin Adam said. Ghana currently produces 200,000 barrels of oil per day (bpd), led by its flagship Jubilee field which produces about 100,000 bpd, he said. The west African nation, which became a significant oil producer in 2010 when it began pumping from the offshore Jubilee field, is keen to unlock its vast oil and gas resources. Adam said global oil majors like BP…

Aker BP buys Hess' Norway unit for $2 bln

Output from Hess Norway field stakes 24,000 boepd. Aker BP will add the Norwegian operations of U.S. oil company Hess to its expanding exploration and production portfolio under a $2 billion deal announced on Tuesday. Under billionaire investor Kjell Inge Roekke, who controls a 40 percent stake, the Norwegian company has made eight acquisitions since 2014 including a merger with BP's Norway operations in mid-2016. The Hess operations will bolster Aker's production by about 17 percent, or 24…

Aker Solutions' Shares Surge, Recovery in Sight

Shares of Norwegian oil services company Aker Solutions surged on Friday on higher than expected quarterly earnings, a better outlook and a new contract, signalling the end of a three-year downturn in its markets. The company, controlled by Norwegian billionaire investor Kjell Inge Roekke, said it saw signs of recovery, particularly offshore Norway and in so-called brownfield project portfolios, which aim to improve output from existing fields. "Clients are looking into their assets and projects to see that they can lower the break-even costs," Aker Solutions Chief Executive Luis Araujo told Reuters.

Aker BP Ups 2017 Output View

Oil firm Aker BP, the second-largest operator of oil and gas platforms off Norway, raised its 2017 output guidance and lowered its production cost outlook as it posted second-quarter earnings roughly in line on Friday. The company is the result of a merger between the Norwegian business of oil major BP and the Norwegian oil company Det norske controlled by billionaire Kjell Inge Roekke. Aker BP said its output guidance for 2017 would be raised to a range of 135,000-140,000 barrels of oil per day…

Aker Solutions, Kvaerner mull 2017 M&A

Norwegian billionaire investor Kjell Inge Roekke aims to change the ownership of one of more of his companies in the oil services industry this year, he wrote in his annual letter to shareholders on Friday. Through his Aker ASA holding company, Roekke is the top owner of several major suppliers to the oil industry, including Aker Solutions and Kvaerner. Shares of Aker Solutions rose sharply last month following media reports the firm could soon be sold to U.S. competitor Halliburton. "We're open to building larger…

Det norske Sees More Norway Assets for Sale

* On Norwegian M&A market: "There are more assets on the market, more buyers looking for possible deals. * Says aims for concept selection for Northern Alvheim area mid-to-early next year, final investment decision a year later. * "The goal...

BP, Det norske in $1.3 bln Norwegian Oil Merger

All-share deal aimed at cutting costs, challenging Statoil; new venture could produce more than 10 pct of Norway's oil. Oil companies BP and Det norske have agreed to merge their Norwegian businesses in a $1.3 billion all-share deal to cut costs, challenge Statoil's dominance of the local industry and look for more acquisitions. The new venture, which could produce over a tenth of Norway's oil output, will offer BP an opportunity to tap into new oil production and reserves in the next decade after it cut back exploration in recent years.

Statoil, Det norske Look for More Acquisitions

Statoil bought a stake in Sweden's Lundin Petroleum; Det norske bought Norwegian assets of 3 oil firms in 2015. Norwegian oil firms Statoil and Det norske are looking at more acquisitions after recent deals, their chief executives told Reuters, hunting for bargains after a plunge in energy prices. Statoil last week bought an 11.9-percent stake in Sweden's oil firm Lundin Petroleum for $540 million, increasing its dominance on the Norwegian continental shelf where it already operates more than 70 percent of Norway's oil and gas output.