Euro Oil Giants Rethink Renewable Balance

Almost five years ago, BP embarked on an ambitious attempt to transform itself from an oil company into a business focused on low-carbon power. The British company is now trying to return to its roots as a big oil and gas player with a growth story to match rivals, revive its share price and allay investor concerns over future profits.Rivals Shell and Norway's state-controlled Equinor are also scaling back energy transition plans set out earlier this decade. Their change of direction reflects two major developments - the energy shock from Russia's invasion of Ukraine and a drop in profitability for many renewables projects…

Neptune Energy Terminates Deal to Buy Edison's North Sea Business

Oil and gas company Neptune Energy has terminated the agreement to acquire Edison E&P’s UK and Norwegian subsidiaries from Energean Oil and Gas. Neptune will pay a $5 million termination fee to Energean.The two companies had last year agreed for Neptune to buy Edison E&P North Sea assets for up to $280 million, after Energean had previously agreed to buy the oil and gas division of Italian energy company Edison for up to $850 million.Neptune's acquisition had been contingent on the closing of Energean's acquisition of Edison E&P.

West of Shetlands Ups Offshore Production

West of Shetland production likely to overtake North Sea for Shell and BP’s UK portfolios by 2020, said a report.Over the last four years oil and gas production in the West of Shetlands has risen and with that, a growing relevance for the biggest players still active in the UK continental shelf (UKCS), says GlobalData.The company’s latest research reveals that the West of Shetland (WoS) area retains the attention of major Exploration and Production (E&P) players in the region; however infrastructure restraints could hinder future growth potential in the basin.Despite the US based E&P majors…

New App Aims to Improve Project Performance

An Aberdeen-based company has created a lessons learned management system that captures critical project data and helps inform the future performance of complex oil and gas developments globally.Prism Energy, which provides project and risk management applications and consultancy, has worked closely with Genesis over the past 12 months to build a bespoke solution that will assist continuous development.Track is a cloud-based system designed to improve performance by recording and analyzing lessons learned and experiences to ensure knowledge gained during the project phase is preserved.The technology…

Equinor to be ‘Offshore Wind Major’

The multi-billion capital investment by Equinor at its new Dogger Bank Offshore Wind Farm will see it rival its major oil and gas projects, according to Rystad Energy."The offshore wind project Dogger Bank in the UK North Sea will not only be Equinor’s largest project through 2026, it will also rank as the sixth largest offshore development project in the world during this period," said the energy research firm.UK authorities announced on Friday that Equinor and joint venture partner SSE have been chosen to develop the world’s largest offshore wind farm…

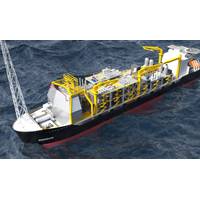

Shell Sees More FLNG Opportunities

Royal Dutch Shell sees more opportunities for floating liquefied natural gas projects, but not necessarily like its $17 billion Prelude operation off Australia, which shipped its first cargo last week, over two years behind schedule.Shell Australia Chair Zoe Yujnovich said on Wednesday that it was too early to tell whether Prelude, one of two floating LNG (FLNG) projects in the world, would be replicated in future, as the company was still commissioning the project."I think that there's an opportunity for the floating concept.

Gas Production Set to Triple in Iraq

Gas developments in Iraq will overtake oil projects in 2019, measured in resources sanctioned for development, according to analysis from Rystad Energy."For the world’s fourth largest crude producer, natural gas is about to take pole position," said a statement from the energy research and business intelligence company.New developments are on track to triple the country’s gas production from just over 1 Bcfd in 2017 to about 3 Bcfd in 2022, according to Rystad Energy.It forecasts that gas developments in Iraq will overtake oil projects in 2019…

Woodside Inks LNG Supply Deal with ENN

Australia's Woodside Petroleum WPL.AX has signed a Heads of Agreement (HOA) to supply liquefied natural gas (LNG) to China's ENN Group for 10 years from 2025, both companies said on Friday.Woodside, Australia's biggest listed oil and gas explorer, said in a statement the volume covered by the HOA is 1 million tonnes per annum (mtpa), to be sourced from Woodside's portfolio of gas supply. Signed at the LNG 2019 conference in Shanghai, the HOA follows a cooperation agreement sealed last October.ENN is aiming to increase its market share in China's gas distribution and retailing sector…

Oman: Gas Production to Surpass Oil by 2023

Oman’s gas production levels are set to surpass oil by 2023 thanks to an impressive surge in the development of gas fields in the sultanate, according to Rystad Energy, the independent energy research and consulting firm headquartered in Norway.“Gas is on the rise in the Arab country on the southeastern coast of the Arabian Peninsula in Western Asia, and this transition is very timely. Oil output declines over the last two years may indicate a point of no return for Omani oil, but the country’s sliding oil production is set to be replaced by gas…

Woodside Raises Dividend

Australia's Woodside Petroleum Ltd surprised investors with a fat dividend on Thursday after reporting a 36-percent percent rise in annual profit, underpinned by stronger oil prices.The higher-than-expected payout came after shareholders stumped up $2.5 billion to buy new shares a year ago at a time when Australia's biggest independent oil and gas producer expected oil prices to average $65 a barrel.By the end of the year it was flush with cash as oil prices had averaged $71 and the Wheatstone liquefied natural gas (LNG) project…

