Mubadala Energy acquires Kimmeridge LNG and gas projects in the US

Mubadala Energy is an arm of Abu Dhabi’s sovereign wealth fund. It signed a deal with Kimmeridge, a US-based energy investor, on Thursday that gives it stakes in American gas assets. This marks its entry into the United States market, as part of the company’s growth plans. Mubadala Energy announced that the deal to purchase 24.1% of Kimmeridge’s SoTex HoldCo would give Mubadala Energy direct access to Kimmeridge’s unconventional gas production and to a Louisiana liquefied gas export project. The latter is expected to reach a final decision this year, with a first offtake scheduled for 2029.

Woodside and Tokyo Gas discuss stake in US LNG Project

Tokyo Gas and Woodside Energy are in discussions about a possible stake in the multi-billion dollar Louisiana LNG export project. Two people familiar with these talks confirm this. Woodside, a major Australian oil and natural gas company, closed a deal this month to buy Tellurian Inc., a developer that had put itself up for sale after running out of money while building a U.S. Gulf Coast plant capable of converting shale-gas into LNG at a rate of 27,7 million tons annually. Tokyo Gas Natural Resources, the U.S. subsidiary of Japan's biggest gas and electricity utility, is in talks to acquire a stake in the project.

Rolling the Dice in Chaos: The Prospects of Investment in the Gas Industry

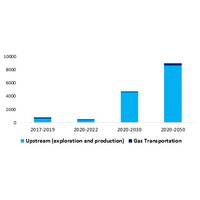

As stated in the Declaration of Malabo at the 5th Summit of Heads of State and Government of the GECF Member Countries, in order to sustain the security of demand and supply of natural gas, it is necessary to ensure sufficient investments through the entire gas value chain among all gas market stakeholders [1].Since the start of 2020, every aspect of the global economy, including investment projects in natural gas industry, have been strongly hit by the outbreak of the Covid-19 pandemic. In fact, it is always a challenge to develop an accurate short-term forecast for tactical decisions…

Saipem Joins JV for Arctic LNG2 Project

Italian oil and gas industry contractor Saipem reached a deal on Friday to participate in a joint engineering venture for a liquefied natural gas (LNG) project in the west of Siberia.The subsidiary of Eni said in a press release that it has has reached an agreement with Technip France SA and NIPIgaspererabotka to participate in the Joint Venture for the realization of the Arctic LNG2 project.The project has been awarded by Arctic LNG2, a company formed by Novatek JSPC (60%) and Ekropromstroy Ltd (40%).It comprises the detailed design…

BHGE to Bring AI to Oilfield

Oilfield service company Baker Hughes, a GE Company (BHGE) has entered into a joint venture with the California-based Artificial Intelligence (AI) software provider C3.ai to accelerate the digital transformation in the oil and gas industry."AI in the oil and gas segment helps improve overall performance by ingesting massive quantities of data, becoming intelligent about specific operational environments and predicting problems before they occur so that operators can improve planning, staffing, sourcing and safety…

Keppel Makes First LNG Cargo Import from N. America

Singapore's Keppel Gas, a wholly owned subsidiary of Keppel Infrastructure Holdings, has completed its first liquefied natural gas (LNG) cargo import under Singapore's spot import policy.The policy allows gas customers in the Republic to import up to 10 per cent of their annual long-term contracted LNG intake on a spot cargo basis.The spot cargo of 160,000m3 of LNG originated from an LNG liquefaction project in North America, marking the first time that Keppel Gas has diversified its gas supply portfolio beyond…

Oceanic Breeze Brings LNG to Japan

Japanese energy company INPEX Corporation announced that the LNG Tanker Oceanic Breeze called for the first time at INPEX’s Naoetsu LNG Terminal located in Joetsu City, Niigata Prefecture, Japan.The tanker has delivered a cargo of liquefied natural gas (LNG) from the INPEX-operated Ichthys LNG project in Australia.Oceanic Breeze is owned by Oceanic Breeze LNG Transport S. A. (OBLT), a joint venture between INPEX Shipping Co., Ltd. (INPEX Shipping) (30%) and Kawasaki Kisen Kaisha Ltd. (K-Line) (70%), and designated…

