Prices rise on increased demand for electricity and uncertainty about Russian flows

Dutch and British wholesale prices for gas rose on Friday, as a result of a surge in demand from power plants and a decrease in wind speed. There is also uncertainty over Russian gas supplies to Europe due to the imminent end of the Ukraine transit agreement. The benchmark contract for the Dutch TTF hub rose by 0.30 euros to 43.58 euro per megawatt-hour (MWh), which is $13.68/mmBtu by 0955 GMT. Meanwhile, the contract for the next day was up 0.75 euros at 43.40 euro/MWh. The day-ahead contract in Britain was 1.2 p higher, at 107.60 pence per therm.

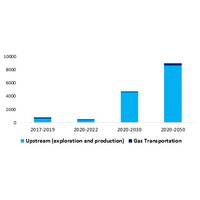

Rolling the Dice in Chaos: The Prospects of Investment in the Gas Industry

As stated in the Declaration of Malabo at the 5th Summit of Heads of State and Government of the GECF Member Countries, in order to sustain the security of demand and supply of natural gas, it is necessary to ensure sufficient investments through the entire gas value chain among all gas market stakeholders [1].Since the start of 2020, every aspect of the global economy, including investment projects in natural gas industry, have been strongly hit by the outbreak of the Covid-19 pandemic. In fact, it is always a challenge to develop an accurate short-term forecast for tactical decisions, as bias forecast integrity will result in deeper problems.

Petrobras to Sell Natural Gas Assets

Brazilian state-owned oil firm Petroleo Brasileiro SA has reached an agreement with anti-trust regulator Cade to sell off a series of natural gas transportation and distribution assets, the company said in an exchange filing on Monday.Petrobras, as the company is commonly known, said it had pledged to sell stakes in pipeline networks including a 10% stake in Nova Transportadora do Sudeste (NTS) SA, 10% in Transportadora Associada de Gas (TAG) SA and 51% in Transportadora Brasileira Gasoduto Bolivia-Brasil (TBG) SA.It would also sell its indirect ownership in distribution companies, possibly by selling its 51% ownership in subsidiary Gaspetro or the stakes themselves.The d

Petrobras Sells TAG, Gets $8.7 bln

Brazilian state-run oil firm Petroleo Brasileiro SA (Petrobras) has concluded the sale of gas pipeline system Transportadora Associada de Gás S.A. (TAG) to a group led by France'sEngie SA and Canada'sCaisse De Depot Et Placement Du Quebec (CDPQ).According to a stock exchange annoucement, Petrobras received a total of 33.5 billion reais ($8.69 billion) from buyers on Thursday for the 90 percent stake it had in TAG.Petrobras will continue to use natural gas transportation services rendered by TAG, through contracts already in force between the two companies…

Total Takes Over Toshiba's U.S. LNG Biz

French energy giant Total takes over the liquefied natural gas business of Japanese outfit Toshiba's Freeport LNG train tolling agreement and gains $800 million.The French oil and gas company will is paying $15 million for the shares in the Texan assets, the firms said. Toshiba will also pay Total $815 million to take over all the contracts linked to the business, Total added."It includes a 20-year tolling agreement for 2.2 million tonnes per annum (Mtpa) of LNG from Freeport LNG train 3 in Texas and the corresponding gas transportation agreements on the pipelines feeding the terminal.

Chevron Gets Green Light for Captain EOR

Energy giant Chevron announced Tuesday it has received approval from the U.K. Oil and Gas Authority (OGA) to move ahead with its plans for an Enhanced Oil Recovery (EOR) project that aims to unlock millions of extra barrels of oil and extend the life of the long-producing Captain field in the U.K. Central North Sea.Chevron North Sea Limited (CNSL), which operates Captain as 85 percent stakeholder, said its plan includes applying polymer injection technology to increase production and help maximize economic recovery from the field located approximately 145 kilometers northeast of Aberdeen.