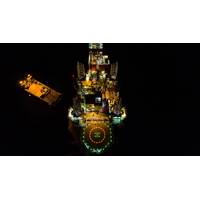

BSOG to Go Ahead with Midia Offshore Project

Romanian-based Black Sea Oil & Gas, controlled by private equity firm Carlyle Group LP, said on Thursday it has decided to go ahead with its $400 million offshore gas project in Romania, the first such project to be developed in 30 years.The Midia Gas Development Project will extract an estimated 10 billion cubic meters of gas some 120 kilometers offshore in the Black Sea.Black Sea Oil & Gas (BSOG) will extract the gas in a joint venture with Italian producer Gas Plus International B.V. and investment group Petro Ventures Resources…

Woodside Boosts Spending for Next Leg of Growth

Australia's Woodside Petroleum Ltd on Thursday flagged higher-than-expected investment spending for 2019 as it steps up early work on the two big natural gas developments that will drive its growth in the next decade.Australia's largest independent gas and oil producer plans to spend between $1.6 billion and $1.7 billion in 2019 on projects, significantly higher than an estimate from UBS of $1.2 billion.At the same time it is roughly halving exploration spending from $273 million last year."The cut in exploration spend is really us looking forward now that we've got growing confidence in the projects -- in Browse…

Aqualis Offshore Establishes Office in Australia

Marine and offshore engineering consultancy Aqualis Offshore has set up an office in Perth, Western Australia, to support oil and gas developments in the Australasia region.“We have supported important projects offshore Australia in recent years and believe it represents a market with good potential. There seems to be an increasing confidence in growth in offshore activity here, so we feel the time is right to set up a dedicated office in Australia,” says David Wells, CEO of Aqualis Offshore, which is part of Oslo-listed energy consultancy group Aqualis ASA.In 2017…

BP Green Lights Trinidad, Tobago Gas Projects

BP in Trinidad and Tobago (bptt) gave the go-ahead to two new gas developments, Cassia compression and Matapal, offshore Trinidad, it said on Friday.BP will build a new platform, Cassia C, and first gas from the facility is expected in the third quarter of 2021.Matapal will be a three-well subsea tie-back to the Juniper platform. With production capacity of 400 million standard cubic feet of gas per day, first gas from Matapal is expected in 2022, BP said in a statement.(Reporting By Shadia Nasralla; Editing by Kirsten Donovan)

Oil and Gas Demand to Peak in 2023 and 2034: DNV GL

The oil and gas demand will peak in 2023 and 2034, respectively, according to DNV GL’s 2018 Energy Transition Outlook, an independent forecast of the world energy mix in the lead-up to 2050However, new oil fields will be needed until at least the 2040s, while new gas developments will be required beyond 2050. DNV GL’s Outlook predicts that operators will favour production from a greater number of smaller reservoirs with shorter lifespans, lower break-even costs and reduced social impact compared to those currently in operation.“Most easy-to-produce, ‘elephant’ oil and gas fields have been found and are already in production.

Equinor Eyes Chevron's Stake in Rosebank Field

Norway's Equinor is interested in buying Chevron's stake in Rosebank, an oil and gas field in the British part of the North Sea, two sources close to the process told Reuters.Chevron on Wednesday said that it had received interest from a potential buyer for its 40 percent stake in one of Britain's biggest oil and gas developments.Equinor declined comment.(Reporting by Ron Bousso and Dmitry Zhdannikov; Writing by Nerijus Adomaitis; Editing by Gwladys Fouche and David Goodman)

Chevron Receives Interest in Major North Sea Field Stake

U.S. oil group Chevron has a potential buyer for its stake in one of the UK North Sea's biggest oil and gas developments, a company spokeswoman said on Wednesday.The sale of its 40 percent stake in the Rosebank project would mark Chevron's complete exit from the ageing basin after it launched the sale of its other fields in the region earlier this year.However, it was unclear if the San Ramon, California-based company was interested in selling out of the project, which is yet to be approved for development."Chevron can confirm it has received an expression of interest for its share in the Rosebank project…

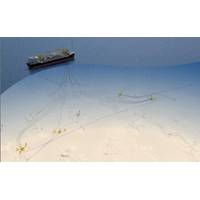

Wood Group Wins Ichthys Subsea Deal

Wood Group has secured a new, five-year contract with INPEX Operations Australia Pty Ltd (INPEX Australia) to provide subsea engineering services for the integrity of the INPEX-operated Ichthys LNG Project, offshore Western Australia. The operations of all subsea assets and the gas export pipeline will be supported under the contract which includes two, one-year extension options and is effective immediately. It continues Wood Group’s 12-year support of the Ichthys LNG Project development; providing subsea engineering and project management services during the concept, front-end, and detailed engineering phases of the project.

Coal: Adani defers Australian Investment Decision

India's Adani Enterprises on Monday deferred a final investment decision on its long-delayed Australian Carmichael coal project as the Queensland state government has yet to sign off on a royalty deal for the mine. The company had been planning to make a final investment decision (FID) on the 25 million tonnes a year coal mine and rail project by the end of May. "Adani is advised that the Queensland cabinet did not consider any submission or make a decision on royalties for the Adani project today," said the firm's spokesman in Australia, Ron Watson.

Despite Sanctions Relief, Shell Still Cool on Iranian Oil Buys

Royal Dutch Shell has bought only three cargoes of Iranian oil since sanctions were eased a year ago, a small fraction of what it used to buy and an indication of the legal difficulties and high prices that still hamper the trade. The Anglo-Dutch firm did not give a reason for the drop in purchases, which were disclosed in its annual report, and the company declined to comment further. But oil trading sources say Iranian oil is often too expensive and in any case remaining sanctions make dealing with the Islamic Republic a legal minefield.