China’s Oil and Gas Industry to Focus on Environment Impact

China’s oil and gas industry is set to reinforce efforts to reduce environmental impacts of its projects and operationsin 2019, said a research.According to a new research from DNV GL, six in ten (61%) senior oil and gas professionals in China say their organizations are actively preparing for the transition to a lower carbon energy mix compared to 51% globally. Industry leaders’ focus on decarbonization aligns with the Chinese government’s new ‘Blue Sky’ plan to tackle air pollution by reducing emissions of sulphur and nitrogen oxides and other pollutants by at least 15% from 2015 levels by 2020.

Eelectrification: Re-engineering a Low-carbon O&G Industry

Cleaner and greener: Azeez Mohammed, president & CEO of GE's Power Conversion business, discusses the key role of electrification technology in decarbonizing the oil and gas value chain.The renewables revolution is in full swing. However, renewable energy alone will not be sufficient to meet EIA’s forecast[1] of a 28 percent increase in world energy use to 2040. And that’s despite its prediction in the same report that wind, solar, hydro and other clean technologies will collectively be the fastest-growing energy…

Wellit Partners with Norvestor

The owners of software company Wellit have decided to sell 60 percent of company shares to private equity company Norvestor.Wellit develops logistics solutions for the global oil and gas industry. Its software, WELS, is a cloud-based multi-tenant platform tailored to the oil and gas industry.WELS enables all involved parties in the oil and gas value chain to communicate on one logistics platform, thereby removing the risk of miscommunication and duplicate information. WELS optimizes planning and reduces lead-time from order to delivery.

Shell Acquires 26% Stake in Hazira LNG

Royal Dutch Shell announced that it has completed the acquisition of French oil major Total SA's 26 percent stake in the company that operates 5 million tonnes per annum-Hazira LNG terminal in Gujarat, India."Shell Gas, a subsidiary of Royal Dutch Shell plc, acquired 26% equity interest in the Hazira LNG and Port Ventures from French energy major Total Gaz Electricité Holdings, to complete the acquisition," said a press statement.The move allows Shell to build an integrated gas value chain: supply from its global LNG portfolio, regasification at the Hazira facility, and downstream customer sales.

Cepsa Appoints Musabbeh Al Kaabi as Chairman

Spanish multinational oil and gas company Cepsa announced that Musabbeh Al Kaabi was named as Chairman in succession to Suhail Al Mazrouei at a meeting of the Board of Cepsa.This follows the appointment by Mubadala, as sole shareholder, of Saeed Al Mazrouei, Ahmed Saeed Al Calily and Bakheet Al Katheeri as members of the Board for a statutory period of four years.The three new board members, all senior executives of the Mubadala group, have distinguished backgrounds and broad experience and knowledge of the energy sector.Musabbeh Al Kaabi…

Novatek, Siemens Sign LNG Partnership

Russia's natural gas producer Novatek and German engineering giant Siemens have signed a strategic partnership agreement that covers cooperation in the liquefied natural gas (LNG) sector.Novatek said in a press release that the agreement was signed by Novatek Chief Executive Leonid Mikhelson and his Siemens counterpart Joe Kaeser in Moscow.According to the agreement, the parties intend to strengthen and develop the strategic partnership and cooperation in integrated gas-to-power projects on a “turn-key” basis inclusive of LNG supply…

Big Oil Pledges to Slash Potent Greenhouse Gas Emission

A group of the world's top oil and gas companies pledged on Monday to slash emissions of a potent greenhouse gas by a fifth by 2025 in an effort to battle climate change.The Oil and Gas Climate Initiative (OGCI), which U.S. giants Exxon Mobil and Chevron joined recently, committed to cutting methane emissions to an intensity of 0.25 percent of the group's total fossil fuel production, it said in a statement.Such a reduction would equate to 350,000 tonnes of methane annually. It compares with a baseline intensity of 0.32 percent in 2017…