Excelerate, TGS Join for Argentina LNG Export Study

Excelerate Energy and Transportadora de Gas del Sur (TGS) have provisionally agreed to jointly assess the viability of an LNG liquefaction and export project at Bahia Blanca in Argentina.Argentina currently imports liquefied natural gas (LNG) through two floating import terminals, particularly during the country's peak winter consumption.The successful development of Argentina's shale gas reserves resulted in a potential excess of natural gas during the summer months. The project aims at studying the technical and commercial viability of liquefying and exporting natural gas during the summer season…

DEKRA Wins Six-figure Contract in Australia

DEKRA Organizational Reliability, consultancy in behavioral change, has been awarded a 12-month contract worth $1 million AUSD, providing leadership training and coaching to ConocoPhillips’ Australia West operation.The Aberdeen-based consultancy, formerly known as Optimus Seventh Generation which specializes in working within high hazard industries, has been working on an ongoing basis with the operator’s UK-based function since 2016. With a focus on leadership coaching which emphasises accountability, driving performance and communication…

India's Reliance Sheds TX Shale Assets

Reliance Industries Ltd said on Tuesday its unit would sell some of its shale assets in the United States to privately held Sundance Energy Inc for $100 million, as the Indian oil-to-telecom conglomerate moves closer to exit U.S. shale investments. The sale includes Reliance's interest in the assets in the Eagle Ford shale in Texas, it said in a statement https://www.bseindia.com/xml-data/corpfiling/AttachLive/ffee7019-ddc0-498a-a7b9-2bd29972adc8.pdf. U.S.-based Pioneer Natural Resources Co, which was a partner in the asset, also exited the blocks.

Petrobras, BP Discuss Areas for Strategic Partnership

Petróleo Brasileiro SA has begun talks with BP Plc to form a strategic partnership, the Brazilian state-controlled oil company said in a securities filing on Tuesday. Petrobras, as the company is known, and BP may collaborate in areas such as oil exploration and production, refining, gas transportation and trading and other operations, the statement said. (Reporting by Bruno Federowski and Roberto Samora; writing by Bruno Federowski; editing by Jason Neely)

Gazprom Says Poland Gas Supply Issue Resolved

Russia's Gazprom said on Thursday a technical issue that caused poor quality gas to be delivered to Poland via the Yamal pipeline had been resolved. Poland on Wednesday temporarily halted gas deliveries from Russia via the pipeline due to poor quality of the gas. "From this afternoon on, the quality of natural gas that enters the gas transportation system of Poland corresponds to that foreseen in the contract," Gazprom's export division, Gazprom Export, said in a statement. (Reporting by Oksana Kobzeva; Writing by Jack Stubbs; Editing by Susan Thomas)

Gazprom Inks Gas Transport Deal with Eustream

Russian gas giant Gazprom said on Tuesday it had signed a 5.3 billion euro ($5.6 billion) gas transportation framework deal with Slovakia's Eustream until 2050. "This agreement provides for a basis for future contracts on transportation and allows to participate in obtaining any capacity in the gas transportation system of Slovakia," Gazprom Export, the export arm of Gazprom, told Reuters in an e-mailed comments. Gazprom said earlier that the Slovak gas transportation system will be used in the long term even if the Nord Stream 2 gas pipeline is built.

Gazprom Cuts Flows via Opal Gas Pipeline After Polish Challenge Upheld

Russian gas deliveries to Germany via the Opal pipeline fell by around 30 percent on Wednesday after Poland successfully blocked a deal giving Gazprom a bigger share of the pipeline's capacity. Gazprom sends gas through the Nord Stream pipeline which runs along the Baltic Sea bed and links up with Opal in Germany but the Russian gas exporter faces curbs imposed by the European Union on how much of Opal it can use. Last year the EU approved a deal between Germany's energy regulator and Gazprom giving the producer access to more than its 50 percent share of Opal's capacity through a mechanism of monthly auctions that lifted exports.

