LNG Bunkering Market to Reach $12bn by 2024

The global LNG bunkering market was valued at approximately USD 397.70 million in 2017 and is expected to generate revenue of around USD 11899.60 million by the end of 2024, growing at a CAGR of around 59.4% between 2018 and 2024.LNG bunkering is experiencing the highest growth rate in developed as well as developing countries, said a report by Zion Market Research.Escalating number of vessels using LNG owing to the need for cleaner fuels in compliance with the stringent government regulations in order to reduce air pollution and maintain sustainability is the main driver that is boosting the growth of the market.

Bahrain's Oil Company Targets $1 Bln Through Dual-tranche Bond

Bahrain's state-owned oil company Nogaholding plans to raise $1 billion through a dual-tranche U.S.

Harvey Gulf Emerges From Chapter 11 Proceedings

Harvey Gulf International Marine announced that it has completed its financial restructuring and emerged from Chapter 11 Bankruptcy proceedings. This marks the completion of the Plan of Reorganization approved by the bankruptcy court, 77 days following Harvey Gulf’s prepackaged filing. Under the reorganization, Harvey Gulf has shed approximately $1 Billion in debt and emerges with a dramatically de-leveraged balance sheet. Additionally, the Company has kept its commitments to its trade vendors, paying all unsecured claims in full.

Shell Deploys Third LNG-powered OSV

Shell Offshore Inc. today marked the delivery of the third liquefied natural gas (LNG) powered offshore supply vessel (OSV) in Port Fourchon, La. The new vessel, Harvey Liberty, chartered from specialist company Harvey Gulf International Marine, will join sister ships, Harvey Energy and Harvey Power, and support Shell’s deepwater operations in the Gulf of Mexico. “This is an important milestone for Shell and Harvey Gulf,” said Tahir Faruqui, Shell’s General Manager LNG North America. Harvey Gulf International Marine’s CEO and Chairman…

Gulf International Services Q1 Net Profit Slumps 77.8%

Qatar's Gulf International Services reported a 77.8 percent slump in first-quarter net profit on Monday, as revenue fell across all business lines and the lower oil prices environment impacted its activities. The firm, which has interests in insurance, aviation, oil and gas and catering, made a profit of 78.9 million riyals ($21.7 million) in the three months to March 31, according to a statement. This was down from a profit of 355.7 million riyals in the corresponding period of 2015, and below the forecast of QNB Financial Services, which had expected a quarterly profit of 123.1 million riyals.

GDI, Dolphin Energy Sign Offshore Drilling Rig Services Contract

Qatar’s Gulf International Services (GIS), the leading service group, has announced that its subsidiary Gulf Drilling International (GDI) has signed a contract with Dolphin Energy for drilling rig services. The contract was signed by Mubarak A al-Hajri, managing director and chief executive officer and Hassan al-Emadi, general manager, Dolphin Energy, Qatar. The work under this contract will be performed by the high spec jack-up rig "Al Jassra" and will consist of drilling three wells on the DOL 1 production platform located in offshore waters of Qatar. The service will commence this month.

Bright Future for LNG Bunkering - TMR

Transparency Market Research (TMR) have given a detailed insights and analysis of the global market for LNG bunkering fuel in its recently published market research report. On the basis of capacity, the market, which had a valuation of mere 70 kilo tons in 2013, is projected to expand at an astounding 63.6% CAGR between 2014 and 2025 and reach 22,540 kilo tons by 2025. The report includes an analysis of market’s historical statistics to present an overview of the growth trajectory exhibited by the…

Oil Price Plunge May Weigh on Gulf Markets

Renewed declines in oil prices could weigh on Middle East stock markets on Sunday. Oil made its biggest weekly loss in eight months last week and U.S. Light Crude fell 5.1 percent on Thursday and Friday alone, after Middle East bourses last traded. Brent crude is within $2 of a new 6-1/2-year low and the sustained slump in oil prices has hurt state finances in the Gulf along with earnings in the important petrochemical sector. Global stock markets also retreated on Friday and U.S. stock futures fell post-close after Paris was struck by multiple deadly attacks…

GIS Moves to Employ Idle Rigs

Qatar's Gulf International Services (GIS) has leased out one of two jack-up drilling rigs whose contracts had gone idle and is also considering leasing out the second one. GIS shares have tumbled 19 percent since it said in April that the decline in oil prices was hurting the business of its subsidiary Gulf Drilling International, leading to the release of one previously contracted rig and cuts in day rates. On Tuesday, GIS said in a statement that two of its rigs were idle but one had already been booked for short-term work this year and a longer-term contract starting in the first quarter of 2016.

Topaz Secures Loan to Refinance Debt, Expand

Dubai-based oilfield services firm Topaz Energy and Marine has secured a $550 million conventional and Islamic multi-tranche loan, it said on Thursday. Standard Chartered, HSBC, Emirates NBD , Noor Bank, Gulf International Bank and First Gulf Bank were lead arrangers on the deal, according to a statement from the company. The loan consisted of three portions lasting between five and seven years, with proceeds used to refinance existing debt and fund its expansion plans. Reporting by Tom Arnold

Harvey Energy Begins Work for Shell

Gulf Coast Shipyard Group (GCSG) informed that Harvey Energy, the first LNG vessel operating in the United States—for Shell Upstream America’s deep water operations in the Gulf of Mexico—is fully in service. The first of six LNG OSVs being built for Harvey Gulf International Marine, Harvey Energy is the break-out vessel capable of operating on LNG or diesel and is the result of a forward-thinking operator, complex engineering and sophisticated building. Along with being able to operate on LNG, she also meets the strident criteria of the ABS Enviro+, Green Passport notation.