Keppel Wins FPSO, FSRU Contracts

In Brazil, Keppel FELS Brasil Ltda (Keppel FELS Brasil) has been engaged by MODEC Offshore Production Systems (Singapore) Pte Ltd., part of the MODEC, Inc. group, to undertake the topside module fabrication and integration of the FPSO Carioca MV30, a Floating Production Storage and Offloading vessel (FPSO). This is the sixth FPSO collaboration between Keppel FELS Brasil and MODEC.In Singapore, Keppel Shipyard Ltd (Keppel Shipyard) has been entrusted with the conversion of a LNG Carrier to a Floating Storage and Re-gasification Unit (FSRU) by a leading global operator of oil and gas production vessels.Mr Chris Ong…

Agreement Paves Way for South African Offshore Supply Base

South Africa’s first dedicated and customized facility supporting offshore oil and gas activities will be introduced at the Port of Saldanha. This follows the conclusion of an agreement between Transnet National Ports Authority (TNPA) and Saldehco Pty Ltd, which was signed off at an official ceremony at the port on Monday, 23 April 2018.Saldehco is a privately owned South African company, comprising principal shareholder HARPS Holdings Pte Limited and local partner Semona Pty Limited. HARPS Holdings is a private investment company with a strong presence in Africa and interests in Oil & Gas…

First LNG from Cheniere US to GAIL India

Cheniere Energy and GAIL (India) today marked the commencement of their 20-year Sale and Purchase Agreement (SPA) to supply U.S.-sourced liquefied natural gas to India from Cheniere’s Sabine Pass liquefaction facility in Louisiana, with one of GAIL’s first shipments departing from the facility. The ship will set sail after today’s ceremony to mark the occasion at Sabine Pass in the presence of Cheniere President and CEO Jack Fusco and GAIL Chairman and Managing Director Mr. B.C. Tripathi, who were joined by Consul General Dr. Anupam Ray, as well as representatives from Cheniere and GAIL.

DNV GL Taps Oudman as Regional Manager

As the global energy transition in the oil and gas industry marks significant changes to come, regional adaptions will pose a broad variation of challenges and opportunities. DNV GL – Oil & Gas has appointed Ben Oudman as Regional Manager for Continental Europe, Eurasia, Middle East, India and Africa to further strengthen the company’s efforts to help the industry overcome barriers to progress. DNV GL’s 2017 Energy Transition Outlook report shows that while the energy transition is well underway, oil and gas will likely remain major energy sources for many years to come.

Wärtsilä to Acquire Puregas Solutions

Wärtsilä said it has reached a deal to acquire a Sweden based provider of turnkey biogas upgrading solutions, Puregas Solutions. The transaction is valued (enterprise value) at SEK 280m ($34.5 million) with an additional maximum sum of SEK 70m ($8.6 million) to be paid based on the performance of the business in the coming year. Puregas, a leading player in its field with subsidiary companies in Germany, Denmark, the U.K., and the U.S., utilizes a unique CApure process to convert raw biogas to biomethane and renewable natural gas.

Tokyo Gas buys stake in Castleton's Texas Unit

Japan's biggest city gas supplier Tokyo Gas Co said on Monday it has acquired a 30 percent stake in a subsidiary of Castleton Commodities International LLC, its first equity investment in a U.S. upstream company. Tokyo Gas did not reveal the price for the stake in Castleton Resources LLC, which owns and operates over 160,000 net acres of leasehold in East Texas with access to the Cotton Valley and Haynesville Shale and has a net production of about 238 million cubic feet equivalent per day, equal to 1.65 million tonnes per annum of liquefied natural gas (LNG).