Court: $1.8B Gas Transport Tariff Row

A Norwegian court will hear an appeal next week by four firms seeking to overturn a ruling that upheld a government decision to cut offshore gas transportation tariffs. The firms - owned by Allianz, UBS, the Abu Dhabi Investment Authority and the Canada Pension Plan Investment Board - said the slashed tariffs would cost them 15 billion crowns ($1.8 billion) in lost earning by 2028. Solveig Gas, Njord Gas Infrastructure, Silex Gas and Infragas, which hold a combined 44 percent stake in pipeline owner Gassled, said Oslo's decision was illegal and took it to court, but lost the case in September.

Latvia Mulls Options for Baltic Gas Facility

Latvia to liberalise gas market next April. A number of companies, including Germany's Open Grid Europe (OGE), are considering buying a stake in Latvia's future gas grid and storage operator Conexus Baltic Grid, the country's economy minister said. Latvia's gas utility Latvijas Gaze is set to transfer part of its assets - including one of Europe's largest underground gas storage facilities, Incukalns - to Conexus ahead of a planned market liberalisation next April. The current owners of Latvijas Gaze - Russia's Gazprom , Germany's Uniper and Latvia's Itera Latvija - which have a combined stake of slightly over 68 percent…

Petrobras Approves 90% Stake Sale in NTS to Brookfield

Petrobras Board of Directors approved, in a meeting held yesterday, the sale of 90% of the shares in Nova Transportadora do Sudeste (NTS) to Brookfield Infrastructure Partners (BIP) and its affiliates, through a Private Equity Investment Fund (FIP) that has other shareholders including British Columbia Investment Management Corporation (BCIMC), CIC Capital Corporation (wholly-owned subsidiary of China Investment Corporation - CIC) and GIC Private Limited (GIC). The sale amounted to US$5.19 billion. The first installment corresponds to 84% of the total amount (US$4.34 billion)…

Shell loads first LNG vessel at Gate Terminal

Shell’s started operations of the new LNG fuel infrastructure at Gas Access to Europe (Gate) terminal in the Netherlands. The new LNG fuel infrastructure included the construction of a new berth. This new berth has now started operations. The loading of Shell’s chartered LNG vessel, the Coral Methane happened on the 19th of September. ·In July 2014, Shell took the Final Investment Decision to buy capacity at the Gas Access to Europe (Gate) terminal, which enabled the investment in new, dedicated liquefied natural gas (LNG) fuel infrastructure. ·The new LNG fuel infrastructure included the construction of a new berth. This new berth has now started operations.

Sinopec to Sell Gasline Unit Stake

China's Sinopec Corp said on Tuesday it would sell half of its premium natural gas pipeline business to investors, a move spurred by Beijing's reform push to boost efficiency and increase infrastructure investment in cleaner fuel. Sinopec, the country's second-largest oil and gas group, said it would hold 50 percent in the Sichuan-East China pipeline project after the completion of the divestment plan that has won board approval. It did not give a value of the target assets, or a timeline for when the sale would be completed. The government is keen to boost investment in the country's patchy 90…

Fitch: US LNG Shipments Signal Global Price Convergence

The emergence of US liquefied natural gas as a competitive alternative for European and Asian customers, combined with an oversupplied market, should drive more convergence between natural gas prices at major hubs and weaken the link between gas and oil prices, Fitch Ratings says. The first shipment of US liquefied natural gas (LNG) from Cheniere Energy's Sabine Pass facility to Europe arrived in Portugal at the end of April. It is unclear how many more shipments will arrive in Europe in the near term, but US LNG contracts are usually free from destination clauses and they will therefore increase liquidity in global LNG.

Belarus States Fair Price for Russian Gas

The Belarussian Energy Minister Vladimir Potupchik said on Thursday that he considered $73 per 1,000 cubic metres a fair price to pay for Russian gas. His comments follow a meeting of Russian and Belarussian officials in the city of Mogilev, where they disagreed over whether Belarus owed $125 million in outstanding payments to the Russian energy group Gazprom. Belarus has received gas at preferential prices from Russia ever since Gazprom took over the Belarussian gas transportation monopoly Beltransgaz. But Belarussian authorities have lobbied for a further discount since last year, without naming its size.