Gulf of Mexico Sees First LNG-powered OSV

A special Offshore Supply Vessel (OSV) has been delivered to Shell for its deepwater operations in the Gulf of Mexico. The vessel, Harvey Energy, is chartered from Harvey Gulf International Marine and is the first of its kind in the region to run on both liquefied natural gas (LNG) and diesel. Built by the Gulf Coast Shipyard in Mississippi to meet requirements of the ABS “ENVIRO+, Green Passport” notation, the vessel is 302 feet long and operates on three dual-fuel Wärtsilä engines. It will run on 99% LNG fuel and will be able to operate for around seven days before refueling.

Qatar Petroleum Signs $1.4b Contracts with GIS Unit

Gulf Drilling International (GDI) signed five-year contracts worth 5.2 billion riyals ($1.4 billion) to supply drilling rig services to state energy giant Qatar Petroleum (QP), QP said on Monday. GDI, a subsidiary of Gulf International Services, will provide two new offshore rigs and two new land rigs, and extend four other contracts. The contracts, which were announced previously, represent GDI's largest single commitment to a client since it was established 10 years ago, QP added in a statement. By mid-2016, GDI will have a total of 18 drilling rigs, the statement said.

GDI Awards N-KOM US$110-M Contracts

Gulf Drilling International (GDI) Limited, a subsidiary of Gulf International Services (GIS), the largest oilfield service company in Qatar, has awarded two contracts worth US110 million to Nakilat-Keppel Offshore & Marine (N-KOM), a joint venture shipyard between Nakilat and Singapore’s Keppel Offshore & Marine (Keppel O&M). The first contract is for the construction of a self-propelled and self-elevating liftboat, which is customised for field transit operations in the Middle East and North Africa (MENA) region in water depths of up to 65 meters.

Maritime Fuel of the Future: Training to an Uncertain Standard

Despite its unquestionable allure, LNG as a fuel carries with it as many risks as it does answers to the problems it promises to solve. As industry and OEM’s work to remove any doubt, the collaborative effort outpaces the slow-moving regulatory machine. Even as Lloyds Register predicts that LNG will reach a maximum 11% share of marine propulsion solutions in 2030, it also says that segments with higher proportion of small ships will see the highest LNG uptake. And, at the same time, says the global classification society in its recent paper entitled…

A New Standard in Marine Communications

KVH provides and Harvey Gulf employs possibly the most sophisticated on-board SATCOM and related service package on the water. That’s no accident. If quality service, high tech hardware and quality personnel are the common bonds shared by marine communications provider KVH and its customer Harvey Gulf International Marine, then the relationship is probably a match made in heaven. Harvey Gulf, already a long-time user of the KVH suite of services and equipment, is today converting every vessel in their rapidly expanding 60+ fleet to the latest and greatest equipment standard. From where they sit, that means KVH.

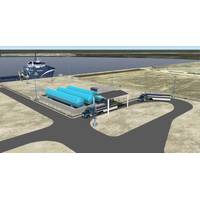

Harvey Gulf Breaks Ground with LNG Facility

Louisiana out in front on LNG bunkering infrastructure. New Orleans-based Harvey Gulf International Marine (HGIM) has announced the ground breaking of construction on its $25 million Phase 1, Slip B, LNG (Liquefied Natural Gas) fueling facility at their Port Fourchon, LA terminal. When operational later this year, HGIM’s LNG facility will be the first of its kind in the United States. This technologically-advanced, environmentally-safe, clean energy facility will be a vital addition to the growing national LNG supply infrastructure…

LNG – Who Cares?

You say you don’t work on an LNG ship? You should care nevertheless. Just ten years ago, LNG Import terminals were being built and/or contemplated throughout the United States. Then, it was widely expected that Liquefied Natural Gas (LNG) imports would account for a large percent of the energy consumption in the US. Fast forward 10 years and we find that industry has made a complete 180 degree turn around. Instead of the US being one of the world’s greatest importers of LNG, it is more than likely that the United States will one way be one of the major exporters of this frigid liquid.

First Harvey Gulf LNG OSV Launched by GCSG

Gulf Coast Shipyard Group (GCSG) has launched of the first of six Harvey Gulf International Marine 302’ x 64’ Dual Fuel Offshore Supply Vessels. Incorporating breakthrough clean-burning LNG technology, these vessels position Harvey Gulf as the leader in the environmental application of liquefied natural gas and demonstrates GCSG’s ability to meet marketplace demand. Harvey Gulf CEO, Shane J. Guidry, comments, “Certification of these vessels will be made by the American Bureau of Shipping to achieve ‘ENVIRO+, Green Passport’ status.